This is not a bad strategy.

STONKS

Anyone want to make any guesses how high this market can really go? It is pretty amazing to be at all time highs basically with the underlying economy being in shambles.

It’ll smash all time highs with vaccine trial 3 news as cyclicals will go berzerk while tech won’t correct coz lolstonks. Maybe 3500 but that’s the guess of an idiot who sold his US positions at 2800

Don’t get too positive. As soon as folks start giving up their phones for financial reasons, or ordering shit online, surfing the web or binge watching netflix, the market will drop.

TGT new all time high

DIS $3.5bn loss. BULLISH up 9.5%

Bad news or good news doesn’t seem to matter in this market. The private payrolls number was abysmal also and up we go. Completely insane.

So there’s some interesting detail in the Disney earnings:

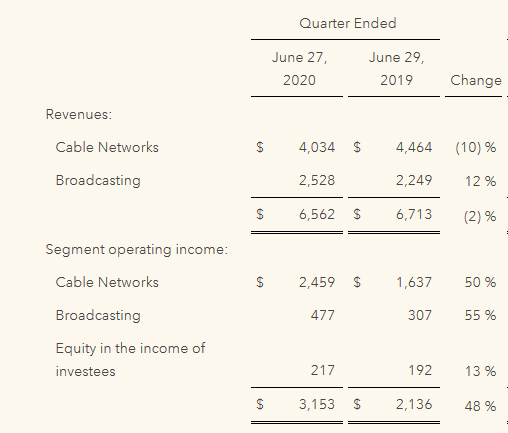

If you look at their media segment, you see a very atypical pattern: Revenue declined by 2%, but operating income jumped by 48%.

This increase in operating income was driven by ESPN. It’s not because ESPN suddenly became enormously profitable, it’s because the costs associated with sports programming were deferred until future periods because leagues suspended play.

The decrease in programming and production costs was due to the deferral of rights costs related to the NBA and MLB reflecting the rescheduling of these events to later quarters as a result of COVID-19.

In one sense, this is appropriate. If you incur costs to generate revenue, you should try to recognize those costs in the same period as you recognize the revenue. So if you’re going to get a bunch of sports-related advertising revenues in the future, then go ahead and defer those costs. But it does seem just a little squirrely.

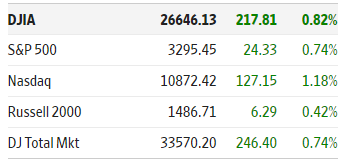

DJIA crashes through 27K. Worth more than in October 2019. STONKS!

Cant wait for the “Corona deaths reach 1 million; Stock market hits ATH” screenshot

Admittedly I’ve been away, but all the economic news I’ve heard over the last few days is:

-

Worst quarter of GDP since we started keeping track,

-

Dozens of big retailers, like JC Penney, Jos. A. Bank, Men’s Wearhouse, all declaring bankruptcy.

Other big retailers have NFI what to expect from a very uncertain holiday season, where they make most of their money in the year, in THIS economic climate, and they all (allegedly) pay rent to commercial landlords, underwritten by banks big and small.

Yet STONKS going UP, UP, UP!

Does anything matter anymore?

Retail was dying even before the pandemic, this just accelerated the demise of what were already the most fragile companies.

I’m starting to put a theory together that the pandemic must naturally benefit STONKS. Corporations and other large businesses are best situated to weather the current storm (particularly with all the cash they’re sitting on thanks to the Trump tax cut), and will end up with much larger market share when their much smaller competitors run out of money and inevitably go out of business. The economy as a whole goes to hell, but the S&P 500 will keep rocketing to the moon.

Man this is frustrating. Finally got a bit of money on the sidelines and wanting to get back in and buy and hold for retirement but the market’s gone completely bonkers. I guess it could be true that nothing really matters anymore and they’ve found a way to permanently prop up the stock market, but it feels more like a 2008 bubble that’s gonna pop eventually. Every bit of news is just insanely negative and coronavirus is gonna keep raging on at least thru Winter. So there’s no way I’m jumping back in right now. If the D. Joans is at 30k next March, so be it, but I’d say 20k is far more likely.

this…makes so much sense.

all hail our megacorp overlords

All my extra retirement money (10%, + 2% employer match) keeps going into STONKS, my Vanguard target retirement 2050 account.

I’m doing the right thing by not dabbling, right?

up 2.6% on the year! what could go wrong, with dollar-cost averaging

…right?

This is similar to what @TrueNorth32 said, but I think the key is that the publicly-traded stocks making up the indices are just not the companies that you see in your normal everyday lives.

From a few months ago:

There are countless businesses getting crushed and going bankrupt and that’s terrible for the employees and the people who depend on those businesses. That’s real economic damage. But those businesses, by and large, don’t really move the needle on the overall market that much.

Also, going back to find this post was pretty fun because it reminded me of that wild time when oil futures went negative. Made myself laugh seeing this:

Good news guys! We only had 1.2m new jobless claims 3 months after we got OFB! It beat expectations! Rocketship to the moon time!

I don’t get how jobless claims don’t matter when they are high but are STONKS TO THE MOON news when they are low.