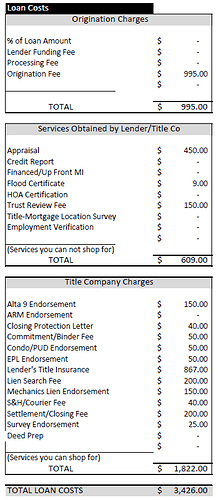

Can I ask roughly what the up-front fees are? I only ask because we’re in the process of scoping refis as well and I’m not sure the current quote is competitive.

I don’t think this reveals anything personal:

Unless you own your house in a trust, you can eliminate the $150 Trust Review Fee.

With around a $380k mortgage, I figure this–dropping from 3.625% to 2.625%–breaks even within about a year. (I got into a spat with a friend of mine about how exactly to calculate this, so it’s possible to think about it in different ways I guess.)

Banks are furious about this .5% Fannie/Freddie refi fee

So I should definitely wait on buying my first house right? I only have like 5% down saved up. Would rather continue renting my dope apartment than move to the suburbs. Nice houses in my neighborhood are $400-550k. I assume housing prices are going to fall in 4-6 months when people can’t pay their mortgages but could see a similar trend like STONKS. My rent is $2300. Wife and I make a little under $200k a year with only 50k in low interest debt (student loans / car payment). I think I am fine paying PMI as saving 20% down seems painful and -ev. Thoughts from you smart people?

I would continue renting. I’m fine with you buying with 5% down but only once you’ve saved at least 6 months expenses in an emergency fund.

Rent is NOT throwing away money.

Got the emergency fund. Told the wife that I am absolutely not buying a house in the middle of a pandemic. The stress isn’t worth it. Just going to keep saving and try to get to 10% down + 6 months emergency fund.

I literally got paid $6 to refinance back in March and dropped a whole point.

Do you like puttering around in the yard? Are you good at fixing things or at least like learning how to? If the answer to both is no, I might suggest just renting forever. I bought a house at 20 (lol poker) and am renting for the first time 15 years later. Renting is awesome if you have a good landlord and the right renter’s market. People buy houses way too much out of mere inertia or because it’s what they’re “supposed” to do.

Home ownership is overrated unless you actually enjoy repairing and caring for a home, imo.

On the other hand…

It’s complete b.s. that landlords don’t have to provide their own references, give an interview, provide bank statements, etc. The tenant has just as much (and often more!) to lose from a bad renter-landlord relationship.

Update: my ceiling is leaking again.

Wow, I had no idea interest rates were so low.

168k outstanding on my 30yr loan at 4% with 2043 maturity rate, excellent credit.

Snap call my mortgage broker first thing tomorrow morning? Tempted to go to 15yr loan instead and save some more money.

Let us know in the thread what you do please, I have about the same in principal left and am also at 4.0%. Was planning on paying it off in 5 years though as I have nothing to do with the $ that I’m happy with in covidiot land.

I despise any outside work and am a complete idiot when it comes to fixing things. Our maintenance guy usually shows up within 2 hours to repair whatever is needed. I guess as long as I’m funneling money into retirement then not building equity in a house is fine?

Its kind of the weathers fault at this point isn’t it?

I am refinancing now, and initially wanted to do a 15 year, but the interest rate spread was just .25% difference between 15 and 30, so I just took the 30.

If you’re interested in refinancing, I’d suggest starting now if you can, as Riverman mentioned above, Fannie/Freddie just put in some kind of refinancing fee. I talked to my broker yesterday and she said it won’t affect me, here’s hoping she’s telling the truth.

Seeing that home prices are up 4% compared to this time last year mainly due to lower interest rates. If i was looking to buy i would hold off for now.

Miss Slicing and myself were aggressively house hunting in Jan/Feb and stopped and are holding off another year.

I am hoping the housing market stays steady since so many people have a lot of their wealth tied up in their homes but I think there is a 5-10% chance or higher that the market goes down in the next 6 months.

You should buy a house if you want the comfort of knowing you can never be forced to leave the particular area, don’t mind being more or less locked into a particular area for several years, and if you’re financially comfortable not just with the downpayment and monthly payments, but also the large irregular expenses that pop up.

I am not a fan of being a homeowner at all. I wish I were still renting. The problem is that we wanted to live in a decent-sized house, for our kids to go to a good school district, and not to have to uproot the kids at the whim of a landlord. So we bought.

One of the most pervasive falsehoods that exists is the idea that renting is throwing away money. Living somewhere is consumption, and just like any other form of consumption it costs money. With rent, it’s the monthly rent payments. With owning a house, it’s the interest on the mortgage and the opportunity cost of the down payment and the periodic expenses that pop up like replacing a water heater.

In some circumstances, renting will end up being cheaper than owning. In other cases, the reverse will be true. In most cases, there’s not actually a direct comparison available because the types of places available to rent are very different from the types of places available to purchase. There is a kind of behavioral benefit to owning, in that paying down your mortgage is effectively a forced savings plan. But if you’re the kind of person that is disciplined enough to set aside money every month, that behavioral benefit might not be that large.

In your case, you sound like someone who absolutely should keep renting. You seem happy where you are, you don’t seem to have any particular need or desire to own, and it seems like your thoughts are of the “Well, everyone says that you should own a home, so we’re thinking about buying” type. Keep saving money, keep enjoying your fairly hassle-free existence, and don’t buy a house until you actually need to buy a house.

Thank you for coming to my TED talk.

Yeah owning a house kind of sucks if you aren’t at least semi handy or interesting in doing that kind of stuff.

I have about 370k left on our mortgage at 4%, going to look at some refi options and possibly go down to a 15 year. I suppose this new fee is going to end up fucking me