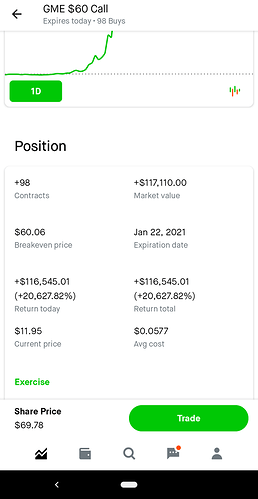

Skimming his posting history, he’s been trading GME for at least a year

Looks like he also bought on it increasing 3x+ by certain dates. Which all hit, those would’ve been higher odds certainly

thing wallstreetbets doesn’t realize yet with pumps

the dump eventually comes

now would be a good time with more demand than supply but what do I know, getting rich on the internet mainly works on pump and dump schemes more than any technical reality. Already knew that with shitcoins and gambling markets with comment sections and whatever youtube shillers. They just brought it to investing.

I skimmed his posts. He initiated his position over a year ago with a legit thesis, got laughed at by ~everyone, and has held this whole time. He made this much money by buying far out of the money calls. The rest of WSB are idiots chasing meme stocks, but I’m gonna give this dude props–he found what he thought was a legit good bet and shoved all his chips in. Gotta respect the gamble.

you too could’ve bought GME to be $60 on .06 cents and binked it all overnight with a deadline of today

from wall street bets reddit

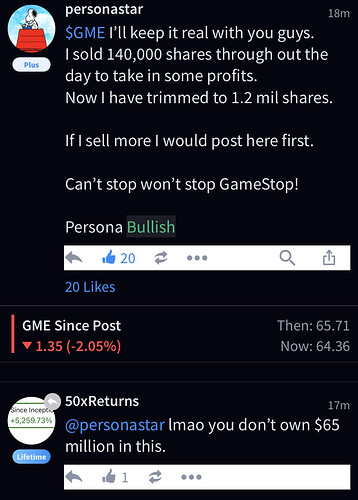

This is from today on Stocktwits. This guy’s account is evidently legit too.

Also - WSB is pumping AMC as is Atlas which is investing discord where the guys have 100k+ followers. They pump low float garbage on Twitter and it immediately shoots up 5 - 10%.

https://mobile.twitter.com/MrZackMorris/status/1352809574135443456

Yes this guy posting a gif moves markets. I wish I was joking.

IIRC they had like $8/share just in cash despite trading at like $4/share, and I think the math on their online biz showed that it was way undervalued relative to other competitors. Obviously not a sure thing but they were more than just a bunch of physical stores, and I think the calculation was basically odds of a successful pivot to mostly-online sales vs odds of bankruptcy. He guessed right, I guess–though it helps to have an entire subreddit backing your play.

I think GME would be insane not to sell more stock at these valuations tbh

Real answer: 3 years of expenses in cash, reduced exposure to stocks (like 40% allocation), and the rest in bonds/cash/real estate. You can also do real estate for income streams, and retire when the income meets your expenses plus whatever cushion you decide on.

Let’s assume you don’t do real estate. REITs don’t count.

That leaves you at 60% bonds. Are you going inflation protected with those? Because that really cuts into the return. If not, are you uncomfortable with interest rates where they are right now?

Also if you have been stonking for a life time and you want to change that to bonds, you are going to completely fucked by capital gains taxes for anything outside a retirement account. Do you just eat that?

How long until you plan to retire?

The question was mostly theoretical. Let’s say you were going to retire in 5 yrs, but because stonks have stonked, you’re probably going to hit your goal in less than 1. Alternatively, imagine you’re the gamestop bro. If you cash out, where do you put it?

The taxes complicate things, yes. You don’t just go from100% stocks to 40% in one year. You also have at least some money in tax advantaged accounts, which are available regardless of income. So a reduced equity glide path leading up to retirement can look like putting more money into bonds over a period of years, as well as selling stocks that are held in Roth/HSA/IRA/401k accounts (again, no excuse not to have at least the Roth). With those two strategies and the low capital gains tax rates, the bite should not be too bad. The lower your expenses, the easier it is. Finally, there are robo-brokers that will tax loss harvest automatically, to keep your gains taxes as low as possible.

I was just asking, because if the person had enough time they could do things like max I-bonds ($20k per year if married) for a number of years. And also consider maxing EE bonds as well to use as a small self funded annuity. (They double after 20 years so $20k per year gives you a $40k per year “annuity” starting in 20 years.)

As far as tax stuff, for us, the way things have shaken out with the accounts that we have it’s kind of worked itself out. We are now 60:40 and plan to stay with this allocation into retirement in about 4 to 8 years.

Our Roth accounts are 100% US equities as we expect these to grow a lot and it will never be taxed. Our taxable brokerage accounts hold all of our International equity in order to take advantage of writing off foreign tax credits that would lost if these funds were inside a tax shelter. Above our international allocation the rest of these taxable accounts are filled with US equity funds.

We then have an inherited IRA that contains TIPS funds up to our desired allocation, and the rest is in intermediate treasuries funds and cash. (In a world with better rates these would be in long treasuries.) We have to by law cash this IRA out within 10 years, so that’s why it’s filled with our lowest expected growth investments.

We then have accounts with the US Treasury to hold I-Bonds, as many as we are allowed to buy. We count these as part of our 40 percent fixed allocation.

Then our 401k’s hold US equity and total US bond at the correct percentages to keep our total allocation to 60:40. Every 6 months or whenever we make large chunk contributions to our taxable accounts we typically make adjustments with these 401k accounts to keep everything balanced.

Edit: And we have one HSA that is all in US equity funds except for the $1000 they require us to keep in cash for some reason.

It all ends up like this:

40% US equity

20% International equity

15% total US bond and and intermediate treasuries funds

15% TIPS funds and I-bonds

10% cash

Probably not perfect but hopefully good enough.

Series I savings bonds and Series EE savings bonds. You purchase them directly from the US Treasury. They are not traded on secondary markets. Probably best to just give you a couple of links. You could also search the Bogleheads forum for in depth discussions on pros and cons, but these two links give you the basics.

I should probably have added, that it’s most appropriate to start buying these when you are something like 20 years out from retirement, but not sooner. Those links go into the reasons why. So if you are very young and not planning to retire early, you may rather just invest in a taxable account (after filling your 401k, HSA, etc.). Especially if you want to maintain an aggressive asset allocation like 80:20 or higher.

Yeah, as I mentioned above, I’m contemplating a somewhat theoretical scenario like Gamestop bro where retirement kind of sneaks up on you so you don’t have years to plan and it’s mostly out of a retirement account. It sounds like the answer is to just go slow and just pay the damn taxes.

I’m normally pretty good about tax-loss harvesting, but how exactly do the robos work? I’ve heard of them, but I don’t get how they avoid things like wash sales triggered by dividend investment in your workplace retirement accounts. I suppose you could input all that stuff, but I don’t think the robo broker would be able to do anything to the accounts that aren’t held by the robo broker.

Thanks. I’ll need to bookmark this one for actual personal use. Very helpful.

I still am curious about my theoretical problem. Let’s say you’re Gamestop bro. You decide to cash out your 11 million on Monday. None of it is in a retirement account. We’ll say after taxes you’ve got 8 million. What do you do? I feel like my plan would be to find a Vanguard target retirement account with a very early date and just stick it in there until I figured out what to do. I probably wouldn’t come up with anything better and just end up leaving it there.

WSB bros are paying ordinary income tax rates on their options wins and short-term gains, so yeah, not much choice there.

I haven’t looked into the robo brokers much. I may do so later this year, when I will have some money to invest in a taxable account.

Really? In Canada you can claim options payoffs as capital gains I think.

You only get the favorable treatment for securities held longer than a year, so most options trading gains will be taxes as ordinary income.

Edit: Wow, holy crap, the tax treatments are even more complicated than the options themselves. Good luck figuring this stuff out if you’re not a tax accountant. Tax Treatment for Call and Put Options

What’s the best way to coat tail these forum kids? Idk how long it’ll work but obviously they are on to something. I’ve got fractions of a bitcoin to burn!

In any case I now own some BB