I don’t think GME puts are the printing machine you think they are. Assuming no further issuance they’d be a ~$2B company at $25/share–not exactly huge, and no reason to think they couldn’t maintain that market cap. With a console cycle coming up and the potential for them to hold on to a small piece of the gaming-related online marketplace they could easily avoid bankruptcy for a long time.

You may be right, my direct experience on this is from the perspective of a registered advisor and I know all the ways the SEC leans on advisors or people providing advice without a license.

Another wrinkle is jurisdiction. In Canada (again not totally relevant but my best point of reference) the commissions regulate exchanges and securities trading and investment advice but stuff like insider trading is a Federal criminal code violation. I wonder if in the US there may also be bodies other than the securities commission that can act here. Like, fraud is fraud even if its securities fraud. Some non-securities specific consumer protection laws might be in play here too.

Meanwhile, GameStop has also been a hot topic in online chat rooms, Twitter and Reddit as some retail investors and day traders aim to push shares higher and squeeze out short sellers.

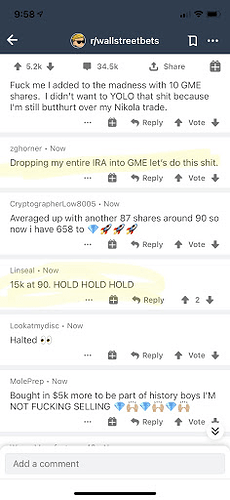

One post on the popular “wallstreetbets” Reddit Monday morning said “IM NOT SELLING THIS UNTIL AT LEAST $1000+ GME.” And this post has already more than 1,100 comments.

Citron Research, a vocal GameStop short seller, said Friday it would not be commenting on GameStop any longer because of attacks from the “angry mob” that owns the stock. Citron said there were too many people hacking Citron’s twitter account on Friday and canceled a live stream where it was going a detail five reasons why the stock will go back to $20.

So, wallstreetbets is just the inevitable conclusion of the UIGEA, no?

GME just dropped $15 and halted

gonna be an interesting day

I guess they’re pumping BlackBerry today, god bless.

I don’t understand why a stock can double in a day without interruption on blatant market manipulation, but trading is halted when it goes down 15% or whatever.

Gotta think Game Stop executives’ entire day is figuring out how quickly they can issue new shares

If you’re an executive with stock options its probably not so bad!

There should be a market to predict which will collapse first: GME or those $100k YouTube basketball video clips.

Fired EXPR calls so the collapse is imminent. Going hiking all day w no phone service so fully expect to be a millionaire or broke when I turn my phone back on. Yes I am a degen.

every broker crashing right now it seems

Pretty butthurt my order isn’t going to get filled

Do I even want to know what in the hell this is?

I was being facetious about the YouTube part, but here ya go…

They aren’t trolling. My question is why didn’t this happen sooner? It’s just a bunch of idiots on a forum pumping stocks.

All this heavily shorted garbage blowing out every short in the market is very healthy and not at all scary btw. Totally normal market functioning.

btw bed bath and beyond now up 45% today

I dont get why this isnt in something worthwhile? Why some piece of shit company like Gamestop?

I haven’t shorted anything since 2012 because it’s (in my opinion) nearly always a suckers bet unless you have some real insight into a near term catalyst that would make the price fall. And even then you can get short squeezed.

It’s as if, and bear with me here, the system doesn’t want you betting against the system… and makes it structurally very -EV.

I’m really glad I stopped shorting stuff… I would have lost a lot on Tesla.

109