Even as someone 100% in bonds for reasons I mentioned earlier, this is bad decisionmaking, IMO. “Because prices went down” is about the worst possible reason to sell…

What does this mean?

I’m selling to re-allocate to BRK.B. I’m just not going to fret if I stay in cash for a little bit in the interim.

Unclear

Likely means they have some sort of counter that’s reset weekly that can only hold 2^32 possible values. If they get more than that because of unexpected heavy volume it’ll cause an overflow which will crash/have some other negative side effects for whatever system they’re running depending on how it’s handled.

Something really really wrong with your skin

Wild day, massive sell off into huge recovery to green and now drilling again at exact same time as yesterday. MSFT went 152->163->157 so far.

Gold is down $77!

Shouldn’t gold be up?

The hubris thinking you could fool Unstuck’s facial recognition technology. I have decoded the original image.

Maybe Trump will get the negative interest rates he craves

https://twitter.com/nytimes/status/1233475545075200000

Update: New company is checking the box that tells the IRS I’m covered under a 401k whether I participate in the plan or not. Income also means I can’t make deductible contributions to a traditional IRA. I’m torn now whether to accept the 401k (to rehash: if I decline the 401k and the associated matching contributions, they’ll take what would have been matched and pay it out as additional salary). Losing all pretax shelters is going to cost me mid-5 figures at retirement, but I can also envision scenarios where accepting the lower salary costs real, compounding money. Can anyone think of factors I might not be considering to sway this decision?

If you’re making enough dough that you cannot contribute to a deductible IRA, I would max the 401k and then also do a backdoor Roth contribution.

Anxiously awaiting to hear back if they made it under the wire or not. Apparently it’s right on the razor’s edge.

Edit: apparently they just made it.

So I ended up making a small nibble at the close on Friday. (Almost everything we have is in mutual funds, so I just end up with the closing price on the day of the trade.) On 12-Feb I moved from 65:35 to 50:50 based on strongly feeling that the markets were not properly reflecting the economic damage already happening due to the virus. After Thursdays close, that had already shifted to roughly 47:53 due to market changes, so I moved to 52:48 at the close on Friday.

Will move to 60:40 next week if the Dow touches 24k.

And all new payroll contributions have been switched to 100% equities for the time being. (70:30 US/Int)

Futures down another 400 points and the 10 year treasury is now at 1.03%.

So I got banned from Bogleheads for expressing my concern that we put a guy in charge of the response who doesn’t believe in evolution, and then “ok boomering” the mod who responded to my “troll”. Clearly an amateurish effort on my part.

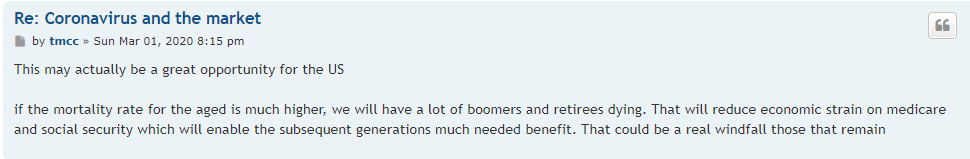

Now this guy here is a real pro. A+ troll and well within the rules:

I’ve got to tip my cap. Nice troll. Even if within the rules, I’d bet it gets moderated away.

As far as your banning, I’d say it was worth it. There is some good info on those forums, but the moderation makes it much worse, imo.

I think it’s pretty incredible that on a forum where the entire point of its existence is encouraging people to stay the course there are a bunch of “moving to cash, this time is different” posts after a 10% dip.

I just checked over there and it look like that post got got. So did a lot of the people who quoted it in response. But not all. There were too many. Maybe mod will get those later.

A+ for sure. Truly great work.