For those in the US planning to retire early, what’s your plan for health insurance? Seems like it would be pricey from 50-65.

Obamacare? With wages at $0 you can get creative.m to qualify.

My plan is to vote very, very hard in the next election and then surely democrats will lower the Medicare age to 50.

If your income is below $15k you’re on Medicaid in a blue state, nothing in a red state.

tax advantaged accounts are protected from bankruptcy so I’m just going to gamble with no insurance.

Just keep in mind that some medical services require cash up front.

I’m joking

retire early with this one weird trick

There are two common paths that I’ve observed in FIRE from reading and hearing other people’s stories and obviously the second group is much harder:

- High-earning individual/couple who have a relatively simple life without too many extravagances, but on occasional indulgence.

- Average income person/couple who starts really early that have to go through more extreme frugality measures like side hustles, house-hacking, live with parents, etc.

My story is similar to @TheHip41 in that my partner and I were making an average income of $35-40k. We both ended up transitioning from our previous careers into software engineering after going through code bootcamps, thus current incomes are quite a bit higher.

So ya to your point, marry rich or a high earner (or consider a career switch if that is feasible and interests you).

That’s an interesting point about JL Collins motivation. Now that you say it, I don’t remember FIRE ever being his goal. His work just caught on in these circles and he gained popularity (and money/freedom) as part of the work. I mostly appreciate his straightforward tactics/approach and communications style.

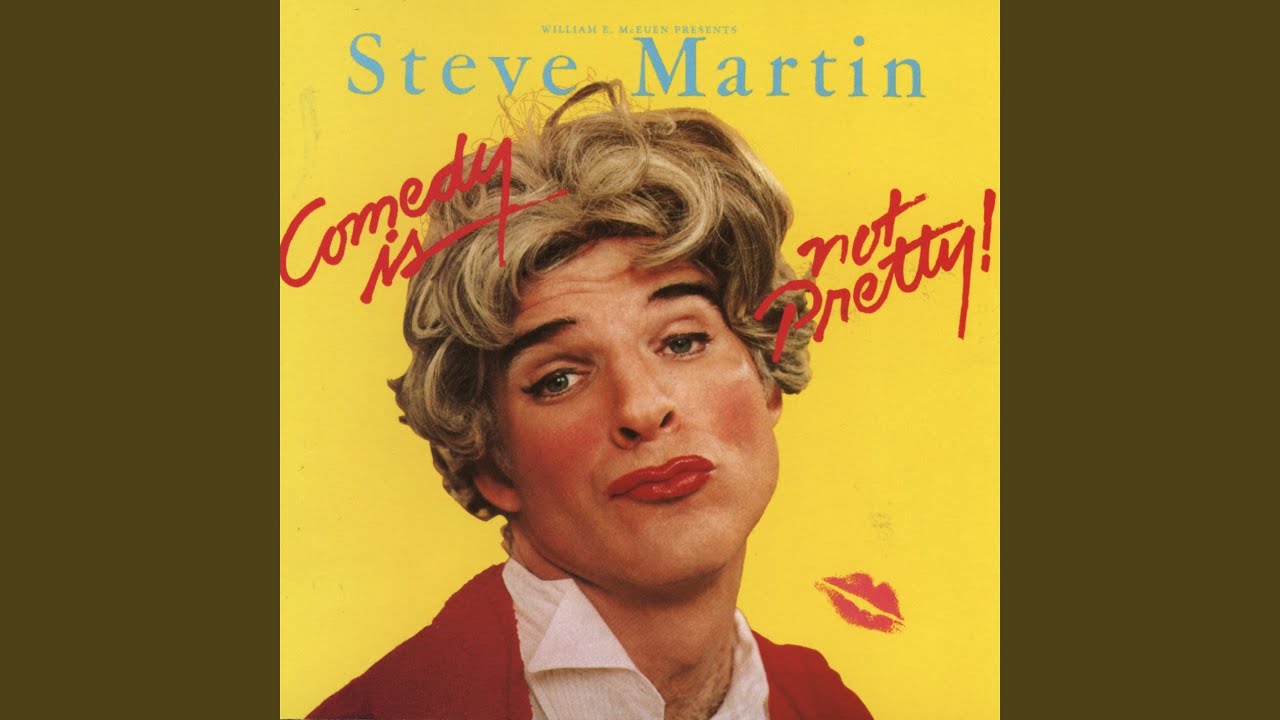

That optionality to not work is powerful chip that not a lot of people have. Your situation is a tough spot and has to reinforce that need for Fuck You Money. I can imagine someone else in that role who spent the money you’re saving on that 2023 F250 and is still paying off their boat + ATV probably sitting there like this all day at work:

I’m actually running into a situation that may lead to me taking a sabbatical ala @Cornboy upthread. At the end of next month I’m getting a major surgery which will require about a 6 week recovery. I’m legally allowed to take up to 12 weeks, but I type on a keyboard, use my mouse, and think most of the day, so return to work shouldn’t be too bad. But if things don’t go well and I’m having problems adjusting, it wouldn’t be a huge deal if I took a much more extended time off from work because of the effort of these last few years.

There are some down sides of course. It would deplete some of the house down payment fund, but I can rebuild later. It would slow down that investment machine that I’ve been stoking so diligently, but it’s not a showstopper. It would also be a gap in my resume, but I’m not sure if anyone in tech cares about that and it is very easily explained.

Care to give a range on this (super ok if not.) My wife starts bootcamp in two weeks and if things work out well I may follow in her footsteps when she is done.

Saving frenetically and then living off of your savings is one way to achieve FIRE but not the only way.

You can also find ways of earning income that consume progressively less time & energy, to where you are effectively retired.

That’s the path that I have taken over the past two decades. I’ve constantly sought out more efficient ways of working and earning, to the extent that I now enjoy the proverbial Tim Ferris 4-hour Work Week.

I don’t have millions of dollars saved and I do work (but only on things I want to do and only to the extent I want to do them), but I have enough savings, enough mostly passive income, and low-enough expenses that I am effectively retired–at least from doing things I don’t want to do solely for the purpose of earning enough money to live on.

The lifestyle doesn’t suck.

I don’t want to put any numbers in the post for obvious reasons but I’ll say that the range we’ve experienced is in line with the data on Levels for entry level positions in Seattle and we’re moving into the Senior level positions. You can unlock the salaries in the table by clicking the buttons that say you’ve already shared your salary. Startups typically pay 10-20% less base but often some sort of hard to calculate ISOs. I would recommend checking out this site for your local area (if it’s available) or search for a company that hires software engineers in your area.

Thank you. I appreciate that. How about remote possibilities? Do ypu see a lot in the industry right now?

Do you actually need a college degree to be competitive for these kinds of job, or is coding bootcamp enough? In other words, does your college degree give you a leg up in any way over someone just like you who went to the same bootcamp, but has no college degree? And if it is an advantage, roughly how much are we talking here?

The hardest amount of money to amass is “enough”.

If you think it’s hard now, I’d imagine when you hit 55, you’ll have to leave even more on the table to walk away.

The only thing worse than leaving more money on the table is leaving more time.

One can be recuperated. The other cannot.