Yep

WTF

Even fucking STEVE MNUCHIN opposed it. They still left it in.

That provision is really good for very small businesses as well. Some people I know with a few employees didn’t even realize they weren’t going to be able to deduct their payroll costs(paid with PPP funds) as expenses.

The big guys are getting a huge break, but I do think it is a very good thing for actual small businesses.

It seems pretty insane. I wanted to understand how on earth you’d motivate this treatment, so I went to the original argument from Grassley (of Twitter ‘pidgin’ fame):

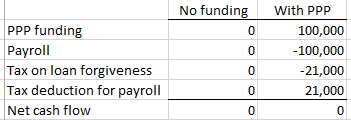

This is my best attempt at making the case for this treatment, using an example where a company borrows $100,000 and is taxed at a 21% rate:

Scenario 1: The government provides loans to businesses with generous payment terms. This would be a completely unobjectionable scenario for most people, as it’s not really giving firms anything, just the government serving as a lender of last resort, which is kind of its job. This introduces no tax issues at all.

Scenario 2: The government provides loans to businesses with generous payment terms, and forgives those loans if the dollars are used for certain purposes. So that incents firms to use the money for payroll. The question of tax treatment relates to 2 things: the payroll expenditures and the loan forgiveness. If the company is taxed on the loan forgiveness and can deduct for their payroll, the two things offset. So the net effect on a company that uses the funds to make payroll payments they wouldn’t otherwise have made:

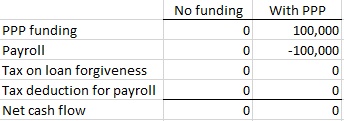

Scenario 3: Same as 2, but the loan forgiveness is not taxed and the company cannot deduct its payroll expenses (under the very basic argument that they didn’t incur the cost - the PPP did):

So scenario 3 is exactly the same net effect as scenario 2. The company is completely made whole for the payroll costs, which is exactly what the government was trying to accomplish.

Here’s Grassley’s argument:

Listen, scenario 2 is exactly what would happen under normal tax rules. You’d be taxed on the loan forgiveness and you’d get a deduction for your expenses. There’s nothing complicated here, and if this is what we’d wanted, we wouldn’t have specified anything about special tax treatment.

AND, since scenario 3 is the same outcome as scenario 2, the same argument applies - if this outcome is what we had wanted, we wouldn’t have made a special clause for tax-free loan forgiveness.

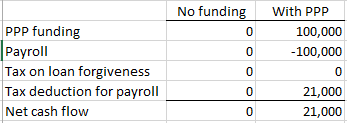

But we did include that special clause, which means OF COURSE we didn’t want to have scenario 2 or 3. The only logical interpretation of us including that clause was because we actually wanted to treat these as tax-free grants to the firms with no strings attached. So the outcome we really wanted was this one:

Where the company isn’t just made whole for continuing the payroll - they actually come out ahead.

I can kind of see the argument, but the conclusion is complete bullshit. Kind of like those mathetical arguments that prove 2=1 by covering up the fact that they divide by zero in one of the steps.

So basically if your tax rate is 20%

You borrow 100k

You are forgiven 100k

You don’t pay tax on 100k

You spend 100K

You deduct 100k

You pay 20k less in taxes

So essentially you get 120k tax free of which you theoretically spend 100k on your employees or other expenses you would have paid anyways. Then you pocket the last 20k.

Coming together to solve problems is also standard corporate bs (and also at times how problems get solved). Ergo, this plays well with the professional class suburban dem.

I dont think I get it. If you were going to be paying the employees and other expenses anyway, they would have been deductible. In either case you aren’t paying tax on the 100k. If the 100k given and forgiven spent on expenses are also deductible you get 100k free and clear. If they aren’t deductible your basically getting 80k.

Am I missing something? How does it end up being 120k?

Because debt forgiveness is typically treated as taxable income.

Unemployment benefits: taxable

PPP loans: both not taxable and deductible

Seems fair

I don’t think PPP was ever supposed to be considered a loan, its essentially free money for businesses. I guess people don’t like that originally a 100k PPP loan was essentially going to be 100k-(tax rate x 100k) and now its just 100k. I still don’t get how a business comes out 120k ahead when the expenses are deductible.

Can someone explain that better to me, I am probably just missing something or looking at it wrong.

You get $100,000 for free.

Then, you get to deduct $100,000, leaving you with $100,000 PLUS ($100,000 x your marginal tax rate).

It’s free payroll (100k) plus not having to pay taxes on unsecured debt forgiveness (in the example 21% on 100k = 21k).

They get 100k

They don’t have to pay tax

They spend the 100k and then deduct than on their taxes which reduces their taxes by 20k

The net may be tricky but typically the are not paying 20k tax on the gain and getting a deduction worth 20k. Total of 120k as the first 20k just cancels out tax they would have owed.

The original interpretation was

Get 100k

Pay 20k in tax

No deductions

Net 80k

The supposed “fair” fix was either

A

Get 100k

Pay 20k taxes

Spend and deduct 80K

Get 16k tax break

Net 96k

Get 100k

No tax

Spend 100k but no deduction

Net 100k

The bill gives them both which nets to 120k.

The general idea is why should the business get to deduct free money from the government. Guarantee that employees and vendors are paying tax on money received from the business that came through the forgiven PPP loan

-my understanding. Taxbro???

This is the crux of it. The PPP was supposed to help small businesses, so not calling it income when forgiven while still allowing deductions for expenses paid for by the PPP are just ways to further help small businesses. It sweetens the deal (considerably).

But the inequity between the help the PPP gives small businesses (read: small business owners) and the help provided to other people is huge. For the second round, requiring a bigger revenue dip than 25% in one quarter would be a good start. Also, as somebody else pointed out, taxing it back if the business’s revenue recovers in 2021 makes a lot of sense. It’s more complicated, but it would prevent this from just being a windfall for companies (people) that had one bad quarter in 2020 but have rebounded.

Then their is the definition of “small”.

But what you fail to realize is that the extra 20k is going to trickle down to everyone else.

You can’t get to a 120k benefit without double counting.

There are 2 extreme possibilities in terms of the beneficiaries:

Extreme A: These firms would have kept paying their payroll even without the PPP loan/grant. For these firms, the PPP doesn’t change their behavior and is more or less a windfall. Without the PPP, they’d be paying $100,000 in payroll, getting a $21,000 tax deduction, and netting -$79,000. (This of course ignores the revenue those workers are bringing in, but that’s not really relevant here.)

Extreme B: These firms would have paid none of their payroll without the PPP loan/grant. For these firms, the PPP does change their behavior. Without the PPP, they’d be paying nothing, getting no tax benefit, and netting $0.

After the PPP, both firms are in exactly the same position - employing at a payroll of $100,000. So they end up in the same position: +$100,000 of PPP proceeds, -$100,000 of payroll, +$21,000 of tax deduction, for a net +$21,000.

So what is the effect on each firm?

Firm A has gone from -$79,000 to +$21,000, netting a $100,000 benefit. They don’t generate any increased revenues or profits because they’re not actually changing the size of the payroll relative to what it would have been without PPP.

Firm B has gone from 0 to $21,000, netting a $21,000 benefit. But they also (potentially) generate additional income to the extent that employing those individuals will generate extra revenue and profit. So the PPP benefits them by $21,000 plus whatever income those now-employed individuals can generate. Is it possible that those individuals could have generated an after-tax income of more than $79,000 (to make the net results >$100k, as some people here are arriving at)? No, because if employing those individuals would have generated more than $79,000 in incremental profit, they never would have laid them off in the first place.

So I don’t see any way you can get to anyone benefitting by more than $100k without double counting something.

I’m going to spend $100,000. The government gives me $100,000. I decide to now spend $200,000. I get an additional tax deduction I wouldn’t have gotten otherwise.

Essentially I get $100,000 of extra value for only $80,000. That’s the extra $20,000.

It’s dumb of me not too in this scenario.

I just have to show any spending of $100,000 that qualifies for the loan spending purpose.

either way i net an extra $20k of value (using a simple 20% tax number).

Let’s set this aside for now and let a tax person chime in.