I’m so jealous that I’m actually a little mad at him for still holding. Fucking retire man

Jesus balls on this fella to still be holding

It seems that regardless of what one actually does, everyone seems to think a prudent strategy is to just be mostly in some total market index fund and have a small percentage in bonds or cash. You buy and hold until you hit your number and they you retire.

What do you do then?

If you get to a point where your overwhelming goal is to preserve capital, what is the best strategy? It seems like if you don’t change your allocations you can get really fucked. If you stop the moment you hit your number, and then the market goes down (which it has to eventually), you suddenly don’t have enough money. To fade that, you might decide to invest in bonds. But the interest rates can go up and you will get fucked in a different way. Buying some sort of single premium immunity seems donkish if you’re not super old.

So where do you put it?

GME

Yeah, I deserved that for asking that question now.

I guess the bull case is they turn it into Virtual reality dave and busters?

It seems to me like the best investment right now is starting a company with no plan to make a profit and some way to generate enough hype that morons want to buy your stock anyways. They have to put their money somewhere, right?

How? They’re not insiders.

I’m pretty sure that’s the DoorDash thesis.

“We lose money on every sale but make it up in volume” is actually being rewarded. Fucking stonks man.

screw GME

I got MEGA MILLIONS TONIGHT since it’s a billion (I know lump sum will be considerably less but suck it wallstreetbets)

also for the very long term, don’t know how financial advisers are gonna survive, we’ve had quite the timeframe where their investment %'s pale in comparison to crazy ass shit and meme things. They’ll never go back to that.

Sounds like you just invented crypto shitcoins but are 3-5 years too late

Need balance and diversity: 50% GME, 50% AMC

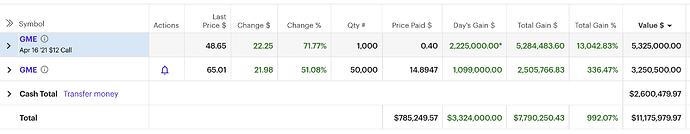

Days like today I question my strategy of dumping all my money into mutual funds and never looking at it. Can’t believe that guy went from $55k to $11m on GameStop… unbelievable.

Pussy. Leverage up.

Same, but ELI3.

bet money on gamestop when it was 3 or 4 bucks a share

won bigly for things that had nothing to do with why he bought it in the first place

the end

The stock he got was when it was worth just under $15 and I thought he bought the options around the same time. GameStop was that price at just over a month ago

Just a sick sick heater lol

bet money on gamestop when it was 3 or 4 bucks a share

won bigly for things that had nothing to do with why he bought it in the first place

the end

You need to dumb it down more.

You bought it at 3, now it’s 65. So about 20x increase. Seems like this guy did better than that.