I think in your scenario it’s 100% fine. Your changes are purpose driven since your goals have changed and you did it with a plan in mind. The issue is when people just randomly tinker with their AA with no conviction and go back and forth.

Being right and getting the right result arent always the same unfortunately. A bit like poker. I still think Ackman was correct vs Herbalife, but it cost him what, $2 billion?

Madoff’s ponzi shit didn’t go down until over 15 years after some smart people figured out something was off.

If you rebalanced after the close yesterday you should get the prices at the close today. (Assuming they are all mutual funds.) Are you sure you’re looking at it correctly?

I sold off the stuff that has way more downside than up right now. Yes, be greedy when people are fearful but this could totally shut down any social business/event and you don’t wanna be in that stuff right now for that situation.

Where is the chart for when you miss the 60 worst days?

A $10k gold investment using the dates on this chart is $52k. Beating stocks by $20k.

lmao

Aus exchange futures were up 0.8 this morning, down 1.6 forty minutes after open. Wooof

Think about it. If the market closed, and then something happened which tanked futures, everybody would go trade out of stock funds. Or if something juiced futures, they would trade in.

I think the dude had to be confused. But you should be able to log into your account and see the account activity. (May say, “swap in,” “swap out”) This will tell you the effective date of the trades. It should be today’s date imo.

This assumes we’re talking about mutual funds and not ETFs or individual stocks.

If you put the order in last night to sell individual stocks, (Apple you mentioned), those would execute as soon as your order conditions were met. If you put it in as a market order, that would have executed at the open.

Yeah, shorting macro events is suicide. You’re not going to want to hold a short position for possibly years in the assumption that you may be correct while missing out on possible upside and paying dividends.

Even if you’re correct, attempting to psychologically guess the bottom is another issue. And if you’re wrong, you’re wrong for more than double the money.

I’m not talking about shorting them. Just sitting in cash for a bit.

This is not accurate. You need to be right about whether the market/overall economy is building value (as is usually the case) or if it’s losing value (more rare but clearly the case when worldwide pandemics force entire countries to shut down). And even then you only need to be right on a weighted basis more often than not. The start and end time is implied in the single decision and again, you don’t need to get it exactly right, but the period you select must spend more time actually declining, weighted for magnitude of swings, than it spends gaining value. This can all be easily proven with some simple math, I’m not talking about whether anyone can actually predict declines accurately enough to come out ahead, just showing that the theory behind it does not require the kind of precision you claimed.

As for the practicality of implementing the theory, I’ll say it’s interesting that so many ITT simultaneously believe you must hold through downswings, but also that all relevant risks are priced in accurately enough that you can’t beat the market. I mean the “buy to your risk tolerance then forget it” is not a niche belief, it’s the golden rule for all “smart” investors. It’s the strategy of most “smart” portfolio managers. We’ve had a prediction ITT that if the covid impact is 10x less disruptive than one of the most conservative estimates the market will drop, but that poster still refused to sell because they can’t predict market moves better than anyone else. It’s not about the prediction though! There are probably millions of other people thinking the same thing, holding on to stocks as the shit predictably hits the fan, thinking there must be some reason the market hasn’t priced this obvious risk in yet, meanwhile it’s just millions of other people slow to turn their thoughts into action for the same reason. I’m really struggling to understand how a forum of poker players are so forcefully demanding to stick to the losing side in such an easily exploitable situation.

Oh my God, that graph is maybe the worst example I’ve seen in 2020 of manipulative misuse of data. Thanks JP Morgan.

Tell me, if you’re pulling money into and out of equities to ‘time the market’ for whatever reason, what odds do you have to be invested for 0/10 of the best days but still all in for the 10 worst?

I think you’re missing the point. Nobody thinks real investors will step out of the market for exactly those 10 days.

What’s being illustrated is that out of ~5000 trading sessions over a 20-year period, a huge chunk of performance was dependent on a relatively tiny number of big days.

The implication is that people opportunistically stepping in and out of the market are likely to miss some of those big days and their performance is likely to suffer as a result.

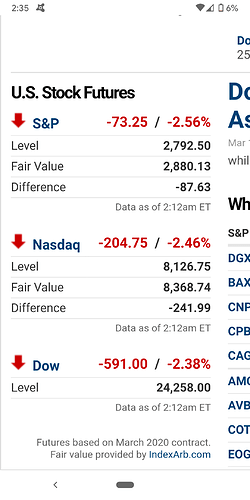

Am I reading this right? Have they lost almost all gains in futures?

Currently they’ve lost about half of Tuesday’s gains.

As I think a few of us predicted (not that it’s a difficult prediction to make), there are going to be a lot of big swings in the market in the coming days/weeks, in both directions.

This is where futures confuse me. That shows a -591, but 24258 is more like 850 less than yesterdays close of 25018, so why the discrepancy in the numbers?

Yeah that makes no sense now that you pointed that out. I wonder if one number is delayed and the other isn’t?

Those two beliefs aren’t at odds with each other, at all? No idea what you’re talking about here.

No one is demanding anything. Do whatever you want, none of us care at all. No one demanded that JT held his stocks, indeed we helped him sell them.

Including dividends it only took about 10 years for an investment to recover to 1929 levels. And I think that’s in nominal dollars, but there was negative inflation during the great depression. A 1929 dollar is worth $1.23 1939 dollars. So actually even sooner.