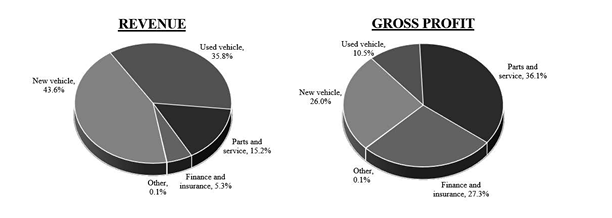

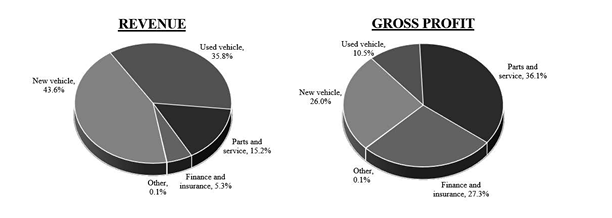

This isn’t a direct response to your question, but to introduce some facts, here is an exhibit from AutoNation’s most recent annual report:

This isn’t a direct response to your question, but to introduce some facts, here is an exhibit from AutoNation’s most recent annual report:

Not really. Spider crab can get low low financing because he has great credit and pays attention. Lots of people don’t and don’t. The first and only car loan I took out I arranged a loan beforehand with my bank for like 7%, it was 2004 or something. The dealer offered me a 14% loan or something and I was all nah my bank is giving me 7%. Oh we can do that the guy said. Didn’t even pretend to check with his boss, just cut the rate in half. Might work on some people. I’m sure it does.

But if spider crab gets great financing he might not do so great in negotiating for overall price.

just curious what the dealership said/did (that showed they were frustrated). bc at that point i may actually point and laugh.

In any case, this financial plan that probably took you under a min to come up with is still far more detailed and coherent than that of 95% of 500K+ earners (most of whom have no plan). I don’t have any problem with someone who is thinking through at this level of detail and decides that the loan is the way to go (even if I would answer differently). The problem is that most people don’t put as much thought into financing their consumption as you put into this post.

I guess you may argue that they understand these things “intuitively” even if they can’t clearly explain the thought process. I disagree with that for most individuals. I think they are mostly deciding based on feels (which is largely “me want nice car now”) and habit. People like you and spidercrab are not the typical auto loan consumer. Not even close.

Is it a good idea to go into the dealership looking for financing, get a quote, and then pay cash instead? Wouldnt you end up getting the best of both worlds?

Yes I think that’s the plan.

Good question. We never actually met them in person so pointing and laughing wouldn’t have worked well. Here is a more comprehensive timeline:

I think it would be a good thing to hit up the dealership you test drove with to give them a chance to match the other dealership’s price. I probably wouldn’t have thought to do so in your shoes though.

They had a chance to beat the other dealership’s price in the open bid.

One other way to wring a few bucks out - I’ve always been able to get dealers to allow me to put some % of the car on a credit card, for those sweet, sweet points. I’ve never got a dealer to allow more than 25% of the purchase price on a card, ymmv.

On my last purchase the salesperson messed up and thought it was 5k limit per card, not 5k total. I got down 20k on 4 cards and paid remaining with cashiers check. The dealer called me a few days later saying it was a mistake and wanted to reverse the charges, but I complained saying I didn’t have the cash and they gave in (after trying to force me to finance). Think they were screwed as the paperwork had already been signed and title transferred so not sure they could actually reverse charges and say I owed them $15k.

Yeah people try to put as much as they can but the fees are killer for car dealer margins. I think the most I ever saw was 30k of a purchase to a very good customer. But normally it was never more than 1-2k.

good, well done

“since you let us test drive, we thought it would be nice if we gave you the last offer, here’s what the best offer is…”

though that obv depends on how much he was whining.

We might have considered that if they hadn’t made and awful bid in the open bid. If he wanted to sell it to me cheaper, he had his chance. But he got greedy.

I think it is somewhat unethical to just tell the dealer the best offer when everyone else gave their best in good faith. I think you could invite them to improve their bid.

Not that it really matters because LOL to car dealers, but is there a chance he didn’t realize for this online bid that you were the guy who had test driven the same model car?

I don’t think that’s unethical at all. They provided a service. Probably part of your community. It’s easier to buy local.

I run a very similar playbook, but I have the tiniest bit of sympathy for Dealer A, who took the time to show me the merch. I will always take my best offer to dealer A say that I’ll buy from them for that amount plus a bit extra. I give them a firm number on what that bit extra is (it’s normally less than $200; it’s also never zero, since the best deal is generally from someone way far out) and I calculate it based on how inconvenient it will be to buy from someone else (Dealer A is always the closest and most convenient dealer).

Dealer A has never been able to do this. I’m like 0/5 in the last 20 yrs.

I guess if Dealer A was a giant douchebag in some way, then I wouldn’t give them the chance. But that hasn’t happened yet either.