Come on down to Sac town. We can share some Corona over some Coronas

If your retirement is dependant on the Dow you are doing it wrong

By it I mean investing, not life!

Ok smart guy - what should a 401k you can’t touch for 9 more years look like?

I don’t see anyone minimising this here. It’s clearly A VERY BAD THING but acting like each year millions of people don’t die and half a billion aren’t infected from malaria, simply because, to put it bluntly, it doesn’t affect America much would be lol worthy if it wasn’t so deplorable.

I could go w 20 days of pretzel sticks and whatever chocolade is.

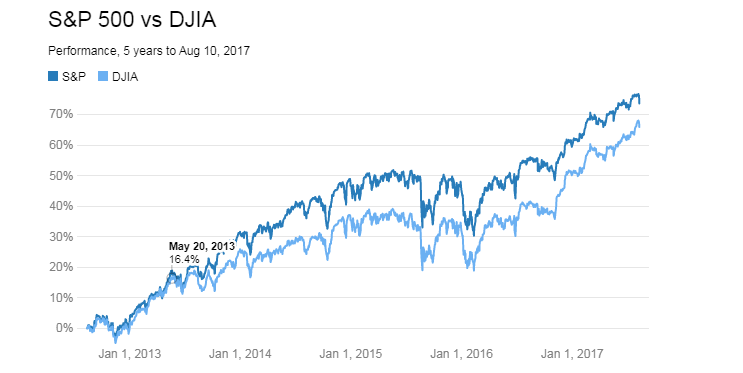

Before trading began Thursday, the S&P 500 was down almost 8 percent from a record reached last week. The Dow Jones industrial average was down about 9.6 percent from its peak earlier in February.

The collapse in investor confidence spread far beyond stocks. Crude oil fell more than 4 percent, as investors weighed the chance of growing economic paralysis related to measures to stop the outbreak.

Bond markets broadcast deep pessimism about the economy, as money flooded into Treasury markets, pushing prices sharply higher, and yields — which move in the opposite direction — to once unthinkable depths.

The yield on the 10-year Treasury note touched 1.25 percent in morning trading. Prices for junk bonds, and even safer corporate debt, fell.

“Stocks and bonds say we’re doomed,” wrote Chris Rupkey, chief financial economist at MUFG Union Bank, in a research note on Thursday. “Anyone who has a better idea for what lies ahead please let us know because right now the direction ahead for the economy is straight down.”

I considered and rejected long-term bonds, because I figured interest rates are already very low, so the price is high. But I do need to protect against an event like this wiping me out, because I’m within 2 years of retirement. So, this was a catalyst for me to:

- Move 12% of net worth from stock funds to cash on Monday

- Move 4% of NW to short- and intermediate-term government bond funds Wednesday

The goal is to own more bonds in the years just before and after retirement, to dampen sequence of returns risk.

I was planning to sell my house this year at a nice high valuation (30% of NW in real estate equity), and rent a much smaller place in the city for a few years, but now who knows? If housing prices plunge, I may stay put and do the needed fixups while waiting for the market to recover somewhat. If they stagnate or go up, I’ll probably sell this year. I now have enough cash to buy stocks after a big drop, or to buy a vacation/retirement home with a large down payment. I failed to change my new money allocation, but will change that to go 100% into bond funds for a while (currently 65/35 stocks/bonds, I think).

I don’t know, TMI?

I feel like since i have about 30% of my net worth in home equity and plan to sell pretty soon - that’s a good counter-balance to my 401k (55% of NW) and brokerage account (15% of NW) in stocks.

When I sell I want most of that home equity windfall in low-risk Euro-based vehicles. I want to hedge against another dollar crash vs. the Euro like 2008. I plan to be traveling the world so that shit matters as far as buying power.

Clovis always turns up for aggressively unhelpful scoldings.

https://twitter.com/thehill/status/1232855791230738433

Lmao when you’re famous you can get away with it

Broad based allocation between stocks and bonds, with a ratio that changes in favour of bonds as you age. Both should be spread among North American and global indexes. Little to none should be in anything directly tied to the DOW.

How the media could end malaria: every time the Dow goes down, malaria gets the blame.

Jesus christ dude 60-90% of what you’re talking about is going to be highly correlated to the Dow. The correlation between the Dow and the S and P 500 is nearly perfect. And the correlation between the broad American market and foreign stocks pretty strong in general and is very strong in downturns.

Age 50. I got the global indexes and small cap value, emerging markets, etc. But it’s all in stocks (nothing is directly tied to the DOW). How much should be in bonds and which bonds?

Btw this is an IRA, not a 401k, so I have a ton of options.

Yeah this.

You are acting like we are making diametrically opposed points when we are really making points separated by small nuance. Not everything is a HUGE FIGHT!!!

Anyway, we can carry this on on a different thread. No need for a massive derail.

That was a common strategy when interest rates were “normal”, but with them so low, a huge fund is required to provide a decent income, so staying largely invested until you are well into retirement is the only reasonable strategy. If you get past 75 and are in great health for your age lifetime annuities can offer value if you reckon to beat the mortality for your age.