I wouldn’t worry about it, an inevitable outcome of the proliferation of target date funds and passive funds and stuff like that will be a race to the bottom in fees and retirement plan sponsors will shuffle around between providers. I wouldn’t worry unless your option to be in passive or target date funds is taken away and they start sending you marketing materials about private markets opportunities and institutional grade hedge funds.

Yeah… QS makes no fucking sense. I was almost in pre-merger but it ran ridiculously high then fell to $11 before going 10bagger a month later.

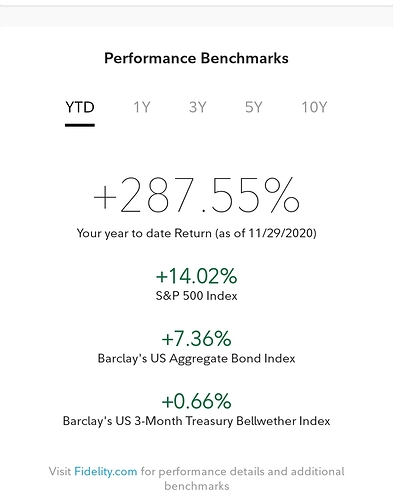

So I broke my own rule with buying individual stonks and started messing around with SPACs in July and this happened…

This shit is nuts right now… it’s beyond bubble status and I’ve been piling profit back into some index funds waiting for the rug pull. I can’t imagine wtf will happen if all the degens actually get $2000 checks.

Insane. Also fuck you (to quote wsb)

Interesting interview with Michael Saylor, who discusses his rational for betting his company’s farm on Bitcoin. Has a unique (at least to me) perspective on why all assets are inflated and why bitcoin is a viable alternative.

Worth a listen if you’re at all interested in the subject.

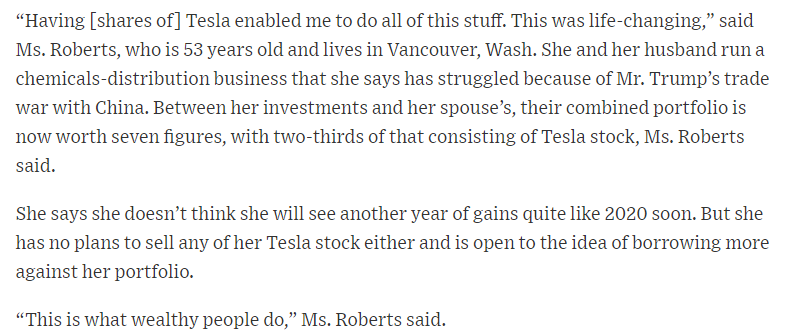

Seems sustainable

Well this always ends well.

If you read the article, some imbecile with a hyper concentrated, leveraged Tesla position says “this is what wealthy people do,” that’s gotta be a sign we’re close to the music stopping.

I just finished “Billion Dollar Loser” about WeWork and Adam Neumann. Boy oh boy, there are an enormous number of idiots working in finance who can be star-struck by a bullshit-spewing CEO. It’s frightening that people who should presumably know better are still falling for the “pay no attention to our GAAP numbers - our projected adjusted metrics look fantastic!” nonsense.

Overall, the story is super interesting but the book was a little thin, so I’m not sure I’d recommend it. I think you can probably get the general idea from the author’s magazine story here:

Are you sure? There are all kinds of agency issues too, like how many financial analysts pumping something like WeWork were, like, personally devastated by it? I am a couple of degrees of separation from investment bankers in my job, but it sure looks like as long as people are moving money around and they get a fee per transaction then they turn out fine. I’m sure it helps them if the investments work out great but I’m not sure they’re the stupid people involved.

The investment banks didn’t get paid for the WeWork IPO because it didn’t close.

The biggest loser in the WeWork saga was Softbank, followed by their landlords. The IPO didn’t happen because the required disclosure exposed the company’s fundamental weakness. Seems like the system kind of worked?

Yes wealthy people clearly have 2/3 of their net worth in the stock of one single company… Then borrow more money to put even more of their net worth in that single company’s stock.

The biggest problem is that I fear that the asset price bubble might be way further off than we think. Every Central Bank in the world realizes they have no incentive to turn off the money printer, and it will just keep asset prices high especially in USA #1 because the Federal Reserve can only take those dollars and pump them into things that already have value, whereas doing the correct and moral thing (Printing $$$ and giving it to poor people) is basically impossible.

I’ve said for 6-7 years and still think it’s true. Every major world economy is on the same trajectory and Japan is the furthest along on that trajectory. I’m not sure if they’ll be the first one to figure out what happens when you can’t print more money or if anyone will have that happen in our lifetimes.

If anyone knows about STONKS losing instead of goes up forever it’s japan though

Boy oh boy, there are an enormous number of idiots working in finance who can be star-struck by a bullshit-spewing CEO.

I’ve said this before, but the Elizabeth Holmes documentary really is a must-watch.

I read the book, and it’s excellent, but I should probably watch this too.

Looks parabolic in linear. Use the log function and no problem BTC 100,000k!

@me when this shit goes cubic

Turns out the bunch of crypto scraps i have kinda ignored in the past years are now worth

about 350$