They certainly do. I’m sure you’ve seen the recent CBC Marketplace report like everyone else in Canada.

Reading the net income portion of bank annual report financial statements is pretty interesting (if you’re into that sort of thing). You can see where most of their income comes from. For example, broad strokes RBC took in $C56 billion last year. About $25 billion was from lending activity (interest collected on loans less interest paid to people, for example) what could generously be characterized as actually socially useful activity. It is, after all, the main social function of a bank to connect borrowers and lenders. Even if they make a profit doing it I can talk myself into believing that could be a net positive for an economy. The other $31 billion is all “non-interest income” which is mostly the stuff with little value or demonstrably negative value for consumers - investment management fees and mutual fund revenue and credit card fees and service fees and the bank trading in their own account, etc. It’s not a great sign that our largest bank is making the bulk of their revenue on this stuff. It’s been like this for a long time, if I look at the 2003 report for comparison, 20 years ago their split was $7B on lending and $10B on service charges, etc.

It is odd though given the US is the centre of technology that the banking system is behind the rest of the world by like a decade.

I’ve been able to do that for about 20 years, though it became much more common and streamlined in the last decade.

E-mail electronic transfers sounds nice. My wife has been coordinating events for our daughter’s gymnastics team and has to provide my Venmo, PayPal, and Zelle info to everyone every time for payment (they can also pay by check or cash). One-stop shop would be great.

The US thing where you give your credit card and they take it away to run is so odd too. Messes me up every time it happens.

Lol this drives my wife nuts as well.

There seems to be some progress on this, last week I was in NYC and a few places brought their thing to the table like a civilized country.

COVID really helped advance some things in the US, a lot of restaurants now have QR codes on the tables you use to order and pay with your phone instead of waiting for someone to come pick up your credit card.

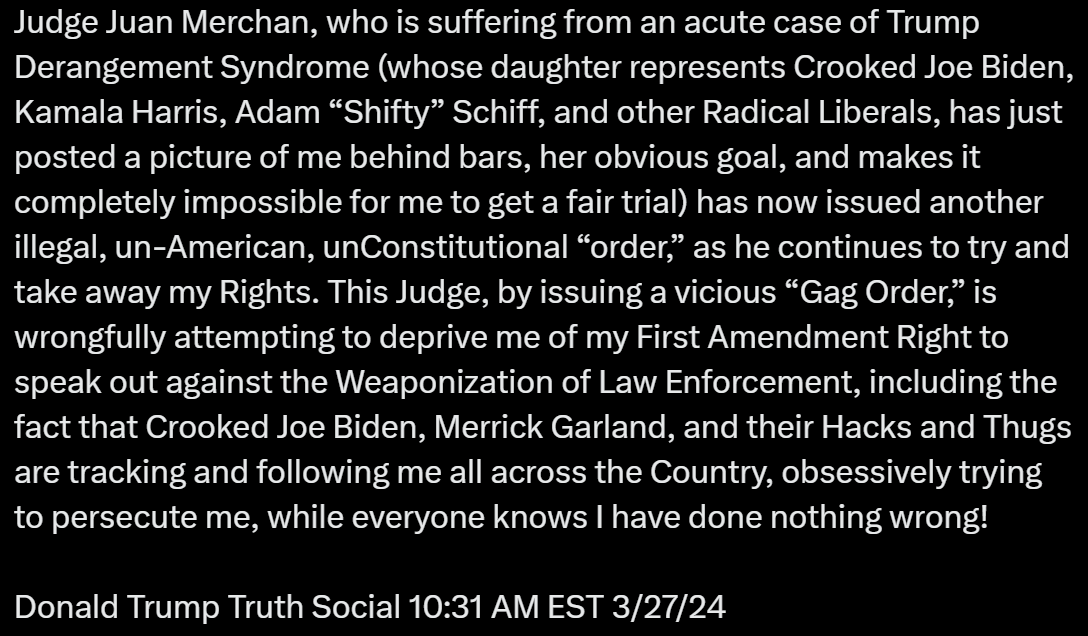

If I read this right, he’s saying that this post violates the gag order. Which it doesn’t afaik but w/e.

He continued on:

Not sure where everyone else is banking, but most major US banks have Zelle where you can send money using an email or phone #. I’ve ever deposited a check any other way but electronically in my adult life. And who takes your credit card away to run?

If not Zelle, there’s Venmo, Cashapp, Paypal. There’s never an excuse why you can’t make a bet ![]()

A lot of restaurants still.

When you say deposit electronically you mean all you literally need to do is take a photo of it from home. Done it’s deposited? You then just throw away the actual cheque. I didn’t think this was widespread in the US.

So it took him less than a day to blatantly violate the gag order. Thats gotta be worth a sternly worded letter, minimum.

I do this through my credit union

Yeah running it at the table is by far the exception and not the rule for me.

Nah it’s been pretty common for a while now.

I’ve been able to do this at USAA for well over a decade. FWIW I haven’t been inside a bank branch since 1999

Yep. You endorse the back and take a pic. Done

I didn’t think about restaurants and bars. I guess they do take your cc and bring it back. How do they do it in Canada?

I don’t think Trump’s post technically violates the gag order, unless the judge is one of the “members of the court’s staff”. I mean, it does in spirit of course, but Trump seems to be not quite over the line.

The judge and DA are not covered by the gag order.