It basically boils down to how much do you care about creating generational wealth? If you have kids, work a few extra years. If you don’t, retire.

I can see doing a job like that for a while, mainly because it is good and desirable to have something engaging to do, and because once you’ve made your stack, the amount of charitable giving you can do is unreal. Like, sure, you could retire and travel and whatever, but you could also do a lot of good with a few milly every year.

Can anyone tell me why mortgage rates are at decade long highs, but my Ally bank online savings account is still paying shitty 0.5% interest?

Yes

The only way to not screw up the economy is to keep shoveling money to the very richest people.

I also figure that there is an factor like the labor market where the only way to get the market rate is to move rather than trying to get it from wherever you are.

I’m not sure I can get arsed up to move it for an extra 1%, but if I could, anyone have any suggestions of where I should move it.

Treasuries

I still want the convenience of a savings account.

I’ve set aside money for estimated tax payments in a savings account earning 0.6% interest

But with these treasury rates, I may finally bother to buy some short term government bonds

| Date | 1 Mo | 2 Mo | 3 Mo | 6 Mo | 1 Yr | 2 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | 20 Yr | 30 Yr |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 04/22/2022 | 0.46 | 0.64 | 0.83 | 1.34 | 2.06 | 2.72 | 2.88 | 2.94 | 2.95 | 2.90 | 3.14 | 2.95 |

I’ve had other shit going on but pretty soon I am going to start job hunting because my 3% raises aren’t cutting it.

Ugh. Me too. I hate it.

No raise for the previous two years. 1.5% this year.

“Sorry. We hired you above the band. Theres really nothing we can do”

“You’re already at the top of the band” sounds like a you problem, Lumbergh

That’s standard bossing. Personally create a payment system, then pretend it’s out of your hands because “hey sorry, it’s the system”

Now at 230! Stay tuned for more hot stock tip$$$

Yeah but what’d you put the money into next and how’s it doing?

Or in poker terms, “Yeah but how much did you lose?”

I’m still waiting for my paper check from fidelity but I’m going to throw it into the last 50k of my 4% mortgage

more words of wisdom from the bogleheads

we all have formative experiences when we are growing up, one of mine was a conversation with my father, who had his own cpa practice and was wise in the ways of money, about my grandfather’s law partner, who could have retired at 40, had a stroke at 64 and lost a lot of mental capacity. my father’s conclusion was to retire when financially independent.

once we were comfortable with our net worth, i walked away from a 7 figure salary with the possibility of a five-year, 8 figure payout. i cherished the time with the kids before they started college and their careers. my wife and i traveled extensively.

having said that, depending on age, $10mm would be a little iffy for me as i typically think in terms of a worst case, 40-50 per cent drawdown and kids are expensive.

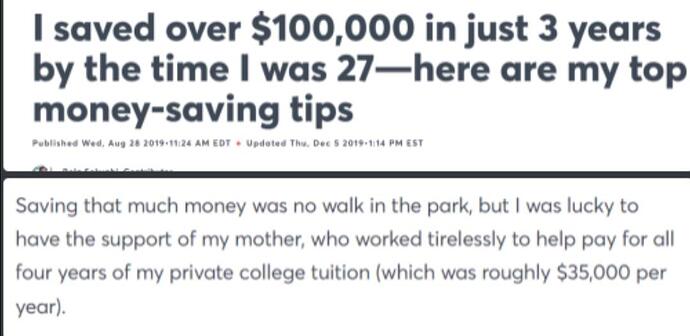

I was able to net $100K in savings if you include the $140K my mom gave me! Go me!

It’s better than that. That same story by the same author is in other publications as well.

$900 mortgage, that’s easy to find now!

and finally, she had no help, really

ETA: She started at $54/yr and in 3 years was making $74k/yr.

Also she’s selling a book with all of her tips on how to save $100k in 3 years with no help!

shockedpika.jpg