Might be time for the SEC to step in.

Also is what WSB doing a crime? I don’t know much about securities laws. If not I am shocked it took this long for the internet to pull this off at this magnitude.

Bitcoin already happened imo.

Fair enough. Bitcoin isn’t regulated by the SEC though. Or at least wasn’t.

Also some one explain why longer dated puts aren’t super free money here? GME issues stock and buys an actual viable company? I can’t get the option prices to load but I assume the puts have to be mega expensive.

Longer dated puts were super free money Friday at $70 too

Same thing with Spy puts at 300

How long can this realistically last though? When the bubble bursts every WSB person is closing their positions. SPY is an entirely different animal from GME.

Unlike Bitcoin you also have the risk of the SEC stepping in to shut this down any minute.

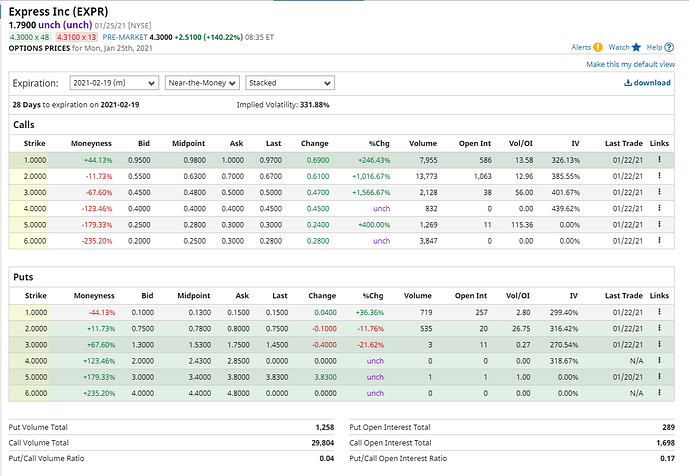

You can buy Feb 26th $25 strike puts for under a dollar it looks like if the option calculator I am looking at is correct after today’s move. Someone explain why I should not be unloading on this.

I know more about Canadian securities law but I think a general principle is that if you aren’t holding yourself out as a paid investment advisor then its pretty hard for the SEC to insert themselves. Their usual remedy for bad financial advice is demonstrating that someone is acting as an advisor with no license, or acting contrary to the conditions imposed on a licensed advisor.

In this case, I think where the securities law applies would be a) go after their trading platform (Robinhood) or b) use trading controls on the exchange.

They have prosecuted people in the past for internet pump and dumps. How is this any different? That’s the part I am not understanding.

Now up over $100/share.

I think there’s a nuance where pump and dump off the exchanges is illegal but once the security is on the exchange, with all the investor continuous disclosure rules etc., you can basically say whatever you want about them unless you’re a registered advisor (which comes with rules) or if you have insider information.

Googling it says this isn’t accurate and on-exchange P&D is still securities fraud. Certainly what WSB is doing is a P&D scheme right?

I am going to be making an all or nothing bet on the GME bubble deflating within 5 weeks at open. If I lose it all that’s fine. I bet large amounts on sports and lose it all all the time. This is a clear chance for a multi-bagger though imo. The stock was under $5 5 months ago and is up 200% in the last trading day based on nothing but internet scamming and a short squeeze.

Disclaimer: I am terrible at STONKS.

There are certainly posters who are attempting to p&d individual stocks but I don’t think you can describe the whole forum that way. I don’t think what they’re doing is fundamentally any different than what people on SeekingAlpha or other stock discussion sites are doing. WSB is just quite a bit less sophisticated / more juvenile and also happen to have a few million rabid gamblers ready to throw money at darts.

How about we just find another terrible failing company that’s heavily shorted

Does Macy’s still exist?

This AMC stuff is so funny to me. I worked forever in the main cinema chain in Australia and still know several people in head office. They are utterlyyyyy fucked (probably independent of covid)

Anyone have any opinion on what kind of strike/date puts you would prefer to bet on the bubble popping?

I like this idea too. Could even let WSB know about our research.

capitalism is the most efficient resource allocation method ever devised by man

Serious question. Would you prefer GME puts or EXPR calls. Lets say a 1 month out expiration.

Piling in one of these at the ground floor would be insane.