That poor financial advisor. $100k per year, poof!

That is a job I could totally do well, too, if I didn’t have ethical qualms. Just being able to explain things people don’t understand in ways they can is a huge part of sales, and that is a skill I have had for almost my whole life without realizing it. Like, I got roped into volunteering to help out at the Kiwanis club fireworks stand when I was teenager, I think for Boy Scouts service hours. I didn’t really know fireworks or sales, but I learned what all the fireworks did and could tell people in plain terms without the fireworks jargon, and none of the old Kiwanis guys could. I raked in sales for them. Explaining financial products to clueless rich dudes who want to feel like they are beating the system in exchange for high fees just sounds so easy. I try to use my powers for good though. You don’t get to bilk rich dudes without bilking regular people first.

Yeah I could absolutely be a fucking superstar Merrill Lynch broker. So easy to rationalize “they would be worse off without me.” Fuck that. Just a scumbag industry.

“Where Are The Customers’ Yachts?” was published almost 70 years ago. Brokerage has always been a scam industry.

I do find that these days the fee-for-service financial planner businesses are at least better. The people that get into that are usually the people who see plainly the rip off artist nature of more traditional models.

Seems like there should be a model for cut-rate financial planning that takes a minuscule percentage to put all their clients into an index fund. If people insist on not doing it themselves there’s got to be a Vanguard-but-with-a-person-you-can-call option out there.

This is the problem. The person has to make enough money to make it worth their while.

By the time you realize the “pay 20 basis points for someone to talk to and make you feel better” thing makes sense you’re far enough along to do it yourself. That service makes a ton of sense for widows who aren’t educated but those people are prime targets for scumbag AUM parasites.

In these models the “financial planner” is usually someone who barely knows anything, and gets paid almost nothing. 99% of conversations I’ve had with financial industry help is like this:

I wish there was some kind of viable business model around “attend a meeting with your Edward Jones asshole broker and tear him apart,” because I seriously can’t imagine anything more satisfying to do with my time. Would absolutely do it for free.

I never knew a gif could give me vertigo

It’s kind of sad. Some industries there just isnt an alignment between selling a good product and being profitable.

Gyms.

Financial planning.

Electricity companies.

The incentives are all out of whack.

GG.

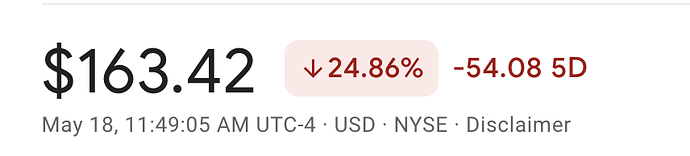

That’s quite the drop, my inlaws are both retired Target lifers hope they diversified those portfolios!

Gyms is a great example. Pre-covid I was going through one of those “man I fucking hate my job, I should quit” stretches and wondered what the economics might look like to open a basic lifting gym, no bullshit and no gimmicks. The numbers were pretty ugly. You need either stupid high membership fees or a fuckton of no shows to make it work, and both of those things are at odds with putting together a quality gym for people that just want to lift some weights.

My team meeting today was pretty spicy. Can’t say I’ve lost $20k on paper before! There’s an internal earnings call tomorrow morning I’ll live post it

subscribed

“Is there any pressure to go down in headcount?” “no”

“we have a short term problem, we have really good fundamentals”

“we didn’t lose money in q1! amazon lost a billion dollars!”

“The analysts were surprised, you never want to surprise the analysts”

Not sure if we’re openly talking about what company this is, but as an outsider I’d say they still look solid despite the stock tanking yesterday.