Here’s the fix: Enter $0 (zero dollars) for your prior-year AGI, the IRS says.

If you used the non-filers tool last year to register for an advance child tax credit payment or to claim the third stimulus payment, enter $1 as your prior-year AGI.

By the way, if you filed an amended return last year, try using the AGI from your original return. Why? There’s a huge backlog for amended returns too. As of March 26, the IRS said it had 2.2 million unprocessed individual Forms 1040-X, which taxpayers used to add, change or correct information for an already-filed return.

Despite this glitch, as of March 25, the IRS had received more than 81 million individual income tax returns, slightly more than half of all the returns that it projects it will receive during 2022. The agency has issued 57.8 million refunds worth almost $189 billion. The average refund is $3,263.

Not sure if we’ve had a Yahoo! hate read before.

‘I beat the game’: Now what? Even successful millennials who earn six figures see no end in sight for student loans

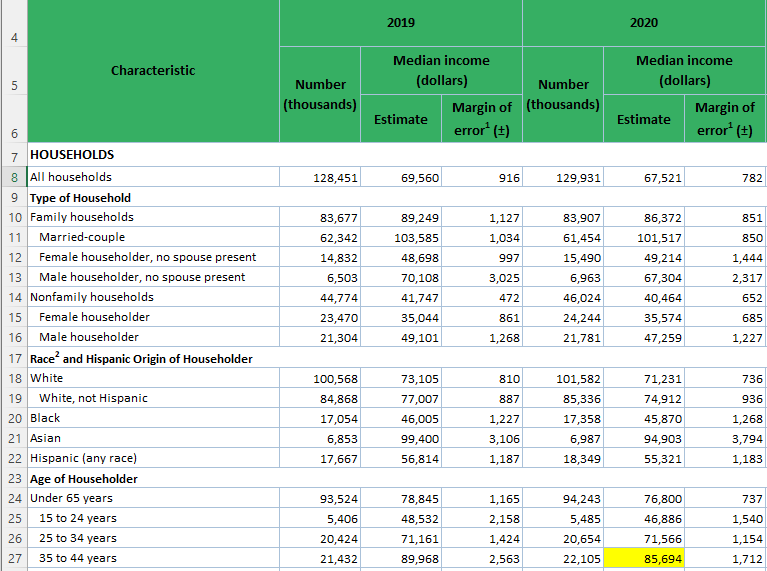

Cristobal makes nearly four times the median U.S. household income of $85,694 for Americans in her age demographic of 35 to 44. Not to mention, she purchased her own home—something only 43% of millennials have managed to do, according to Freddie Mac’s 2021 research.

“I beat this game,” she says. “You told me that I needed to work hard and join affluent America, and I did that—and then you’re gonna punish me for it?”

She’s also found herself in a strange new financial position: Instead of focusing on keeping her spending minimal and boosting her income to cover her monthly expenses, she’s focused on ways to lower her tax bill. “I pay more taxes than Bezos. I pay more taxes than most people make in a year,” Cristobal says.

In fact, Cristobal purchased a home in Stamford, Conn., last year for just under $500,000 in an effort to curb some of her tax bill. “I hate owning a house. Anytime there’s a weird sound I’m like, ‘Great. How much is that gonna cost me?’”

But if she hadn’t bought a house, Cristobal says, she feels she’d have been “taxed to death.”

Since gaining a measure of success, Cristobal says, she’s a bit worried about what she may lose if she makes the wrong choices. “Now I have money,” she says. “But I don’t have wealth, and that’s what I worry about.”

But Cristobal is not in a hurry to wipe out her federal loan debt just yet, on the slim hope that the Biden administration launches a forgiveness program. “This is where you start gambling a little bit,” Cristobal says with a chuckle.

Yet she’s well aware that her chances of getting $50,000 or even $10,000 knocked off her outstanding balance are minimal. “Nothing AOC or Bernie Sanders has put forward will benefit me. I’m now too successful to count,” says Cristobal, who feels like she’s being punished for her success.

Awww what a shame.

FWIW Median HH income is actually under 70k - something that is easily finadable in the link provided!

Are there any MBAs making over 300k who don’t complain about taes?

Well if it’s a reading contest we are having, I got no shot.

IMO weirdest thing about that story is that she makes over 340k but only spent a half mill on a home in CT. Seems barely plausible ime.

If we don’t give her a tax cut she might have to start taking in roommates! Have we no decency???

A quick search on realtor.com shows a bunch of houses in Stamford CT in the $450,000 to $500,000. They’re not the nicest houses, but they exist. And she’s apparently single, so she probably doesn’t want to commit to a $1M + home.

100% parents gave her the house down payment

Edit; nm, misread, LOL still having 180k student debt

I just can’t imagine going through life as someone making 4x the median HOUSEHOLD income as a single person and viewing taxes as being “punished for my success”.

That level of constant aggrievement has to be just so deeply unhealthy for you.

I am from Stamford and know many people in somewhat to very similar circumstances. They are generally six months to a year from being fucked.

Her tax rate is probably 40% effective between state, city, and federal/fica. If she makes retirement accounts and such she probably has 12k a month to work with but between lifestyle creep (how you gonna make 340k and drive a Kia Optima), constantly trading money for time, and the aforementioned student loans she banks I would guess 4k max a month.

Then instantly uses all of that every 3 months on a vacation.

They spend all their money just like everyone else.

The real LOL is spending 200k (what the FUCK) on an MBA.

Just had to go to U of C. Even their debt is a flex.

I honestly think high-earning wage people should be pissed about the tax code. They are the ones actually paying the highest percentage of their income as taxes, in contrast with the super wealthy who, via clever combinations of capital gains rates on any realized income, unrealized gains going untaxed, and loss harvesting via bullshit real estate depreciation or whatever, make out like bandits.

Spending $48K a year on vacations as a single person is batshit craziness.

Yeah I was just going to say that she has an inkling of a point in there but the real point hidden among her complaining is that rent-seeking wealthy people need to be paying way more in taxes.

I sympathize with some people to a certain extent on the student debt front. My wife paid for an MBA out of pocket (started when she was like 27). Basically when she went into it, she landed on there being 2 career tracks for which paying out of pocket for a top level MBA makes sense: Investment Banking and Consulting. Those are the only 2 places where you make enough to start paying down the debt fast enough.

The fact that supposedly super smart people take out $200k in loans for a 2 year degree then go get a job post-MBA in marketing which pays like $80-100k for the first 3-5 years is a really poor assessment of the financial value of that degree.

That’s all fair, but she should be mad at the tax code favoring the people with more than her, not framing the taxes she pays as a punishment for her success.

That’s maybe high but these types of people don’t really say no to themselves is the general point.

Like the “I spend $200 on Amazon if I feel like it!” Is total horseshit. I’d bet my entire net worth her wardrobe is >50k.

After paying Florida prices for Airbnb’s and hotels and everything else I’m now fully realizing how good I had it living in Cambodia playing poker against rich Chinese fish in USD. Damn.

When I was getting out of broadcasting, I was communicating with someone in admissions at UNC about going for an online MBA there. I think it was one of the top online MBA programs at the time, there was some in person stuff, and obviously the UNC name is reasonably prestigious. The degree was $93.5K… in 2013. It would be a bit of a stretch to say they were recruiting me, but the admissions person kept telling me that I’d be a great fit, they liked cool backgrounds/stories like sports broadcasting, and my grades were good enough. So it felt like I was a shoe-in if I wanted to go for it.

I compared the cost of entry (low/zero) and earning potential of poker to the cost of entry (lol holy shit) and earning potential of an MBA, then factored in enjoyment and freedom and poker came out way ahead. Not starting $100K in the hole was a big part of why.

Yeah she’s spending $200 on Amazon every time she feels like it which is probably a few times a week, and that doesn’t include the money she’s spending on Nordstrom when she feels like it, on actual in person shopping when she feels like it, etc.

Nowhere near that degree of spending but I was amazed how much I have been able to cut my spending % wise just by not letting myself buy shit on Amazon unless I really really need it.