but the stock market is up which means the 10% who own 90% of stocks are doing very well.

Biden gonna lose and run again in 2028

approval rating is something from the beforetimes, when people perceived polarization as moderate (possibly erroneously so). we are also very much aware of the devil trmp is. i would say trmp is twice as infamous, but even so he’s already lost to biden with the incumbency edge. so, it’s at best a wash in terms of raw winning chances.

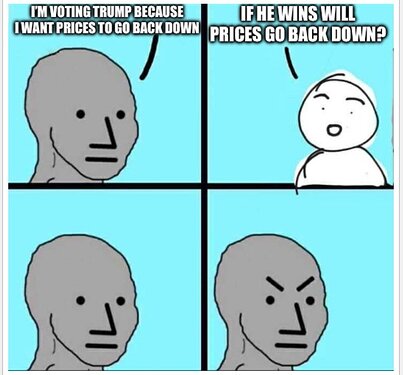

kurgman writes about this semi-regularly. people are not inclined to believe good news.

First, many of those hostile commenters seem to be under the impression that economists are using special consumer price indexes that omit a lot of stuff to assess Americans’ standard of living. But nobody does that. When economists say, for example, that the purchasing power of most workers’ wages is [higher] than it was before the pandemic, they’re measuring prices using the whole consumer basket.

…

But if you say that, you encounter, as I did, an outpouring of rage. Why?A lot of it is political. Many people on the right simply assume that anyone who says that something good is happening on Joe Biden’s watch must be a liar. And some people on the left also balk at the idea that inflation is falling, because that seems to them to minimize the suffering of working families.

But not everything is political. The question of what’s happening to inflation is, or should be, a purely technical issue.

here’s the linked tweet from the article so it doesn’t clobber the text.

(https://twitter.com/arindube/status/1684244062860374016)

non paywall link

http://archive.ph/https://www.nytimes.com/2023/09/19/opinion/core-inflation-rate-data.html

i mean, we are trying to extrapolate an incumbency edge based on a very limited dataset. the numbers suggest incumbents do have an edge, and most losses had unusual circumstances, e.g. a high-profile third candidate in 92, carter was absolutely railroaded by the reagan cult (similar to today) even though today this board talks about him as one of the best presidents, and ford was never elected at all. chart also misses trmp, which i would still argue was atypical to another sitting president.

But don’t forget that Trump actually won in every state (by a landslide!) if you take out the voter fraud. So he’s the actual incumbent!

if you tell most people inflation is down they are going to respond with "then why am i still paying $XXX for x, people dont really know or care about the difference between inflation dropping and sticker prices dropping, unless sticker prices start going down (which they never will less a huge recession + job loss) convincing people that inflation is dropping is going to be a very tough task.

I believe there may be a problem in this analysis in that I believe that we have to renormalize what is considered a good/bad approval rating. Modern approval ratings are now much lower because 100% of the other party gives you a thumbs down plus some percentage of your own.

I wanted to see your work here. My understanding is that rich people of course are doing great as always, low-wage earners have actually been holding their own thanks to some decent bumps in hourly wages, but then the entire middle class has been stagnating with shitty 1-3% COLA raises (if any) that haven’t come close to offsetting inflation.

Probably most of my circle is on a positive trajectory over the last 5-6 years for sure.

I recently saw this article that was interesting: Net worth surged 37% in pandemic era for the typical family, Fed finds — the most on record. It ends up using this Fed report released in October as source data. The report is somewhat limited in that data is only through 2022, so it doesn’t measure the “right now” but 2022 was a pretty brutal year in the markets

On page 11 it has a pretty cool graph that shows net worth for folks grew 37% on the median and 22.5% on the mean. This is cool to me because income and net worth are almost always skewed upwards because of the big earners on the tail end. So to see the median outpace the mean it means the lower income levels had a larger proportional increase (I think). But now that I say that and read this quote from page 13:

Median and mean net worth rose throughout the net worth distribution. Growth in median and mean net worth was largest for the bottom quartile and smallest for the top decile. Still, these growth rates reflect substantial level differences in the net worth of each of these groups. Among families in the bottom quartile, median net worth was $400 in 2019 and $3,500 in 2022, and mean net worth was negative $15,700 in 2019 and negative $5,300 in 2022. Among families in the top decile, median net worth was $3,012,500 in 2019 and $3,794,600 in 2022, and mean net worth was $6,641,800 in 2019 and $7,810,500 in 2022.

It makes sense that raising $400 any amount is going to be a higher percentage increase. But still $400 → $3500 is like 900% over 3 years so that’s worth noting. That same report also shows that incomes for those in the bottom quartile did not outpace inflation. So it’s not exactly a slam dunk that the lower quartile are doing better, but maybe they have more of a cushion? Or is that almost entirely driven by an asset like real estate? ![]()

What fraction of this group owns their home?

I’m happy to look at anything to the contrary, but every data point I can google says that real wages are higher now than they were 5 years ago (incl. for 'production and nonsupervisory employees).

https://www.bls.gov/news.release/archives/realer_01112019.htm

https://www.bls.gov/news.release/archives/realer_10122023.htm

Going from $10.75 an hour in December 2017 all the way up to…checks chart $11.02 in September 2023 says that you’re technically correct, but that’s still a whopping $0.27 an hour raise.

Interest rates in 2017 compared to interest rates now are night and day, rents go up 5+% every year, groceries are definitely up more than 2.5%.

Is that when the Dow crossed 25k like 5x?

I’m not accusing you of making this mistake, but a mistake that A LOT of people make is to take the above data, compare it to inflation, and then conclude that wages have not kept up with inflation.

You absolutely cannot do that, because the wage data that ParlaySlow linked to is already inflation adjusted. So even after taking into account inflation, real wages are higher than they were 5 years ago. (Of course you could argue that inflation is mismeasured–which I would probably disagree with–or that your basket of goods is considerably different from what the CPI is based on, but that’s a more nuanced argument than people tend to make.)

I think he makes an interesting point that if real wages are pretty close to the same, but prevailing interest rates are much higher, then maybe your average person feels that the economy is worse? And if so, is that rational?

Interest rates going higher hasn’t been friendly to my portfolio, but I’m massively short a 2.5% long term bond (in the form of a mortgage) that is doing great.

The part of the equation olds deliberately just decide not to understand is that for the shit young people actually want or have to buy, inflation is actually like 15%. Houses, health care, food, cars, education all up massively. It’s just spitting in their face to yell HURR DURR ACTUALLY THE ECONOMY IS GREAT, BIDENOMICS!

I think he makes an interesting point that if real wages are pretty close to the same, but prevailing interest rates are much higher, then maybe your average person feels that the economy is worse? And if so, is that rational?

Maybe, but what happened to the talking heads screaming, “Democrats have robbed senior citizens and other savers with this zero interest rate nonsense. They’ve got nowhere to save and they’re not getting any increases in their social security payments!”?

Now you can invest risk free at 5% and get meaningful COLA adjustments, but people seem to be the opposite of happy!

I’m not accusing you of making this mistake

You absolutely could have accused me of that at first because that’s exactly what I did, then re-read the charts and realized I was being a derp and deleted the post.