This moment feels to me like February 2020. If you were decently well-read, you knew that a global pandemic was coming to our shores in weeks, and the upheaval would change society. But not everybody was paying attention, so you had this special knowledge, a crystal ball into a hideous moment ahead. It was nerve-racking to know that everyone else wasn’t freaking out as much as you.

That’s how I feel about the supply chain right now.

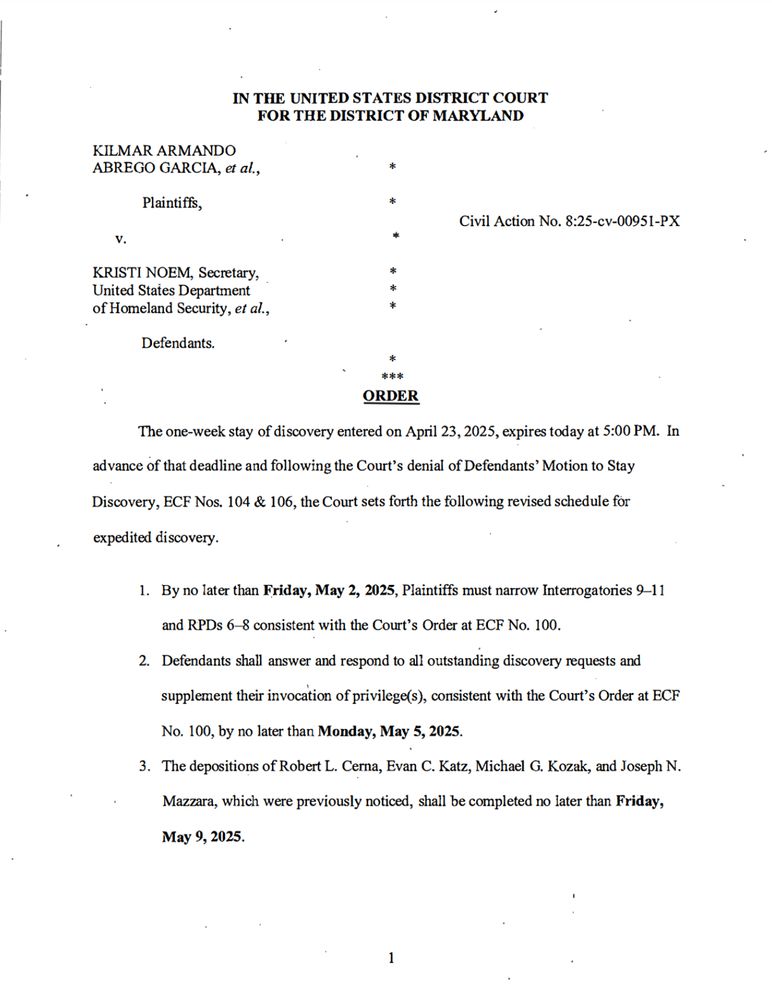

I don’t care how well-stocked a company is; if they rely on finished goods or component parts from China, there will come a point pretty soon when they won’t have enough. West Coast ports are just about to feel the effects of this, because it takes around 30 days for container ships to make the journey from Asia to the U.S. Next week, ships entering the Port of Los Angeles will drop 35 percent compared to last year at this time, and a quarter of the ships scheduled for May are already canceled. The Port of Long Beach is down 38 percent this week. Chinese exporters are just stopping production, either looking for new markets or finding another business

So this is why UPS announced 20,000 job cuts yesterday. This is why companies are pulling back all their forecasts of future earnings, because they are essentially unknowable, and desperately cutting spending wherever they can. This is why, during earnings season, Procter & Gamble and Colgate-Palmolive and Adidas and practically everyone else are talking about price increases and cuts to their outlook. This is why people are posting their Temu and Shein orders with giant “import charges” attached (that’s about a different tariff, the closure of a loophole that allowed direct shipments from China). This is why farmers, seeing China cancel pork shipments in one of the retaliatory measures, are already in a state of depression and begging for bailouts. (Which cannot come unless Congress replenishes the farm bailout fund, as I explained last week.)

And this is why shortages are a matter of time, with supply-linked inflation accompanying them. That accompanies layoffs in the logistics sector, then retail, and eventually across the economy.

Some of this is further out; normally, planning would be going on right now for holiday orders of toys and Christmas decorations, and nobody can do that. Even fireworks orders for America’s semiquincentennial are being affected now. But the collapse in production, combined with the timing of shipping and trucking and the wearing down of inventories, means people will see these effects on store shelves around midsummer, precisely when economists at Apollo Global Management (I’m no lover of private equity, but hey, they know money) place the start of the recession.

If the tumult stopped at novelty items, that would be one thing. But China dominates things like transformers for electricity, and pumps and other component parts for air conditioning. The near-term gap could mean serious disruptions in the summer months.

I’m not an oracle. All of this information is readily available. But the majority of Americans just have a wisp of it, a vague sense that something bad is going to happen. Trump’s poor approval ratings reflect that. But if I’m right, and I’m just doing a basic reading of things happening in the real world, you ain’t seen nothing yet.