I still don’t really understand how it works that each Euro country gets to issue its own bonds in a single currency. Given the fiasco with Greece and Spain and Portugal, I guess the answer is: not great.

Therein lies the rub

$157 billion in a fund yielding 19 basis points. Wat

That actually looks pretty decent.

hey, still better than the 0 basis points suzzer’s straight eurocash is paying

I was expecting negative after your last post, so I was pleasantly surprised.

Transfer wise is legit, have used this a lot, including doing business in euros and moving 6 figures from uk to usa when I moved back. It’s real banks, can get a debit card and do online transfers in the normal euro way. It’s real banks so the normal protections apply depending on jurisdiction.

Capital preservation is a legit goal.

Guise I’ll hold your money for a small fee, no problem

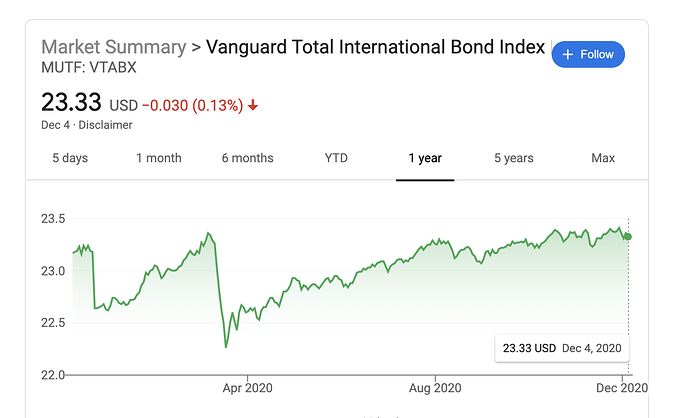

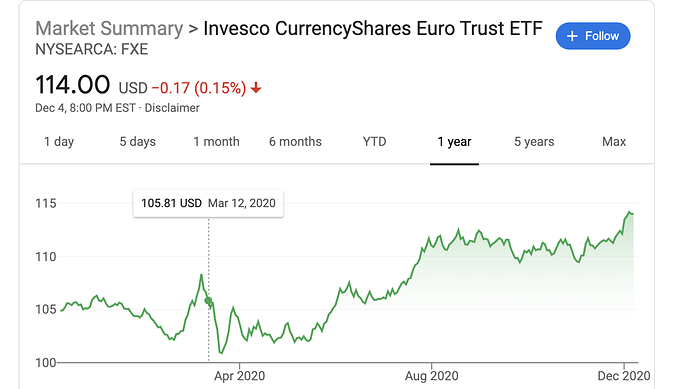

Unless I’m reading these wrong VTABX basically even over the last year, whereas FXE is up about 8%. Is there some kind of dividend or something that doesn’t show up on this?

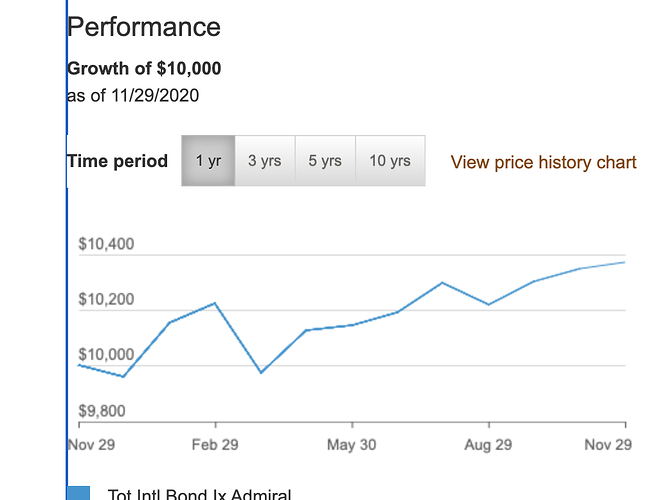

Ok your link says you’d be up about 4%. How does that work exactly if the price doesn’t go up?

Thanks. Even if I don’t use it to currency trade, it seems like it would be quite useful when traveling, whenever that becomes a thing again.

While we’re on the subject, the best solution I found (and I haven’t looked recently) was to just get an account at interactive brokers, just convert to whatever currency, and hold the funds there. It seemed relatively simple and without excessive fees. If I get serious about holding something other than dollars, I’ll check that out again.

It’s yielding a hefty 0.2%, so that’ll get paid into your account quarterly. I think on Vanguard the performance on those charts is only updated like monthly or something so it won’t be up to date exactly.

It is up 4% because interest rates have gone down.

But the bottom line is I would have made twice as much in FXE over the last year right?

Also shouldn’t that be .8% total? Why does Vanguard show you’d be up about 4%?

Bond funds are fucking ridiculous.

Why does google say the price is flat over the last year?

Yeah probably. Vanguard doesn’t update those 1/3/5 year returns in real time, it’s probably from the end of last month.

I think those returns are historical ( i.e., what already actually happened). It’s not what is projected going forward.

Well you guys have sure cleared up all my confusion about bond funds. I might get .2% every quarter. Or I might get 4% over a year. Or I might get bupkis and like it.

.2% annualized