Could not resist after this tweet

Paper hands weak bxxxx

lol buying apple for more than the rest combined gtfo

I guess i just don’t yolo…

My buddy bought 100 shares of GameStop this morning after I’ve been telling him about the wsb craziness the past couple of weeks and sold like an hour ago for a quick $3300 profit, now he’s mad he didn’t wait a little longer lol

weekly 200c are now going for $2200

98k volume

Looks like 150 might be the wall for today tho

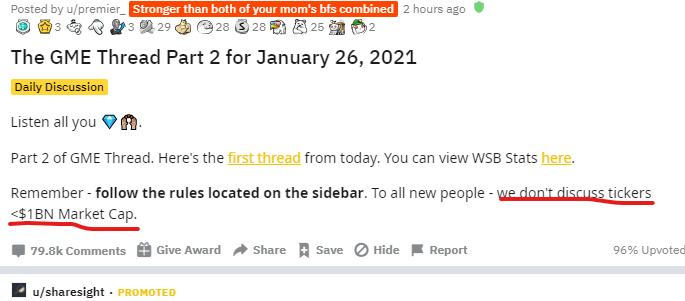

Thought the underlined was pretty funny on the WSB thread:

Are companies allowed to issue shares and just sell them into the market whenever they want, assuming prior disclosure that they reserve the right to do so? Because Game Stop would be insane to not issue equity right now.

My wife’s was called employer stock purchase plan (ESPP). They would take a percentage of your paycheck for 6 months and at the end of that period they would use that to purchase stock at a discount price. I don’t remember exactly how it worked but it was something like take the lowest share price during that 6 month period and you get to buy at that price or maybe they gave you a further discount based on that price.

Yeah that sounds familiar.

If the company has a current shelf registration they can do an offering without having to file anything new with the SEC. However, I think they still have to put together a prospectus supplement for the offering (which provides the exact details of the offering - e.g. price, shares being sold - as well as any material updates from the prospectus filed with the shelf).

GME filed a shelf on December 8, 2020, so I think they could do an offering pretty quickly if they wanted.

Hertz tried and the SEC shut them

down… but they were literally going bankrupt.

Yeah, I think that was a good decision by Hertz. Allowing the market to operate is one thing, but letting a bankrupt firm issue obviously-worthless stock would have been terrible regulatory action.

GME should obviously be issuing as much equity as possible. I assume I’m going to have nightmares about waking up to find out that Berkshire Hathaway has been acquired by GME in an all equity deal.

I’ll be honest, this trade has not worked out in the risk-free way that I had imagined.

gme up $25 since that tweet lmao

165 what the fuck

a hedge fund might be closing soon with that number, maybe even the one that just got bailed out

$170 now

probably aren’t even shares available to short but GOD IT"S SO TEMPTING WHEN I HEAR PEOPLE GETTING EVERYONE IN ON IT

190

LOL WHY DIDNT I BUY ANY FUCK ME

GME +69,420% in after hours trading

The musk bump lmfaoooo

I almost bought a few yesterday at 75 or whatever but there’s no way I wouldn’t have sold now. good lord

hedge funds are not winning this war right now at least