Seems like they are considering it an early withdrawal, which makes sense.

I guess if your purpose of withholding is to get some of it refunded, then it would make sense to deter that.

Any thoughts on why VXUS immediately dumped 3% in after hours on Friday?

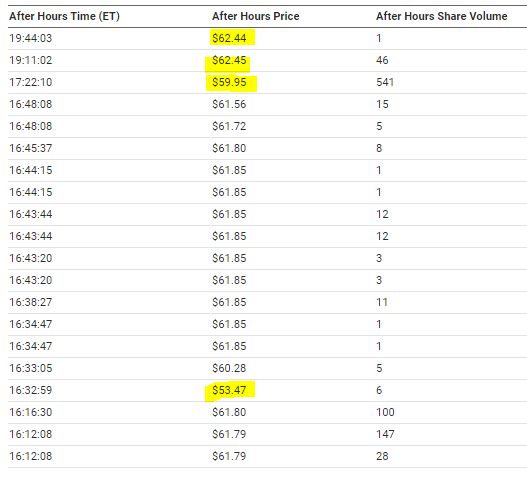

Edit: Wow it must be low volume bouncing it all over the place. I would assume the Vanguard X US fund was huge and not susceptible to these kind of crazy movements, but maybe not. I might have to look into how to trade after hours and just put in a steady stream of low (or high) bids and see what happens. Check out these trades from the list of the last 100 trades. I mean, who thought it was a great idea to sell at almost $10 share less than market?

Market sell into few bids?

It just seems crazy that a fund that large could be susceptible to those crazy swings, even after hours. If this happens on the reg, why not just place some crazy low bids after hours all the time and see if you can occasionally scoop?

i remember someone itt had their savings in BlockFi paying 8% interest, here is the cliffs on that

“We’re the largest lender of cryptocurrencies to institutional borrowers, who today are primarily market makers and proprietary trading firms that are active in this asset class and have been for a while, but they can’t finance that activity with their traditional prime broker relationships because banks aren’t active in the space yet,” he said. “That’s the reason why the yields are still high, because this is a new asset class. It’s nascent, it’s growing quickly, and it doesn’t have access to the traditional sources of debt capital. And as a result, when we’re lending, we’re able to charge higher rates, and then we pay that back to the folks who are our clients on the front end.”

Maybe it’s because I’m drinking a beer, but this doesn’t make any sense at all.

Lots of awesome jargon though. I’m in!

Basically as long as bitcoin keeps going up you get your 8.6% and your principal is safe. If bitcoin drops they explicitly say you could lose your principal.

I’d rather loan money to a local small business if I’m going to take on that kind of risk.

Nice so you invest in highly risky crypto and cap your upside to 8.6% with likely no downside protection. Where do I sign up?

Guys they’re on to me

It is the year 2021, and it is impossible to make an online deposit into my own checking account.

I received a state tax refund. How I came to receive it is a story in itself, but it’s for a rather large amount. I have several bank accounts. I figured I would be able to use one of their mobile apps to make a deposit, as I have done many times before.

I had my mother mail me the check. Due to postal delays, it took weeks to arrive, but arrive safely it did, thank God. So I open up my bank apps, only to discover they all have a $5,000 deposit limit and the check amount is greater than this.

One bank refuses to raise my limit. Another bank allows me to. Great! So with my limit raised, I photograph the front and back sides, enter the amount, press confirm, receive an email confirmation. Mission accomplished.

But wait! Several hours later, I receive a second email informing me they have rejected my deposit. Thank god I didn’t destroy the physical check after receiving the initial confirmation.

But why the rejection? It turns out the check is made out in both my and my wife’s name. And the account is in my name only. So unless the names on the check match those of the account holder, I’m out of luck. The friendly customer service agent on the phone suggests I bring the check into a nearby branch or ATM. Grrr.

So now I have to send the check back to my mother to have her physically bring it into the bank on my behalf. Since I’m afraid of it being lost in the mail, I’ll have to pay for expensive shipping, insurance, etc.

It’s the year 2021 and this is our financial system.

I know it’s too late for this now, but when you filed you couldn’t set up a link to your account for them to withdraw or deposit as required?

Well that gets into the story of how I came to receive the refund in the first place. Long story short. The state groundlessly seized funds from my bank. I appealed and had them reverse it. They did but could only send me a refund check, not a deposit.

This is somehow even stupider, and an even worse investment, than I imagined. Holy shit.

We should start UP hedge fund. We can “leverage existing inefficiencies to deliver superior risk-adjusted returns with limited downside.” Or something.

Allow me to translate:

We are operating in brazen defiance of a host of federal and international KYC/AML regulations, and our business will inevitably be shut down by the Department of the Treasury. Until then, our senior management has determined that we can earn substantial profits for them and our shareholders by engaging in these illegal activities using funds obtained from our creditors.

I have a question about some Fidelity mutual funds I’ve had for many years. The funds have a lot of capital gains distributions most years resulting in a lot of taxes each year. Is there any mechanism of converting these to a lower tax investment without taking a huge capital gain?

But if BTC only goes up 4.5% the might not eat your principal. So you win!

I know everyone trashes BofA on here but this is one good reason to have them - branches everywhere.

Also for me it’s the easy monthly transfers to my Dad. But we’ve had that discussion.