Right - 2x and 3x ETFs lose a little every day in a flat market (at least someone told me that a long time ago - seems truthy). Meaning you have to have a sense of movement and timing - like options.

Volatility decay can destroy you in a flat but choppy market.

Bogleheads has a massive thread backtesting 55/45 3x s&p and long term treasuries. Rebalanced quarterly it crushed but definitely had some rough years.

As an example through Oct 2020 SPY is up 2.94% YTD. The above allocation is up 29%.

Disclaimer: Don’t go into this blindly or take any of this as investment advice. I read the entire thread and I do have a sliver of my Roth in this but it’s small and I’m probably the youngest one here. Happy to discuss in more details if anyone wants to.

This is interesting. Do you have a link to the thread?

https://www.bogleheads.org/forum/viewtopic.php?t=272007

It’s extremely long and there’s a part two. I read and observed the thread for a good 6 months before even putting a penny into it.

Also the author got run off the forum by the moron boomers over there which is a shame. He told someone who had like 10 mill in a taxable account to put his money in a growth fund so they don’t get destroyed by taxes on dividends and they went mental. BUT MUH 3 FUNNNNNND!

They must, the leverage isn’t free

I could only do something like that if I told my wife to pick the account password and never tell me what it is. I can’t even imagine the volatility, a bad year has to be -60% or worse.

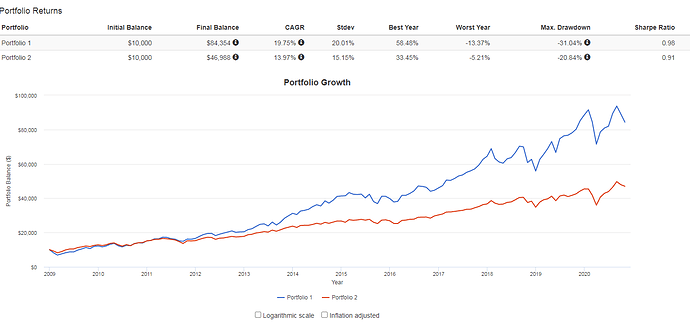

Portfolio 1 is 50% 3x S&P 500 and 50% TLT and 2 is 100% VTI. 6% extra CAGR for not that much more volatility.

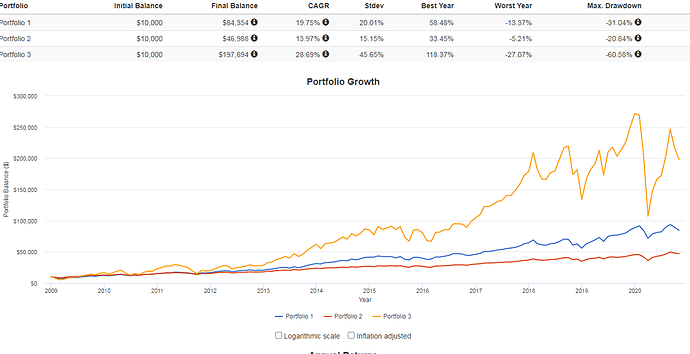

edit: added hilarious 100% 3x S&P portfolio as well:

Yeah I’m numb to paper losses at this point. I managed to hold through March/April and now I’m up bigly - definitely not for the squeamish.

Yeah that was my takeaway too. The thread has simulated data back like 50+ years.

If you substitute TQQ and swap to like 40% TQQ 60% TMF the return gets even higher but so does volatility. Don’t think anyone did a significant back test either so I don’t trust it at all.

lol leveraged long treasuries and a leveraged stock portfolio? That portfolio would have gotten zeroed in the late 70s, right? Rising interest rates and a stagnant stock market? Oopsie, there goes your retirement!

They back tested it through the 70s with simulated data. Definitely had periods of significant underperformance but it survived. Also, LTTs work differently now VS back then. I forget what changed and I’m too lazy to search the thread.

Again - you’d be insane to put anything significant in this. I’m not putting more than like 3% of my portfolio in it to just use it as a data point with the understanding it could all go poof.

Too late, just changed my entire portfolio to 50% 3x S&P and 50% TLT.

I mean, simply buying or adding to VOO whenever possible and forgetting about it is still prolly the best play for most peoples situations.

On a shorter term trading perceptive, the market is very talented (and heavily invested lol) on bleeding accounts dry on the generally thesis that may be shared at a particular time - ie thinking the market will soar as a result of the vaccine or crash from the second Covid wave or lack of stimulus.

I guess I’m simply sharing my opinion that shorting the market at these times of motivated buying isnt a terrible idea but is hard to do.

Yeah, exactly.

There apparently are people who thought lame duck Trump would do the stimulus, or something

Lol stonks

https://twitter.com/carlquintanilla/status/1326930529594331137?s=21

This was the most obvious thing ever. I don’t believe for a second stocks price changes have anything to do with this shit. It’s just order flow in and out and that’s all it ever was.

I’m an idiot but I bought a bunch more spy puts this am dec 20 expiry. I will never learn my lesson.

I used to hold a significant portion of my portfolio in a 2x monthly SPY tracker. Since it reset monthly it mitigated the issues discussed above that you get from the trackers that rebalance daily. Had to sell it due to my job limiting my holdings, but held it for a bit over two years and based on my tracking it did perform about twice as well (less fees which were more than a normal ETF, but not terrible). It also paid double the dividend of the SPY, which was nice.

It was a ETN offered by UBS (SPLX). Just checked and they no longer offer it - not sure why. Not sure if anyone else offers a similar product now, but something to possibly consider.

MGM and WYNN are still down, CZR has recovered mostly, I guess because of their merger?

Well I think it’s a good time to do so, personally. If shit doesn’t cooperate with the trade in the next 2-3 weeks I would gtfo, imo - it’s going to come down to the severity of the lockdowns, gl.