Is there any way to figure out how much people are paying to borrow GME stock?

I don’t know how to get borrow costs, no. Recent news stories indicate around 23%, though.

23%?

Excuse me, I was taught in school that the U.S. has exceptional regulation of financial markets.

in a way, yes

WSB option holders are gonna get bled here while everything trades sideways

So many random people are asking me if I’m in GME right now

There are lots of things that rich people are apparently allowed to do that would destroy the world if everyone did them.

Yea this has spread to regular folks on social media. Definitely a sign that GME has peaked.

Here I am holding BTC/ETH as the high risk part of my portfolio with the rest in mutual fund stonks like some sort of boomer pleb. No tendies in sight

Boring ass GME day.

https://twitter.com/toxic/status/1353890766800621569?s=21

Interesting thread - I’m too stupid to understand if it’s true though.

Rather have the boring day rather than the drop of EXPR

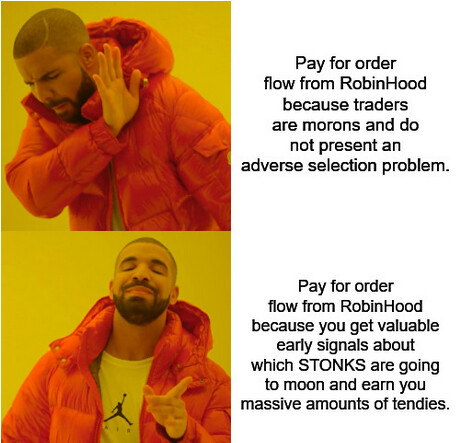

I’m not sure what this thread is implying. That Citadel is using the RH order flow NOT because they want to scrape a few pennies on executing the trades, but because Citadel wants to use the RH order flow as an information signal and take on a large position based on that signal?

That seems unlikely to me, but I’ll be honest - I don’t feel like I have a good understanding of STONKS.

I thankfully sold it at open today for only a modest loss. Yikes.

I did not, but will wait until tomorrow to see if things recover.

Looks like I spoke too soon.

Need to update my syllabus on adverse selection.

It’s almost certainly not happening. It’s illegal for a brokerage to share their order flow with select clients before executing those orders.