Fresh-squeezed is sooooooo much better than bottled. It’s night and day.

So someone correct me if I’m wrong.

The two big short squeezes on right now are GME and AMC. Any others?

BB NOK BBBY SPCE

I thought this was a stonks reference and I was trying to figure out what “bottled” could mean.

My understanding is that dark pools have to report trades to the exchange a stock is listed on shortly after the trade is executed, so any shorts should be reported and captured in the disclosed short interest.

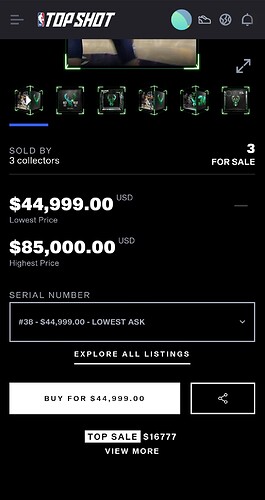

What am I missing here? Someone bought a virtual replay of a Giannis play for $17k? My brain is malfunctioning right now.

Yes, it’s like a sports trading card but you can’t put it in your bicycle spokes and ruin it.

Thanks. I had no idea.

GOAT

It went to whoever sold them the shares necessary to cancel out their shorts, so probably the redditors who took a profit instead of HODLing.

Example:

Alice is long, owning one share.

Bob shorts one share by borrowing Alice’s and selling to Carl for $100

The price goes to $120 and Bob decides to cut his losses.

Dianne is offering to sell a share for $120, which Bob buys.

Bob’s newly bought share instantly gets returned to Alice, so Bob’s is now flat.

Bob lost $20 and it went to Dianne.

(That’s how I understand it, but if someone corrects me then take their word over mine.)

Why the fuck are any of you using Robin Hood?

that’s the app of choice of the WSB investors. Do you dare question their trading expertise?

Yup, or both!

Hedge funds were short before WSB was long, yes, but they re-shorted on the way up too, so they easily could have been borrowing shares from WSB people. And I didn’t know about double-borrowing before today, so that makes it a spaghetti diagram. There is also naked shorting—shorting without even borrowing the stock—but I haven’t looked into whether that was happening with GME. My finance bro friend claims that naked shorting can happen when someone shorts using leverage.

https://twitter.com/AmericasComic/status/1354452317257560067

https://twitter.com/iamTannenbaum/status/1354571307401228292

https://twitter.com/loganbartlett/status/1354613330900635651

twitter is gold right now

Someone should tell them to quit using zero-commission platforms. They’re making the war more difficult on themselves by letting their enemy see all their stoplosses etc. Plus there was that nonsense today with RH & others blocking users from buying GME. Fuck that! There are alternatives that don’t do that.

Do you use TWS on your pc? I swear I saw that choice yesterday, but I haven’t been able to find it today. Where is it? I wanna be a team player.