I think you’re just paying for the convenience. You would have to buy a fuckton of bonds to mirror Vanguard Total Bond diversification. And Vanguard’s fee is absurdly low.

On top of that, my impression is that most individual bonds are very illiquid with poor price transparency, so the potential for getting your face ripped off by your broker is very high.

There’s a cost associated with hoarding cash, though, right? You either buy a box in a bank which costs money or keep it in a mattress and accept the -EV risk that you get robbed.

Sure but let’s assume a 1% negative rate. Is there any place in North America with a 1% chance of you being robbed. Some quick googling puts it much higher than 1%.

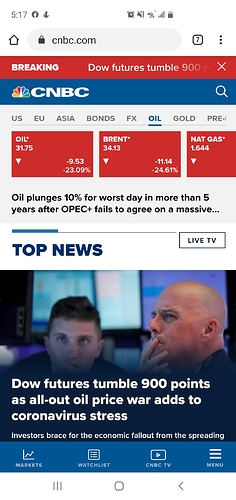

The CFD market for DJIA is down about 2% right now. This isn’t a perfect indicator of what will happen on Monday, but it seems to track roughly about like the futures market, but trades when futures are not trading.

Does civil asset forfeiture count as getting robbed? If you have more than 10,000 cash any encounter with the police is a good chance for it to be taken

I’m out. Sold all my mutual funds and put a stop loss on my stocks so that if the market drops like a rock at open I’ll be in all cash (although I guess the index funds don’t settle until the end of the day - here’s hoping for a big dead cat bounce one day please).

I know - timing the market. But I just can’t take the stress of watching this thing drop 50% as half the country slowly wakes up to what’s happening - and the real panic when the healthcare system gets overloaded. I doubt I’m risking missing out on a ton of upside at this point.

I don’t blame you. I went to 50:50 back in mid February, but wanted to get 100% out then and didn’t have the courage. My plan now is to buy into the falling market by increasing my equity each time the market drops a further 10% until I’m either 100% equity or the market stops dropping. If it never comes back in a reasonable time frame - say 5 to 10 years - I figure that means we’re so fucked anyway it’s not going to matter. But if we get through this and the market comes back I figure this will make up for the nearly 3 years I was unemployed during what should have been my prime earning years.

DJIA CFD market just dropped from negative 2.2% to negative 4+% in minutes. We should get numbers from the futures market in a couple of minutes.

Wowie.

I guess I’m on 15 minute delayed quotes on futures but it just posted for me down 3.4%.

Yeah the Saudis are playing extremely dirty pool in an effort to bankrupt competition in US and Russia during this crisis? At least that’s what I think I understand about what’s going on.

I was wondering why my oil company came out and filled me up yesterday (on the weekend which they usually don’t do) when I still had 2/3 tank. Scumbags.

That’s the end of the US oil industry if prices are even $10 above that.

Where is jiggscasey when you need him?

I’m guessing the feds trotting out a talking head to calm the markets isn’t going to stave off the plunge next time they try it. Which will probably be tomorrow morning.

I’ve gotta assume big boy oil companies lock in contracts in excess of their pursuit costs? Like if you know it costs $50/barrel to extract and the current market price is $70 can’t you agree to sell it to someone in 2 years for $60?

There’s a fund that tracks dollar vs. Euro and makes money if dollar goes down.

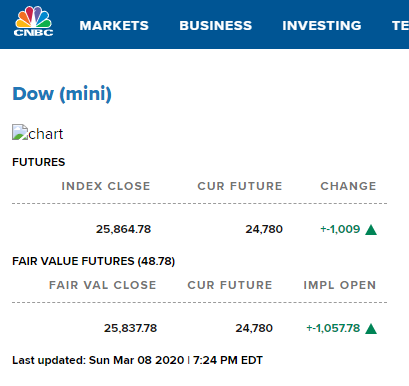

Either I’m missing something or CNBC is having trouble with the maths.

Meanwhile, the drop is accelerating toward 4.5%.

Yea cnn just updated and it’s showing down 1049 now