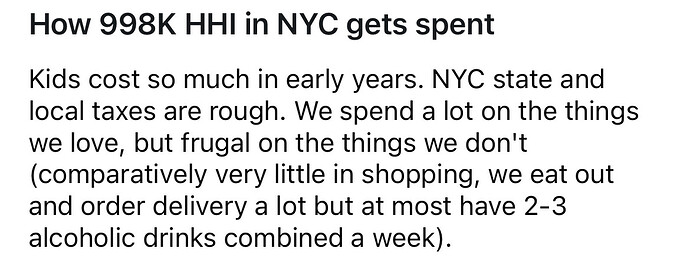

WHoops, I meant “consumption, saving and charity”

Then the nanny can watch the kids while we fly business to Europe. Point being if we are grossing $1 mil/yr, then we are not flying coach, staying at the holiday inn and packing baloney sandwiches. And we’re definitely taking at least 3 trips/yr. $50k is nothing unless they are just too busy to find the time.

The 2k/month for food for 4 people is obviously impossible in Manhattan, as well as $500/month combined for utilities and insurance.

They are not driving a 94 Saturn SL2, they are insuring at least one new leased car. Their garage will be 3k/month alone.

Let alone heating/cooling. Nonsense.

I don’t think they own a car since weekend car rentals are part of their expenses

Maybe one of their best financial decisions!

There is a weekend car rental section at the bottom, I take that to mean they don’t own a car.

People’s reactions to these are always funny, I would love to post one but I don’t track spending by category.

Same. I would have 3 arrows for Housing, Amazon, and Costco.

$250/month for weekend car rentals AND transportation seems fairly impossible combined with the rest unless they teleport everywhere.

Like, if you’re really essentially carless in Manhattan then your groceries are getting delivered and you’re not paying 2k/month. You really taking your 2 year olds on the subway regularly? Etc.

The food is certainly not impossible if you’re not eating out or ordering Uber Eats all the time.

I only skimmed the first few comments, but it doesn’t seem like they were complaining. However, I’m not really sure what the point of that post was.

I also didn’t think the post was a complaint or OP pointing out how burdensome things are for them. But I’m also not familiar with that subreddit to know if there’s broader context.

Yeah, I saw that. It doesn’t really sound like a complaint to me except possibly about the taxes. And even that is pretty mild as far as rage goes. It could also be interpreted as a fair description. That is a high percentage of tax (if calculated correctly).

It’s very possible one or both has a job that is providing meals frequently as a perk and this is why food expense is lower than we’d guess.

It is just complete horseshit that someone making $1m as a doctor pays like 450k in taxes and someone making $1m a year from real estate they inherited pays $0.

Bit of a non-sequitur here, but seeing some pissing matches between conservative and liberal account on Twitter re: inflation and grocery bills had me take a look at my food spend last year vs. 2019.

2023 food spend (which includes everything: groceries, restaurants, delivery, bars, liquor store, all vacation food, etc.):

-0.47% vs. 2019 (so virtually no change)

+5.5% vs. 2022

Found it pretty interesting in light of all the conversations, sometimes hyperbolic, about inflation’s impact on certain categories.

As far as I can tell, there is a ton of confirmation bias happening where the idea of high inflation / high consumer prices is a commonly held belief, and then people are regularly confirming that belief on selected purchases. Even in periods of normal inflation, some items increase in price more than others. So while there has definitely and clearly been aggregate price inflation, many people are psychologically experiencing even higher increases because they are anchoring on the individual items that have increased the most.

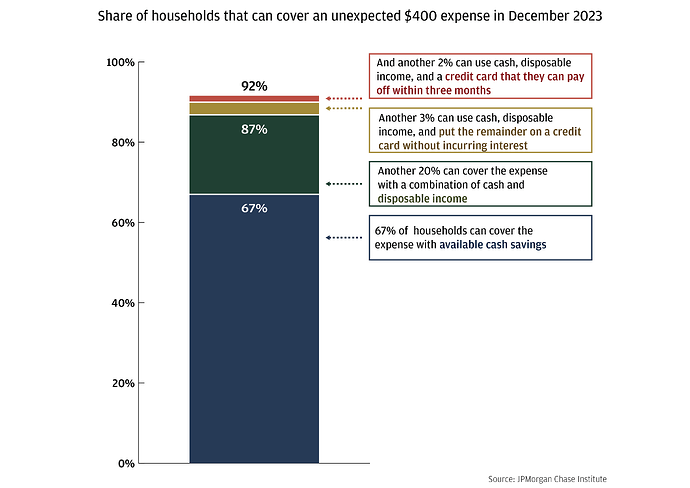

JP Morgan got tired of hearing “300% of American’s can’t afford a $400 unexpected expense” apparently. Here are the highlights

- 77 percent of low-income households can cover an unexpected $400 expense, though many must cover it with disposable income or short-term credit.

- 43 percent of low-income households unable to weather small expense shocks might be able to pay them with access to additional credit.

- The share of households that cannot cover an unexpected expense remained steady throughout 2022 and 2023.

- White and Asian households, middle-aged households, and multi-person households are better able to cover an unexpected expense than their counterparts.

Lol at people can use credit to cover it. Yeah and how do they pay that off?

If I’m reading the graphic correctly, 8% of people can’t cover the $400 expense. 5% can only cover if they use some type of credit. So that makes 13% of people not being able cover an unexpected $400 expense, which is a lot lower percent than what is reported. I actually have hope and it feels like an easier problem to attempt solving when there isn’t a lie about “70% of people can’t afford $400”. At least that’s how I perceive it.