Alright I bought 30 AMC. Lol. CMON DEALER ONE TIME!!!

maybe I’m a weirdo but I haven’t sold any of the RSUs I’ve been granted and have vested in the last 3 years. And now my company’s stonk had doubled since the initial grant!

Owning stock of your employer is really bad. Generally speaking, the worst financial thing you can do is load up on idiosyncratic risks, because no one pays you to do it. (That is, if a risk is akin to flipping a coin, there’s no special compensation for bearing the risk, because people in financial markets can just buy lots of coins and diversify the risk away. The risks you get paid for are the nondiversifiable ones.) You have a risk that your employer will go out of business and you’ll lose your job or promotion prospects. Why load up on with risk that a chunk of your retirement will go poof if that happens too? Better to diversify.

Some companies have attractive employee packages to buy their shares on top of the retirement plan. I agree your retirement plan should be plain vanilla diversified funds but if you can get an employer match on a stock plan then you actually are compensated for the concentration risk.

Yeah, that’s true. I meant to add that if you are getting compensated for the risk (because there’s a sweet stock ownership plan or you got a lucrative C-level gig that requires you to own a bunch of stock), then go ahead. Just don’t do it for free.

GME already halted at 9:40

Excellent, thanks.

Totally agree. One of the most tragic outcomes of one of the big scandals (Enron?) was that they were filling their own employee retirement plans will employer common shares. Regular employees had their retirement savings completely wiped out.

Even worse, the retirement funds were frozen while the ship was sinking, so employees couldn’t sell even if they wanted to:

Through the 401(k) retirement plan, employees chose to put much of their savings in Enron shares, and the company made contributions in company stock as well. But around the time Enron disclosed serious financial problems last month, the company froze the assets in the plan because of an administrative change. For several weeks, as the stock lost much of its value, workers stood by helplessly as their retirement savings evaporated. They were not allowed to switch investments at all – even though the plan had far less risky choices.

The unfortunate timing caps a year of pain for Enron’s workers. At the end of last year, the 401(k) plan had $2.1 billion in assets. More than half was invested in Enron, an energy conglomerate. Since then, the stock has lost 94 percent of its value.

meh its like 30k

https://twitter.com/bopinion/status/1353793741887303687?s=21

https://twitter.com/bopinion/status/1353793745968377857?s=21

I’m sorry but this WSB shit reminds me of the city bus driver telling 8th grade me that the future is tech stocks in 1999 (he was right in general but his favorite stock was Novell and he was definitely the kind of guy who would buy the stamps.com IPO. He was YOLOing it up in the stock market so that he could retire early and buy a boat)… or my personal trainer telling me to buy bitcoin in 2017 like 2 weeks before it popped.

These people are all going to get crushed, and they are a sign of coming trouble. When is a good questions as always and we can’t time it, but this is not going to end well.

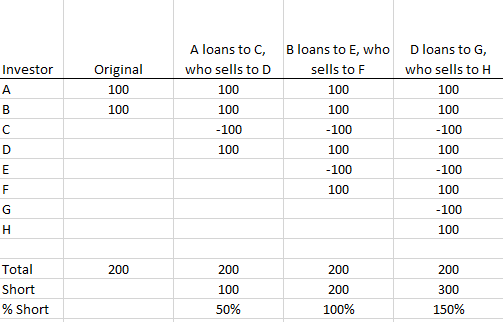

How can a company’s short interest be above 100%?

My guess is that every short doesn’t require an underlying stock availabke in the float. Maybe just some percentage is required? (Similar to how a bank only needs some perrcent of loans held in reserve cash.)

This is just getting even weirder.

Really bad look for Chamath.

Seems like you should have to borrow the shares. But if you don’t have to borrow the shares to short a stock why would anyone borrow shares? And if you have to borrow shares how can the short interest be bigger than the float?

Just sequential lending and shorting. Nothing necessarily evil. For example: