We are now in the meme bubble

I assume it’s gonna be like every other pop, something that seems 100% obvious in hindsight but in reality was very difficult for anyone to predict. I’m pretty confident that these meme traders are gonna get wiped when it happens though.

the same as predictit pumpers or those people who pumped shitcoins, they’ll never stop because they’ll make a ton of money

like all schemes, if rubes keep piling in, it just keeps going up might take quite some time to crash and even then they’ll move on to the next thing and nobody ever learns

More regulation by the SEC. If they stop allowing these tech companies with no revenue to show 800% growth by FY 2025 a lot of these IPOs will faceplant.

SPACs are the most insane bubble. It’s a ton of pre-revenue companies that are unlikely to otherwise IPO being handed a pile of cash while the SPAC sponsor gets a pile of basically free shares. These sponsors like Alec Gores will probably book over a billion in SPAC promote fees in 2021.

I don’t think it’s popping for a couple of years at least. Of course, it wouldn’t shock me if it popped tomorrow or next month or any time really, but I think we have a ways to go. In any case, after doing some market timing around the pandemic, I’m back to my usual plan of sticking money in at my AA and doing nothing except rebalancing 2x/year.

Yeah it’s something like this. I have a feeling we’re going to look at all of these massively valued companies and there will be a repricing.

Like someone in 2025 will say “Hey… Uber said they’d be making a profit of $5 Billion annually by 2025 and they just posted an annual loss of $1.5 Billion. When is this company going to actually make any money? And hey while we’re at it… DoorDash, Airbnb, and Tesla still haven’t turned a profit yet either”

I think the fundamental problem is that you need willing sellers. The problem with the stock market as it stands is that there is so little actual monetary interest in the short side relative to the massive individual investors, hedge funds, index funds, pension funds, etc who are all interested in the long side. So the only people willing to sell stocks are either HFT-Adjacent firms (like the one I work at) that aren’t taking a short position for more than a week, or people who already have a long position in it, meaning that any major interest from the buy side is going to drive the price way up because the liquidity that is willing to sell is pretty small.

So I think what you’re saying is?

Sorry that was a good post but it was just begging for stonk man

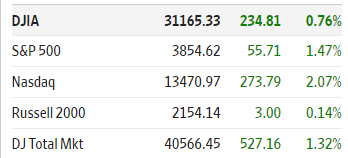

What is this malarkey? STONKS loving sleepy Joe!

Go Joe Go

Stonks ripping on the godless trans black communist mandate.

Going to be an amazing 4 years of boomers twisting themselves into pretzels saying the market isn’t the economy and they had more money under Trump.

I would expect a lot of “its all a bubble funded by government overreach we need to reduce the deficit and go to a gold standard” to start picking up in the derposphere.

well they did have more money under trump a few months ago but they bet on him to win an election after he lost said election

I’ve said this for a while but I think it’s finally manifesting itself a bit in the current environment of “lol stonks go up”.

My theory has been:

There is going to be some strange externality caused by the fact that a ton of private wealth is basically held in the same few basic US Equity-based index funds.

I don’t exactly know how it’s going to manifest itself. But it does provide a strange type of marketplace where almost all private wealth in the marketplace is hoping for these specific 500 or 1000 or 2000 companies to do better. And there isn’t really a clear definition of when that bet on the valuation has to be right or wrong, as long as more people are willing to keep putting money in these same companies saying they should be valued higher than they currently are.

The nice thing about value investing is that if all else fails you still have something that produces a certain amount of value. What you’re describing is more of a pyramid scheme. When the shit hits the fan there’s nothing to backstop it, until you get down to where the value investors become interested.

Now you could argue that our whole fiat money system is basically a giant ponzi scheme. Which might be true. But it’s a ponzi scheme that’s outlived plenty of investors, as I hope it does me. Bubbles rarely outlive investors.

I’ve had this exact conversation several times. There is so much interest in keeping that portfolio of stocks creating consistent returns that it has to impact how they act.

This is definitely true, but it is very interesting to see the trend toward institutional money pulling out of public markets and moving toward more direct ownership and private placement. Retail investors depend more in index performance than powerful institutions, and that gap is widening.

I mean, I’m definitely worried about it, but I don’t see any alternatives for investing my own money. I have no access to private deals and am not smart enough to evaluate managers even if I did. There are some truly great opportunities in real estate but again, you need to have millions of liquid dollars to invest in them.

You actually might if you are willing to pay active fees. I am not a US investor but in Canada we are seeing some managers pop up that are wrapping private investments in retail funds and then you can pool you money with other retail investors. But the fees are unattractive.

@edc5036 any concerns about hodling when the new treasury sec says they will likely look at ways to curtail bitcoin and crypto?