She should let Mason’s editing staff take a crack at cleaning this up, amirite?

uhhhhhhhh

You have to put in your password to log in to treasury direct by literally clicking on letters on their “virtual keyboard”???

Haha not only that but there is no recognition of upper / lowercase letters

Just wait until you have to visit multiple brick and mortar banks looking for a medallion signature if you ever try to add a bank account.

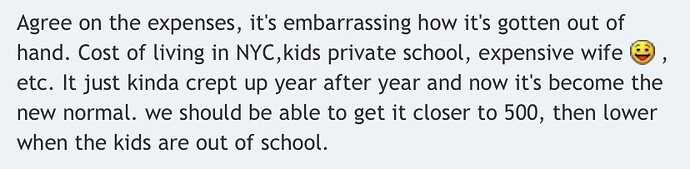

$700k in annual expenses. How!?!?

https://www.bogleheads.org/forum/viewtopic.php?f=1&t=377116&newpost=6680512

FYP.

He posted that includes over 100K/yr in AUM fees to his advisor, so now we only have to explain 600K.

Amazing how people can find ways to live beyond their means no matter how high their net worth is

Poker whale?

That’s $2,000 PER DAY

He may not be one of them though.

If we knock out his AUM fees, then he spends about 600K and based on info in the thread has a net worth of over 18 million. 3.33% withdrawal rate seems OK at his age.

I personally would still feel a bit insecure, but I think his risk of ruin is probably acceptably low.

I think he’s borderline at best at that level of spending. Not clear if he is including taxes in his total outlay.

Here’s his explanation of expenses.

If I had to make a serious guess about how someone spends that much money, I would guess that he’s got several properties spread around. The cost to maintain properties that you don’t live in gets pretty out of hand pretty quickly, like if you are a rich person and you want to have one main luxury house, one recreational property in say Florida, and a condo in a place like NY, that adds up fast.

Good point on taxes. I assumed those were included also. But maybe not.

If a significant portion is kids education expenses, then he is looking at a pretty huge reduction after that, which should make the whole operation more sustainable.

Seems like exactly the kind of situation where it will be hard to stop spending in a downturn. NYC is really really expensive and I can’t imagine the wife and family are going to easily swallow a significant reduction in quality of life. Also if you’re in those social circles the pressure to keep up is a real problem. He’s really wealthy but likely surrounded by people with way more. Once you get used to spending that much it has to be very tough to go backwards.

You can easily spend $100k renting a house in the Hamptons for the summer. Seems like that could be in his range.

That’s a problem for everybody. Not just the ridiculously wealthy.

Reading through the rest of the thread, it looks like he managed to cut his expenses by close to 100k/yr by ditching the financial adviser, so that’s a pretty solid start on the belt tightening even if his other spending stays the same.