Straight 6 or V8?

Weirdly enough I cannot recall. I have to assume it was a 6 cylinder as it couldn’t have gotten by on less then what it had. I do remember hitting 65ish once on I35

Splitter

A lot of the “leasing is for donks” takes center on “driving a newish car basically always is for donks.” Buying a car that you replace every 3-5 years may well be more expensive than leasing if you’re updating that often. And, as you note, buying a luxury car that has a ton of expensive repairs after the 5 year mark is a losing proposition, too. Cars are expensive, and about the only winning proposition is to buy a pretty reliable car and drive it straight into the ground (especially if you can do a lot of repairs yourself, but this keeps getting harder on newer cars), hopefully after 15+ years. I’m not sure I’m going to be able to teach my daughter(s) to drive on my 2014 Mazda, but I don’t mind trying. Not having a car payment right now is great.

But, if you’re in the financial situation that updating your car every 3-5 years is no big deal, and that’s how you want to spend your money, the choice between leasing and buying isn’t so clear cut as “leasing is for donks.”

I think leasing is for donks comes from the stereotypical suburban morons leasing luxury cars they can’t afford while saving nothing. If you can afford it comfortably I think leasing a new car every 3 years is totally defensible.

Even then it’s generally for donks. If you just buy new and sell after three years it should be better (in general) than a lease. If it wasn’t then there is no edge for the lease company.

Of course as stated above, you can occasionally find a great deal where the lease is actually better than buy and sell or at least very close.

But in the larger sense, leasing is for donks is like saying playing craps is for donks. Craps is -EV, but if you enjoy it and can afford it, then it’s fine to play. Same for leasing.

Agreed. If you have chosen to light some of your money on fire and can easily afford it, then leasing is a fine way to do that.

Um, no.

That’s a terrible example. Given how low interest rates are paying straight cash for a house would be idiotic. Much better to take the mortgage and invest the difference.

I’m sure I have said repeatedly that occasionally the numbers can work out to make lease OK or better. That’s includes sales tax in the consideration.

Hmm, good point. The $2k in tax makes my re-lease or buy for $24k EV calculation pretty close to even, or at least highly dependent on 2026 trade-in value and any significant lease incentives. (Buying was $3k more profitable over 5 years, assuming $8k trade-in value in 2026. It’s $1k better to buy after-tax, so the max EV move is highly dependent on the actual numbers.)

edit: looking at the price of 2012s, $10k for one with low miles may be a better comparison (to the value of mine in 2026), which supports buying. But, can probably get like 3k incentives from dealer for re-leasing.

It’s not like there’s no edge in them selling to you, and you aren’t the only opportunity for them to make money: the lease and the subsequent sale. Furthermore, you’re liable to face a similar edge when trading back into a dealer, unless you’re doing a private sale, which is a substantial undertaking of time and effort even if one is a savvy enough seller to be +EV in a private sale compared with a dealership.

I think he was speaking in more general terms, that they’re going to be making money off you one way or another.

The the cost (including tax, interest, and everything else) of a buying a car and then just selling it 3 years later has to be less than a lease, because the dealership is taking on risk by leasing it. If they want to be compensated for the risk (which is natural otherwise, why do it), then they have to raise the cost a bit.

Most of the time that calculation works out in favor of just buying and selling later. But as I’ve said, sometimes you an get a good deal where the lease is fine (for someone who has decided they must be a new car every 3 years kind of person – that’s the real donk part).

Basically, my first play is to get a free service and a damage charge fix/assessment for the bumper. Then my play will be to tell the dealer that I don’t care if I re-lease or buy the old car or maybe get another make unless they can give me borderline unreasonable deal.

Kinda hoping that someone with inside knowledge of the lease game can chime in and tell me where I could screw them over.

No doubt there is some convenience factor when it comes to the sale part. Like goofy I can’t be arsed up to do a private sale, but I have taken every car I’ve ever sold to Carmax (I never trade in at the dealership) and I’ve received very close to what I would get in a private sale. My results may be atypical there.

I know I’ve said it a bunch of times, but for some reason it doesn’t seem to get through. Everything you say is correct if you get a good deal on the lease. Most of the time, even accounting for all of those factors, you would be better off buying and selling. Not always.

The real donk move is getting a new car every three years (buy or lease). It’s -EV, but if you like it and can afford it, then it is no different than playing craps.

EDIT: Also the lease doesn’t really take the risk off of you, you’re still responsible for the car. The risk the dealership has is that they can’t collect from you if it comes to that. In the case of goofy the leaser, that’s not going to be an issue. So you’re not getting any benefit in that regard. Plenty of rich folks walk away from a house they’re underwater on, but I’ve never heard anyone do it over a car.

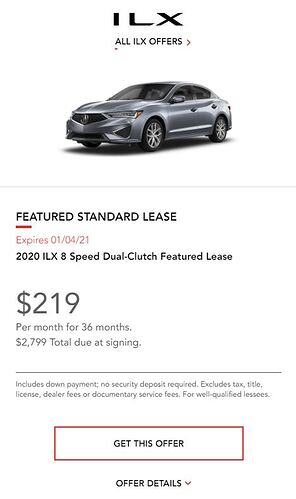

Fair play Acura.

Lowest 3-series these days is a 330i for $41.5k sticker. The sticker on my 2018 325i is like 35k. I think they got rid of the old “bottom end” 3-series sedan, and it’s now the 2-series “grand coupe” for $35.7k.

Seems like a good price for an Acura lease.

219x36+$2799=$10,638 total cost over 3 years. That’s pretty decent. (Sticker on the ILX is $29k.)

Acura after lease purchase option is $14,270.25, which is pretty solid as well.

In Canada there are tax incentives to leases if you are writing them off on a business.

In Canada there are tax incentives to leases if you are writing them off on a business.

That’s similar here. If you’re getting a car through your business, then lease makes a lot of sense.

Would this be the right place to post and have a discussion on AOC vs Dore beef? It’s really pissing me off and a ton of progressives are attacking her now. And my good friend is doing it on FB and I’d love for someone better than me at this to dunk on him for me lol

It flared up in the transition thread a bit. Might be worth it’s own thread.