also seems pretty successful in delivering returns to those investors

The real world promises are growing fast though. If this thing blows up it’s going to be spectacular.

Is this actually true though? Tesla has actually not raised that much capital since it went public. When Musk tried to get the Saudis to stake him to take Tesla private, it blew up in his face. I think it’s more accurate to say that Musk’s hucksterism is aimed at talent and customers than at investors.

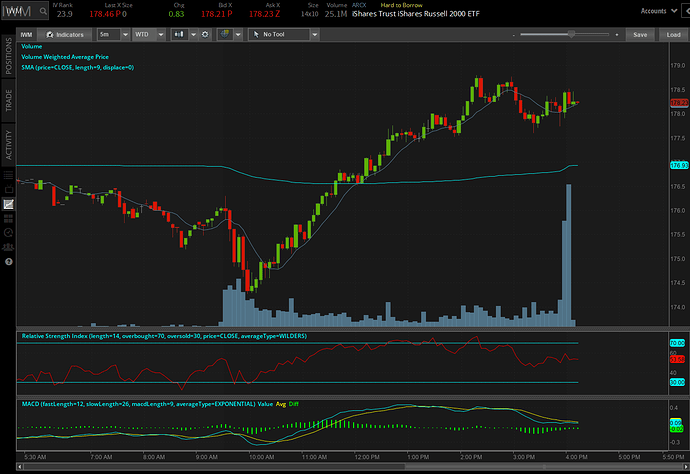

Russell 2000 wild today

Small caps are supposed to get hit the hardest by covid but now they’re even higher than the pre-covid high.

STONKS

I came to this thread a stonk idiot, but I am now a stonk genius with help from this:

meme stocks going nuts but market barely up

TSLA +10%

FCEL +25%

SDC + 15%

SPCE +8%

RIDE +18%

Look at CIICW. SPACS!

Was too scared to buy warrants on a rumor (again). Picked up commons yday though.

Bigly moves on PSTH in last 30m while the rest of the market drilled

What triggered the drilling? Shutdowns?

Stonks go up, stonks go down, can’t explain that

Nope, bullshit. You’re the stonk whisperer. You’re the Soul Reader of the Stupid Masses, the Sultan of the S&P, the Discerner of the Dow, the Clairvoyant of the Crash, the Seer of Stonking, the Reader of the Rally.

You’re the Phil Hellmuth of exploiting the retail masses. So use your white magic and tell us what’s happening!

The problem with the market is that when you’re running good you feel that way. It’s a lot harder to see that you’re getting lucky instead of generating alpha at stonks than it is with poker.

profit taking, overbought, normal pullback, nothing to worry about

Suzzer has spoken.

True but suzzer may actually be good at predicting human behaviors surrounding black swans. It’s not like he claims to be good at it in between, and he’s definitely been out in front a couple times in these situations.

Getting back in the market at the right time was basically just knowing that I was playing with fire in risking missing a run-up I could never get back with my nest egg. I was looking to jump back in at the first tiny sign of good news. The first big market upswing in weeks forced my hand. I was willing to let the market crash from there - assuming I’d eventually get my gains from missing some of the first drop.

If I have an edge, which I probably don’t, it’s in not even trying to see the trees for the forest. I just assume prices are rational by any kind of nitty gritty number crunching. But I do consider if there’s something so crazy going on right now that people are going to start reacting irrationally, and even experts are going to delude themselves that it can’t happen until it does (see recent political betting markets). Otherwise I’m pure buy and hold.

Of course you can easily argue this market is completely irrational right now. But I see it as more long term irrational and who knows when the music is going to stop.

My other possible edge might be 25 years of being a stonk market buff, and everything else I’ve observed in life - but in that sweet spot where my brain hasn’t completely deteriorated yet - so I can still synthesize most of it.

Yeah that’s quite possible. I do agree we’re in a long term irrational market that could go that way for a while. I’m holding out til all the shutdowns are in place, it seems like that could cause another correction.

To me there are two separate concerns - the short term covid hit and long term multi-generational ponzi scheme (or not?) question.

The market could easily have another big drop in during our long dark winter for sure. But I expect people to be looking to jump back in just as quick. I made my money on the first drop and I’m not going to get greedy trying to time another (watch me blink after a 20% drop). If the Spanish Flu didn’t send the country into a long-term recession, it’s hard to see how covid does.

I think everyone has the same information now, whereas in March you legit had stonks bros who were still deluding themselves that covid was going to be NBD. Also we didn’t know how bad it could get. We hit the far milder end of possible outcomes based on how Italy and China were looking. I do still have 20% in cash as my hedge against big covid drop #2.

For the long term ponzi thing - my goal has always been to die/spend all my money/mostly pull out of stonks before the music stops. I’ve been reading the doom and gloom stuff from guys like Peter Schiff for 20+ years. They make a TON of sense. I thought the dotcom crash was going to be the big one. Then I thought the Financial Crisis was going to take decades to recover like the Depression. But yet here we are still bubbling away into the stratosphere. There’s no point in being right if the bubble outlives you.

I don’t know if they realize what we’re headed for in the next month or two, but I doubt it.

I think it’s just late stage capitalism. All the money is at the top, they have nowhere else to put it, thus stocks are over valued.

And if the scheme unravels then everyone is fucked anyway so might as well keep your money in there.