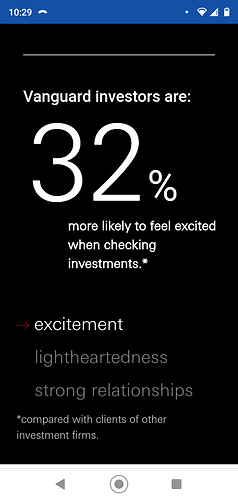

Saw this just now while on Vanguard:

When Trump finally gives up the market will go up massively (even though obvious). When vaccine is FDA approved the same will happen. At some stage in 2021 you’d think there would be some pullback given the overall massive economic clusterfuck for the vast majority of the population but then again anyone assuming pullback since April 2a020 has been wrong so far so nobody knows. SP500 to 4000 seems quite likely before year end because what could happen that the market would even construe negatively? nothing has been construed negatively so far

Insanely soft, high rake

Widespread rolling shutdowns from ~now to ~March?

Yeah count me as immensely pessimistic on US policy relating to shut downs. I’m assuming derper states will refuse to do anything post January 20 and I do worry about how strong any of Biden’s policies will be (would be so happy to be wrong). Can the executive make the states comply even?

I mean hospitals everywhere are going to overrun within the next few months without some level of shutdowns. It’s hard to imagine the economy keeps functioning regardless of shutdowns, but I assume once people start dying in hallways we’ll see more action.

I don’t think the president can enforce a national shutdown, but he can certainly exert pressure and provide support for one.

The CDC can absolutely order restrictions on public activity. The only thing they aren’t allowed to do is quarantine people without a positive test. But business shutdowns are within their power.

Forcing lockdowns and an economic tank without stimulus is going to get us absolutely killed in 2022 but I see no way around it.

This is why it’s not happening faster. I think the leaders know the public needs a taste of how grim this is before acting. It’s sad but it seems to be where we are as a society.

My brother is being offered this by his company. I am pretty knowledgeable about retirement investing in Canada but not the US. This seems like a no brainer but hoping someone can provide some insight.

I removed the link

Congratulate your brother on being a baller and tell him to hook you up with some free hotel rooms.

Already get the latter. :)

Does this look like something he should do? To me any tax deferment is good.

Impossible to tell from the information provided but I can’t imagine senior executives are creating retirement plans for themselves that suck. I think it is a regulatory requirement that senior management’s supplemental retirement accounts are subject to creditors to keep owners from shifting company assets to personal retirement accounts to get them out of the reach of creditors. You can imagine why this would be problematic in smaller firms.

My read is this is something above standard tax deferred retirement plans so as long as he maxes his regular accounts this is a way to save more tax deferred money. Does that sound accurate?

Yes, looks like a good deal.

It defers income to retirement when the baller employee is probably in a lower tax bracket.

Thanks.

It’s a tax thing. If the plan is backed by assets that are beyond the reach of creditors, the exec is taxed as soon as it’s set aside, rather than when it’s paid out.

Ah, makes sense.

There might be pension law issues as well, if you put the assets in a trust its hard to see how thats not a pension plan subject to ERISA rules.

https://www.washingtonpost.com/business/2020/11/13/value-investing-growth-investing/

This kind of article getting written is actually a pretty good indicator for a market that is about to crash. No idea what will finally cause the balance of capital flows to go from positive to negative though.