Both of those are correct #notfinancialadvice

Welp. I messed up.

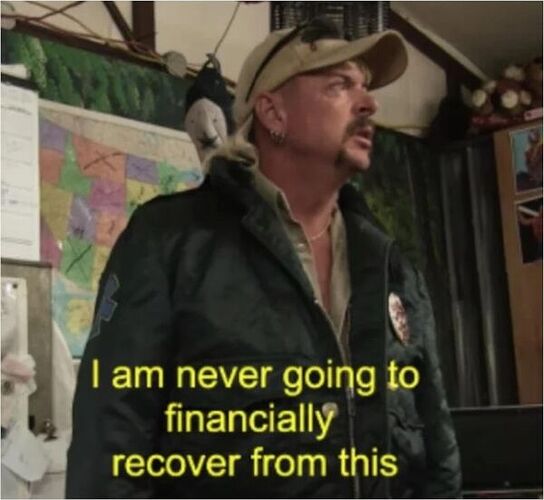

I missed my conversion window last year, as was verified by the knowledgable members of this forum, and have felt exactly like this ever since.

Can’t you convert a tIRA to Roth whenever you want? What is this about messing up and missing windows?

I guess if you wait a while and have gains you pay taxes on conversion, but there probably haven’t been a lot of gains this last year.

My income is going to be way higher this year so the conversion would incur higher taxes now.

I need to convert in order to do a mega back door Roth because of the pro rata rule. With equities depressed and a lower AGI, last year was the sweet spot.

I should be retired around Trump’s next inauguration

Could be worse. I converted my IRA last April, lost 20%, and my income should be lower this year.

Is there an age limit when conversions can be done?

No. If you’re of RMD age, you can’t convert that amount and have to take it prior to any conversions.

I thought this too. Based on his subsequent post, it looks like he was talking about a mega back door roth and not just a standard backdoor roth.

This thread really caught fire.

![]()

Great, now everyone’s gonna want to be homeless.

Everyone’s gonna want to be homeless and transgender so they can get paid and compete in women’s sports!!!

(Probably a direct quote from tonight’s Hannity or tucker shows)

i wish this would just embed. it’s a super jacked dude yelling at you to think yourself rich.

I plan to retire within 6 months

There’s an envisioned version of my life here in Japan where I buy a mini-sized RV and spend half the year traveling around the country. Have the time and money to do it.

Except that I hate long-distance driving and generally prefer the comfort & familiarity of my own home.

Every day it gets more appealing to me