I mean, just going to your boss and saying, “Hey, I’m taking on a lot of additional responsibilities within the company in light of Joe’s departure. I’d like an increase in compensation to match,” isn’t a bad starting point. You don’t have to be underhanded or tricky, but open about how you’re increasing your value to the company and deserve more because of it.

Hey all,

I own an outpatient private practice in Virginia that, as you might expect, was booming over COVID. Experienced 80% growth over prior 12 months, have about 20 staff between therapists and admin folks. Grossed about $1 million over that time, netted $250k. Throwing that out not as a brag but to give you context for what follows.

Due to the massive demand increase for mental health during pandemic VCs have invested massively in these mega-practices that basically just go around buying up littler practices to create interstate agencies. One of these approached me and we’re in the beginning stages of hashing out a buyout.

-

No idea what my practice is worth in terms of a big lump sum payment. I’d effectively give up my 100% ownership for $$$$ but I’ve heard everything between $1 million and $5 million being within reason, depending on how they calculate value.

-

I’ll hire a lawyer to review whatever contract may come, if we get to that stage. Brother is an F500 M&A guy and is advising me at this juncture. General advice from those of you with experience with these negotiations…?

-

I’m extremely poorly informed about money. If I cashed out for $3 million, I imagine the deal would be I’d invest that conservatively, then whatever that money earns either gets reinvested or siphoned off for my own living expenses, right? I’ve seen 7% thrown around, so would that mean I’d have $210k in year 1 to tap into or reinvest? Imagine the less I’d need to tap into it the better as reinvesting would mean more money to earn interest on, yeah?

-

I’m 37, wife is 42. We have a 5 year old. We’ve got maybe $100k in IRA, we’ve paid off student loans, we’re renting but will buy a home by this time next year.

Any thoughts or advice would be appreciated.

I can’t answer any of your questions but congrats!

I don’t know what the going rate is for your kind of small business but usually there are advisors that will be able to give you a good sense of what an appropriate ratio of the purchase price to annual revenues is. My wife’s parents sold their business about a decade ago to a large corporation and I think they used a consulting department from one of the large accounting firms. You might be able to get some advice on the sale price of comparable businesses, kind of like when you buy a house and the real estate agent and give you the average price of comparable houses.

At your age, you won’t be able to draw 7% out of an investment account and sustain that. A conservatively invested portfolio is going to yield way less than 7%, and you’ll have to pay taxes on investment gains. If you cash out for anything in the millions, and you know nothing about money, you have two good options. Option 1 is invest a bunch of your own personal time in learning the basics and do your best. Option 2 is find some help, but make sure that you get GOOD help. Try to look for fee-for-service advisors where you pay them $X to make recommendations to you. Don’t go to an advisor who is compensated based on taking a % of your assets each year.

Is your business set up as an S corp, a C corp, or a passthrough? The kind of buyer you’re describing normally won’t engage their tax counsel early on, so you can potentially sneak some good stuff into a term sheet that they’ll have to live with later. (Generally, structuring so that you get CG treatment even if it doesn’t make any economic sense to the deal as a whole. Also getting them to agree that none of the consideration is allocable to the noncompete they’ll doubtless want.).

You should also get your own counsel now. Looking at a term sheet doesn’t take much time at all, but it can be really, really helpful. A good lawyer can also give you some sense of where the market is on valuation and/or point you to bankers and such if needed. PM me if you’d like me to try to scare up a referral for you. A friend of mine does these kinds of deals all the time (on the PE-fund side), so he might have worked across from someone good in your area.

Post this to reddit somewhere and get more eyes on it imo.

Congrats. I don’t know how you’re supposed to do it, but I’ve learned from TV/movies you’re supposed to engineer a reverse hostile takeover of the bigger company and/or go on the run when you learn they’re buying up companies to test an experimental procedure to produce super soldiers. Also there is a love interest. Good luck.

I PMed you, but it’s an S Corp.

What’s your EBITDA? Is that the 250K? Or does the 250K include your salary?

In any case, if we assume your EBIDTA is 250K, then a valuation of 5 million (i.e. 20X) seems pretty high. Even 3 million seems like a lot, but I’m making a lot of assumptions about your business model when I say that, so I could be way off.

SUPERJOCK TO NFL SECOND STRING PIPELINE OOH SO INSIGHTFUL

I’ve been having a couple conversations recently for potential new job, but I’m in unchartered territory with both. Appreciate any thoughts.

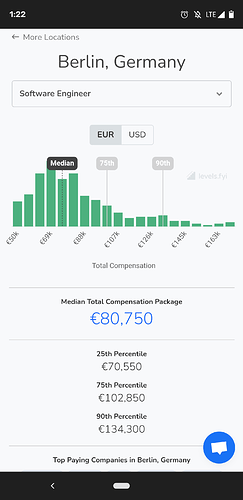

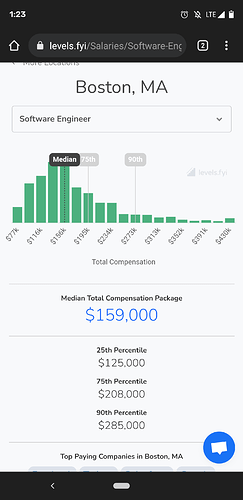

#1 - A job in Europe. I don’t expect a lavish expat package, but I don’t want to be at a significant “loss”, either, due to taxes, cost of living, retirement savings structure, etc. Anybody have good resources for researching and learning about expat roles and things I should be considering? Or personal experiences?

I’m middle to late in the process and HR just asked me for my comp requirements. Here’s the major caveat - I previously worked for this company in the US. They no doubt can pull up my comp or ask the US division. My plan is to basically say that I always felt treated and compensated fairly by the company, and given that this position is similar in seniority and job description as what I did in the US, then my expectation is to be in line with that. However, there are so many expat-related variables, that I need to understand more how they would structure things before I provide additional #s. I believe my US comp, even just converted to Euros, would be high for over there, but after higher taxes, would result in lower take-home pay for me.

#2 - A smaller start-up (in USA). Growing quickly and recently completed another round of financing. Prepping for another probably in 6 months or so. I’ve never worked for a start-up, so I have no idea what I should be knowing re: equity or differences in comp structure to more traditional corporates. My sense is that they would offer a base + equity. I would likely have to fight for some type of bonus structure. I did a bad job on my initial call with HR - said I need to understand the whole package, etc., etc., but they kept pushing, so I stated a base that is 10-15% higher than my current. HR rep hesitated a bit - which made me at first thing it was a high # - but I have continued on pretty rapidly in the process.

Seems like this (unless it’s egregiously different) should be pretty far down the list of priorities. At least it would be for me.

Do you have friends/family where you are now that you wouldn’t be able to see very infrequently now? Do you know people in the area you would be moving to? Are you looking for a way to get out of the US permanently?

There’s no “right answer”, but I’d definitely talk to people who have done that if you’re even remotely considering option 1.

No doubt - I raise it because under my initial assumptions, it would be significant. But we’ll see where that conversation goes.

To address the other questions - 10+ years ago, it was an occasional discussion point with Mrs. JordanIB, and a dream to go over there for a bit, not intended to be permanent. But as expat assignments became less frequent, and my comp increased here, I thought the window had closed. Then this opportunity came up. I worry more about taking her away from a core friends/family group here than me, but before I even threw my hat in the ring, I asked if she was still up for it. There are no kids.

I definitely need to speak with some folks over there - I know some but not many. Most folks I know over there are likely on sweet packages that would not be offered to me. There’s one pretty analogous person, but I think they are gunning for this job, too, so it would be awkward!

My companies (and most tech/engineering companies) internal pay scale between Berlin/EU and the US is very aggressive. I would not expect to get paid around what you do now if you work for a bigger company without some outside reasoning.

Why do people doing the same job get paid so much more in the US?

More competition for the best employees by the most wealthy companies in the world basically. There aren’t enough good software engineers in the market anywhere, and Google, etc. are willing to pay $250k for 5yoe if you are good.

It’s not that Germany has surplus engineers, the EU does. Google probably doesn’t need many for engineers because they aren’t headquartered there. Salaries aren’t determined by what it costs, they’re determined byvehat Google needs to spend to get the people they want.