So it seems like 50/50 cash/stocks isn’t terrible - considering I don’t plan to be in cash that long. IE the 2%/year of whatever I’m missing out on from not having half in bonds isn’t much. I have some of my cash in FXE - which tracks the Euro vs. dollar. For some reason that’s down today though.

You will likely change by the time you’re 7 to 10 years out from retirement. I was always aggressive (never 100 percent but 90 and then 80) but once you start nearing the required numbers for FI most people get more conservative. Although I do know some people older than me that are still at 90 or higher. You might turn out to be one of those sickos.

I also have about 30% of my net worth in the form of home equity, which I do plan to sell soon and not buy another for at least a while. So that feels like cash to me.

Speaking of homes. Saving for a 20% down payment is fucking painful. Pretty sure I’m going to end up settling for like 7% whenever the time comes.

We are also more than likely still going to receive social security, so you can treat your estimated benefit like a fixed income investment. At least that’s how I partially justified staying more aggressive until recently.

Yeah I have no problem living in Honduras on SS alone if it comes to that.

For me at least the key to enjoying my 50s is not having to worry about maintaining an expensive US lifestyle into my 90s on the tiny chance I live that long.

Private Mortgage Insurance is painful as well.

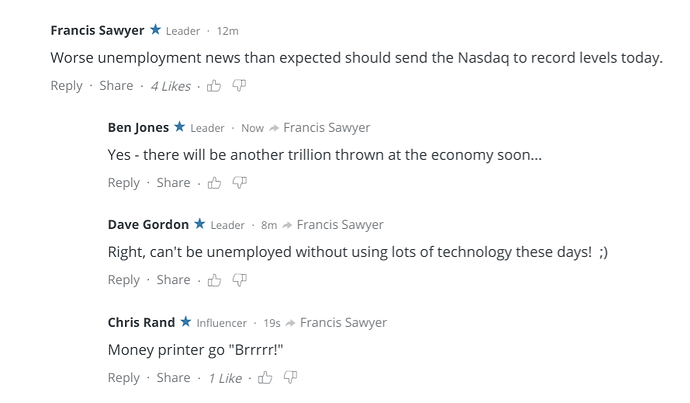

Haha I always read the marketwatch comments for a laugh

File this one under the @suzzer99 method of bubble detection. Some guy on FB who used to be a drug dealer, then transitioned to “poker pro” is now hawking stocks on FB.

“Stocks are dropping drastically, hop in and lets get some money!” followed by a bunch of emojis.

A somewhat unrelated post from him today… “All it takes is one person to have great credit to put everyone around them on!”

He also posted a screen shot of his FICO score with “#RealEstateGuru.”

Good news everybody, we are relaxing banking regulations to require less cash on hand and allow risky investments. What could go wrong?

I am not playing this game until it returns to some form I can sort of understand. I understand how the long side thinks and I find it incredibly insufficient to the circumstances and I think timing something with this many variables makes being short into just gambling.

I may just permanently exit financial products and just continually reinvest my money into real world stuff. The valuations they can justify by comparing themselves to the risk free rate of return are completely insane. Some XX% of these companies won’t generate more than 10x current annual EBIT between now and when they are sold for parts by their creditors three bankruptcies from now.

![]()

Imagine how this is all going to read in the history books.

Yeah, I mean, we’re getting exactly what people voted for. Rampant deregulation of anything and everything at every opportunity. A complete disregard for science and facts. A total disregard of lives in pursuit of being more awesome and patriotic and rich.

I’m really looking forward to this particular wave colliding with the shore already. This shit has felt wrong forever.

The Dow is in the red again, better deregulate something else @realDonaldTrump, quick!!! OPEN THE CASINOS AND LET THE BANKS BET IT ALL ON INSIDE NUMBERS AT ROULETTE!!!

Yeah I stayed on the sidelines for a few years really, didn’t feel comfortable putting money to work until the crash in March.

At this point with what we know about CLO’s, easing bank regulations seems absolutely insane.

Meanwhile, in Europe, banks have been asked to suspend dividends. Over here we’re like nah, gamble it up!

BREAKING: Fed limits banks’ buybacks and dividends for Q3 due to their stress testing for V, U and W-shaped recoveries.

Loan losses for the banks amounted to $560B to $700B. Aggregate capital ratios declined from 12% in Q4 2019 to 9.5% to 7.7% in the stress test. No word on individual banks.

This on the same day the FDIC eased regulations on the banks to allow them to make riskier investments. What a mess.