I’m following my plan. It’s very hard to call a bottom so I’m going to buy my way into the bottom.

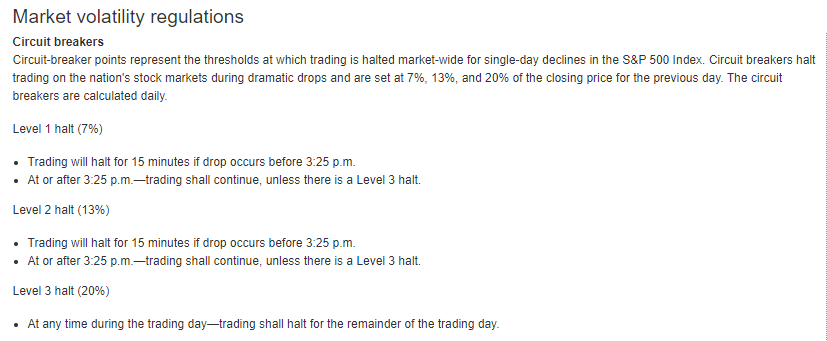

Anyone know when the circuit breakers trip? 4% already today.

10% in one day, I believe.

Buffett is 89 and Munger is 96. Their longevity is clearly widely-known.

I’m already overweight in Berkshire (it’s the only individual stock I own), but bought more Monday @$220. Already down 10% on that. But yes, if things get a lot worse, there’s no other place I’d rather be. Their primary problem for the last several years is an incredible build up of cash with nowhere to allocate it. If this lets them buy into companies cheaply (or even better, buying back shares of their own stock, which Buffett finally seems willing to do), Berkshire is going to get a lot more valuable.

Oh shit I didn’t know that.

Yeah, historically Munger has been his right hand man:

Hence the bobblehead pair. (On the right is a young spidercrab)

But now the most important people are:

Ajit Jain - runs the most important aspect of the insurance businesses

Greg Abel - Runs Berkshire Hathaway Energy and is the Vice Chairman of Non-Insurance Operations

Ted

(For the first time, they’ll be taking questions at the Annual Meeting)

Todd Combs and Ted Weschler - co-investment managers who have been getting an increasing amount of investment authority

I don’t even know what investors are supposed to do if interest rates go negative. The 10 year treasury is now down below 1.20%, am I going to have to pay banks to hold my money? Commercial real estate and other income producing assets are going to get bid up to bubble prices, what a shit show.

I think they have been negative in Germany for some time. So weird.

I would love just once for Trump to have to answer a question “what is monetary policy.”

Forget about investors - it is absolutely criminal that the federal government isn’t engaging in an enormous amount of debt-financed infrastructure spending right now.

FTFY.

Is there any reason to prefer Class-A over Class-B? Obviously I don’t care about voting rights.

Class A costs >$300K/share.

I am aware of that.

I’m not aware of any other distinction than accessibility based on price.

Historically, Class A shares have tended to slightly outperform Class B shares, but this is by no means a guaranteed outcome into the future.

Doesn’t sound like enough to go crazy and put so much of your IRA into one share of stock for the average shlub like me.

I just put a stop loss on 3 of the stocks in my brokerage account (the one I may need to draw from in the next 10 years - about 15% of my NW) at slightly below market - QQQ (sold all, not a ton), MSFT and AMZN (sold half of each).

That will put me about half in cash and I figure I’ll face right into the teeth of the Riverman curse and pick up some BRK.B at some point. But no hurry on that.

how do we go back in time and change a 4 byte sequence number to 5 bytes in a public spec that thousands of brokers have coded against?

We’re on pace to hit 2^32 = 4.3 billion orders in S&P weekly options an hour before market close.

From a buddy of mine who works for one of the exchanges.