I can’t imagine being 50+ and seeing multiple years of retirement evaporate on a daily basis.

I bought in another 7% stocks at close today. Now around 67% equities.

I am scared about it dropping way further so maybe it is a good time to be a little greedy.

Still think there is a lot of opportunity for positive news now that USA is taking this thing more seriously

Could be, I didn’t pile 100% in. Could be that is priced into the markets by now too.

And when it doesn’t bounce he’ll show you a different triangle that explains why. TRIANGLES MAN

This is honestly why I had to unload everything. I don’t have the stomach to ride it out. I’m already in a state of constant crippling anxiety over everything else that’s going on.

Btw this is exactly why I was all in on stocks before this even though I don’t really believe in 100 PE ratios. I figured Trump’s tax cuts → stock buybacks had a long way to still pump up the system. At a certain point I planned to pull way back. Stupid corona ruined the party.

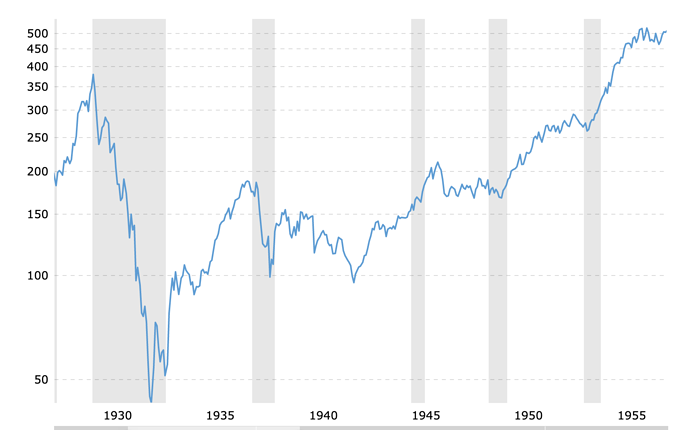

This is what I was afraid the financial crisis might look more like. I couldn’t believe how quickly it bounced back. It took the DOW 25 years to recover in non-inflation adjusted terms.

Supposedly inflation-adjusted only adds another 4 years but I’m not sure I buy that. Anyway it was a long fucking time.

But also I don’t believe our inflation numbers. I have a feeling they weight way too heavily on shit like food and flat-screen TVs. Meanwhile stocks, gas, housing, rent, education, healthcare - you know most of the stuff you spend money on - all through the moon. So I think the current stock market price just represents all the hidden inflation out there - and therefore might not be as overvalued as it seems vs. the dollar.

1929-1939 was deflationary. The 1929 dollar is worth like 80 cents to the 1939 dollar. If you take that into account and add in dividends then it recovered in 10 years.

Hello

But I was unemployed for almost 3 years following the great recession and lost almost everything then. So good news, I’m more like losing only 1/3 to 1/2 of years of expenses on these bad days!

Yeah sounds reasonable.

I can withdraw my IRAs in 9 years. I guess I should load up on a bunch of dividend stocks and throw away my fidelity password when I decide to jump back in.

Totally understand. I figure at this point I’m too late so may as well ride it out, with 20+ years left until retirement (well, probably more now!). But it’s not without pain and anguish. It was a lot easier to take this attitude in 2009 when the absolute numbers were much smaller. I probably lose each day now what I lost in the entire 2009 recession (and I’m sure the same is true for many).

My one saving grace is that I foolishly stockpiled far too much cash the last 3-5 years, such that even though I was basically 100% equity in all my retirement accounts, my overall asset allocation was probably 55/45 cash.

55/45 has to be feeling good right now.

Might be best to just not look at it and try not to think about it.

I wasn’t in this thread when I was buy and hold. I didn’t want to spook myself.

And quickly rising, LOL!

Yeah, I honestly didn’t really look much all day. But then was forced to since during the 3pm presser NBC put it up as a split screen. Sigh.

Update on buy and holding with 100% equities: still feel fine. Worried about the country and my dad who has been hospitalized with pneumonia twice in the last three years. But my retirement account balances aren’t bothering me at all.

At 50/50 without touching it, def feels good. Portfolio only down 9% as of yesterday. Gonna HODL all the way down.

From listening to some of them on CNBC today, a fairly high percentage don’t realize that the official count is way lower than the real one, and/or they’re not even coming close to estimating the real number.

For those of you who are pulling out because you’re closer to retirement, how young would you have to be to be leaving everything in and putting your portfolio (not your net worth) into 100% equities?

Or, to put it another way, what would you do if you were 33?

I’m still pretty confident I need to keep pumping money in, I got spooked today but put an order in that almost filled before close - plan to resume pumping it in tomorrow if it continues to drop.

Keep investing. If I had a lump sum I’d throw it in but I don’t at this time. Lump sum investing tends to work better than DCA but do what makes you comfortable. Right now is a unique set of circumstances but in the long run you won’t benefit a ton from trying to squeeze every penny out of it but you might drive yourself insane watching it.