DOW 24,000 TWICE IN ONE DAY. THANK YOU, WORKING HARD.

If this level of volatility keeps up for a week or two, we may manage to get celebratory 24K and 25K tweets in the same day, then end up at 23K at close and get a fake news media manipulated my markets tweet.

Signal V Noise

Very noisy. Volatile even.

IraqInformationMinister.jpg right?

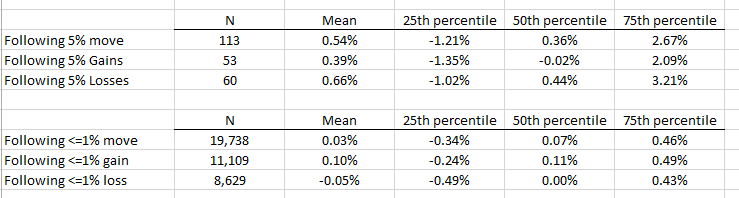

Just to put some numbers to some of the earlier conversation. If you look back over the last 100 years or so at all the days following a big (>=5%) market move, and you compare that to what happens after a small (<=1%) market move, here’s what you see the next trading day:

There’s no statistical relation between today’s move and yesterday’s move, regardless of whether yesterday’s move was big or small. There is autocorrelation in volatility - large moves tend to follow large moves, but I’m skeptical that you could actually implement a trading strategy that would profit of that well-known pattern.

I’m obviously not starting a hedge fund but if you want to prop bet I’ll post trades starting starting tomorrow. You pick any S&P500 ETF to benchmark against. I’ll trade between stocks, ETF’s, mutual funds and cash within NYSE trading hours (no shorts, no options, no leverage). If my trades net more than your fund by the close on 3/10/21 you pay me $x, if I net equal or less I pay you $x. You can pick the value of $x.

You win either way? Nice wager if you can book it!

Oops, edited

I told you guys the dead cat bounce off the dead cat bounce was gonna die. Pay me now.

Fuck it let’s get rich and be legends. I got five on the unstuck hedgefund

fuck it

just loaded up on VTIAX

lettuce gogogogo!

Ok so after the second bounce, the dead cat had a sudden explosion of fermenting gas - which caused it to rocket back up. But that’s fizzling. All foreseen.

I generally agree. Except when the market was setting new highs every day while China was shut down. I knew it was going to negatively hit the market, how could it not? People thought they were going to restart manufacturing a lot sooner, but because of the C-19 thread on this forum it was obvious there was no chance of that and it was obvious (because the market was at all time highs) that it wasn’t priced in.

Where it goes from here, who knows? I suspect very strongly once the shit really hits the fan in the US that it will continue trending down for a while, with the likelihood for more significant losses. But I’ll keep buying back into the drops because I know I cannot predict the bottom. And if it turns around and heads back up I’ll just hold at my current AA because 60:40 isn’t a bad place to be at my age.

But anyway the China thing was a once-in-a-lifetime completely obvious situation imo even if I know that 99.9% of the time I have no clue what the matket is going to do any given day, month, year.

I completely agree that timing the market on a day to day basis is a fool’s errand.

But I disagree that everything is always rationally priced in or at least priced in by people so much smarter and more informed than us that we’re chasing our tail to try to beat them at it.

I think sometimes it’s possible to see black swan events coming before a chunk of investors because people are naturally delusional when strong emotions (IE - a lot of money, or political tribalism, etc) are at stake. You will never convince me that it wasn’t possible to see the dotcom bubble coming. I knew something was out of whack in 2006 as well - but I didn’t see the full derivatives collapse.

I think we’re drawing very live to Italy-level issues - and a chunk of the market is still whistling past the graveyard on it.

We’re drawing live to significantly worse than Italy-level issues.

All i see are ponzi waves

No one is arguing that the market is always rationally priced. Certainly it was possible to see the dot com bubble coming. Many did. The Big Short guys saw the housing bubble coming. But some of the Big Short guys also had to shut down their hedge fund a few years ago because they weren’t making any money, so maybe they just got really lucky? And if it’s hard for Professional Brain Geniuses to beat the market working on it full time, what chance do I have?

I remember people talking about the housing bubble like 3 years before it crashed. Not sure that kind of “seeing” is very actionable for the average Joe. This China thing was obvious and obvious to hit the market within a couple of months at the most imo.

My theory is that only during black swan events do I maybe have a chance of being smarter than the market. I don’t even pretend that I have the level of research, smarts, experience or access to information as the Big Short guys.

But just maybe as a typical buy and hold investor - you can maybe see the forest for the trees and get out before most other buy and hold investors.

The hedge fund guys are jumping in and out so much - they could also see the black swan coming but aren’t selling yet because they still see chances to make money before it really hits - and bounces up and down all the way down etc - based on their algos and HFT front-running and whatever else they do. I’m obviously not even going to try that.

Yeah the big fear was that people were going to start defaulting when their ARMs went up, and it was going to tank real estate - which would hurt the market. What no one knew except like the Big Short guys was how exposed Wall St. was.

Although in retrospect w/o some ridiculous exposure somewhere - local lenders aren’t going to be offering me a loan for $600k when I made $70k/year and tell me I could get a) more, b) a loan for my down payment, and c) a liar’s loan if I can’t prove my income - all for a higher rate of course. This is when I knew something was way out of whack.