Which means what? If I put $1k on Jan 1, 2020. How much do I have on Jan 1, 2021?

.05 percent per quarter

So at the end of the year I have $1002? Awesome. Sounds so much better than my FXE with zero basis points that keeed is making fun of me for.

I will clearly never understand bonds. I think I had a mini-stroke in that part of my brain.

Bonds are easy. When you throw a bunch of them together into a bond fund is where I get confused.

You could have more or less. If interest rates fall, then the bond fund can return significantly more. I think the Vanguard total bond fund is up like 7% YTD. If interest rates rise, the fund will lose money. I don’t really understand bonds either, but I do buy them.

What I truly don’t understand is who the hell is buying 30 year treasuries at 1.7%. It is basically a reverse freeroll. Even a relatively modest rise in interest rates can result in massive losses and it is close to impossible for interest rates to go substantially lower.

So bonds are like women?

Ok so let me see if I can do this. A typical bond funds’ range is something like +/- 10% in any given year and most likely +/- 5% - largely tied to interest rates. Which is maybe 1/4 as risky as a stonk fund? Also you get a TINY payout.

Before I continue - do I have that more or less right?

Correct me if I’m wrong here, but if you just hold for the 30 yrs, you just get your money back plus the 1.7% per year. Your only loss is to inflation, regardless of what happens to interest rates.

30 yrs is a long time to be locked in, though.

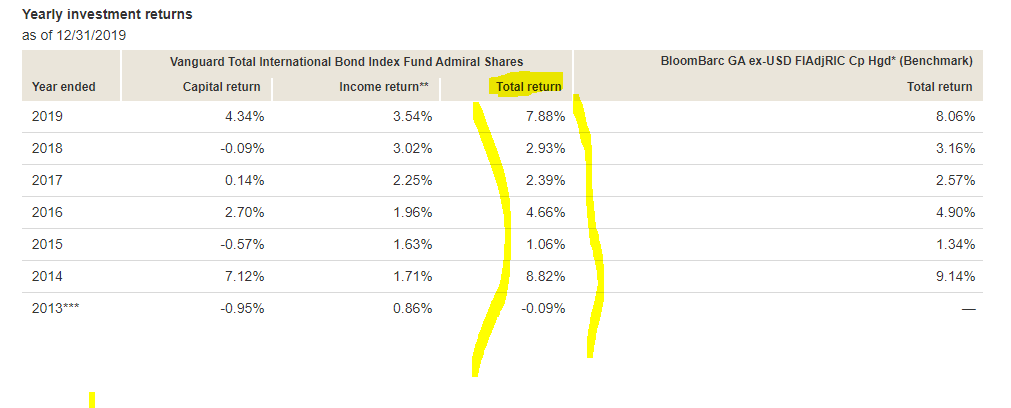

There haven’t really been any bad loss years for the big bond funds, like -2 percent is a bad year. They’ve had years returning greater than 10 percent and some greater than 15 percent (and one greater than 30 percent). But we’ve been in a 40+ year bond bull market.

I don’t know what we can expect for a worse case if rates rise significantly. But I suppose if +30 percent can happen then probably -30 percent can happen.

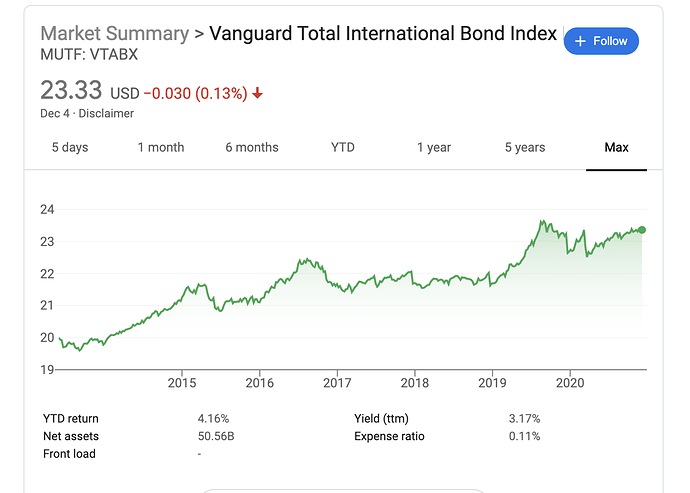

So for VTABX over the last 5 years - it looks like you get about 2%/year + .2%/year payout. Is that right?

This bond talk is boring, let’s talk about insane WSB gains

I mean, that’s a huge potential loss!

But 30 years are the bonds I’m most likely to buy if I ever go away from all stocks, since their volatility is actually beneficial. But yeah, not right now.

That’s what they said when 30 years were yielding 3%.

Yea that’s fake

Now we have 3 sources - Google, the Vanguard site and this - which all seem to disagree wildly on returns on a per year and aggregate basis.

Institutions with 30 year obligations have valid reasons to buy 30 year bonds. Its basically and interest rate risk hedge for entities like pension plans where the LT bonds move in parallel to marked to market obligations.

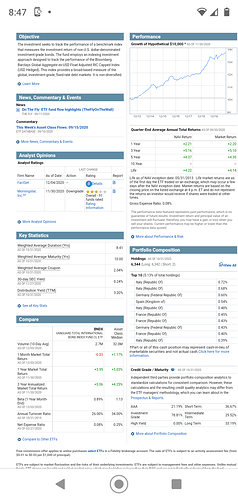

Approximately 38% of my money is in bond ETFs, and 10% of this bond money is in a Vanguard international bond fund (BNDX). You can see below that the current average coupon is approximately 2%.

Depends on what you’re comparing. The thing I posted with the total returns includes reinvesting interest payments. I’m not sure if that chart you posted includes reinvesting interest, or if it’s just plotting the share price. That’s my guess, anyway.