All news is BULLISH. If it’s bad that means more stimulus and money printing. If it’s good that is slightly less good because of less stimulus and money printing but still good.

I generally agree with this. The Covid crisis has really driven home how the interests of the stock market and the economy can diverge. A couple of more nuanced observations:

-

Something can be an economic indicator without being a coincident indicator. If the stock market is actually a leading indicator then you wouldn’t expect it to move in lockstep with economic performance. In dire economic times, expectations of future better times would still result in higher stocks in such a model. I don’t necessarily think this is what’s happening but it is as logically consistent as saying the economy and the stock market are uncorrelated.

-

Another thing to keep in mind is that “the market” is reported in the infotainment space as a monolith but we all know that its based on the aggregate performance of diverse companies. Dramatic performance by companies in the index can swamp the performance of the index as a whole. So care is required to avoid characterizing the dramatic performance of a small number of companies as being representative of “the market”.

APPL is now up 26% THIS WEEK

STONKS are obviously in a massive bubble. The only question I have is can congress and the Fed paper over the reality of the economy long enough to get us to the other side of Covid. If they do then these valuations make sense as we likely have higher than normal inflation (which is fine) and an economy which leaves the corporate landscape doing just fine.

I posted this back in April but if this works just a huge pile of LOLs for classic economic and monetary theory. It was all garbage and likely contributed to economies around the world doing worse than they otherwise would have. If you can literally just print your way out of any economic damage with not much consequence why have we not been doing it until now.

Yeah I agree with all of that. I’m wondering if I massively fucked up by calling bubble and pulling everything out. It’s gross to just watch bad news every day and the market going up every day. I get that the massive corporations are gaining market share but at some point the people who buy your shit need to have money to do so. The underlying economy can only get so bad before it has to matter… Right?

Apparently not? Maybe the whole fucking thing is bullshit and it’s all Monopoly money. Print some more, give it to the rich, new all time highs, lol at the dumb fucking assholes like me who went to cash.

Printing money does occasionally catch up with countries.

Every bubble ever has always gaslit the people calling bubble until the day it popped. Crypto, dot com bubble, tulips, etc. If we ever do head down it will happen all at once, not over time. Now can it go .5% higher every day for several more months? Sure it can, but eventually people will realize that companies trading at P/E ratios in the hundreds (in some cases thousands) or companies who lose money with no real chance of ever making money trading at ATH doesn’t make a lot of sense.

NKLA has had 36,000 in revenue ever (for installing solar at the CEOs house or some such nonsense) has no factory and no product and is up like 1,000% this year or something insane and now has a 13.2b market cap. TSLA is a slightly more mature version of the same nonsense.

Right, my concern is if that go up another 30% and then the bubble “pops” but not back below where it is now or where I got out.

I’m definitely feeling gaslit, though. I buy that AMZN should be up YTD, for example. But 70 fucking percent??? No way!

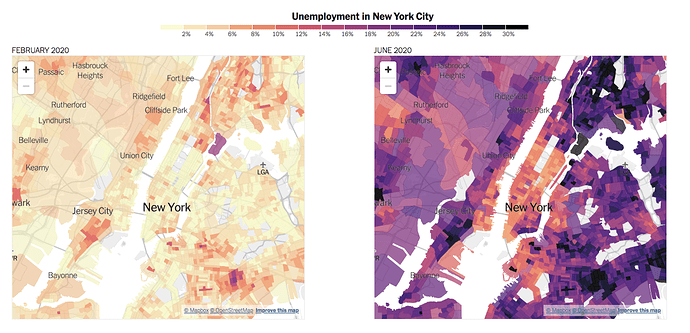

The economic reality on the ground is very bad. OKC which at last report only had a 7.5% UE rate is seeing commercial real estate empty out all over town. Lots and lots of small business has gone under. Many restaurants have gone under. Those jobs aren’t coming back anytime soon. I’m sure if you walk or drive around Philly you will see something similar. That NYC side by side on unemployment posted in the Covid thread is happening everywhere.

So the first wave of this is good for corporations. People still have money either through employment or unemployment/stimulus. All that money gets spent on Amazon or new iphones or whatever. If that runs out and the actual economy has not improved the next wave hits the corporations. If 10-20% of the population stops shopping on Amazon or stops buying Iphones that will have an impact. Not to mention the pending catastrophe in the commercial real estate market.

In short corporations have done very well so far because the income losses have been papered over and then some. What happens when this stops? What happens if we are in a recession for 1.5 years? What happens if we see unemployment north of 8% for the next year? All of those things are very bad for corporations. You also can’t convince me that replacing Trump who has basically allowed unlimited corporate crime and replacing him with Biden and the Dems in control of all parts of congress is a win for corporate America.

this is why I sold everything then waited for a slight dip and bought back half the number of shares of what I had.

so now I can still play the gambling game while having half of my money in a “safer” fund.

I haven’t been in the COVID thread in several days so I haven’t seen that NYT side by side yet.

I agree that at some point the big companies lose consumers due to small business owners and employees losing income. It just seems like even news about that stuff still just makes the market go up. This is not like highly complex next level stuff, it should be obvious to the entire market… You would think.

I also have been inundated by morons in my life asking me about STONKS for the last several months (I am terrible at STONKS so I assume they must be asking everyone or presuming I know something because of my educational background). The amount of Robinhood/wallstreetbets money flooding the market can really not be overstated. A lot of that I have to presume is people cashing out 401ks with no penalty to gamble and UE/stimulus money going in. If that dries up then they are out of bullets.

Good God. Wow.

I also feel like the market is going to shoot up if CARES gets extended, but I also think that it’s already priced in and then some lol…

Full disclosure I have lost almost $10,000 in SPY puts in the last month and a half so I probably have no idea what I am talking about.

Yeah I’m getting killed on puts. Fortunately I only nibbled a little. Apparently it’s a great time to own strip clubs in Houston. Who knew?

Yeah, I’m getting murdered on SPY puts as well. Figure I’m just gonna ride them down to zero at this point because they’re so close to it anyway.

[whisper voice]: this is still true