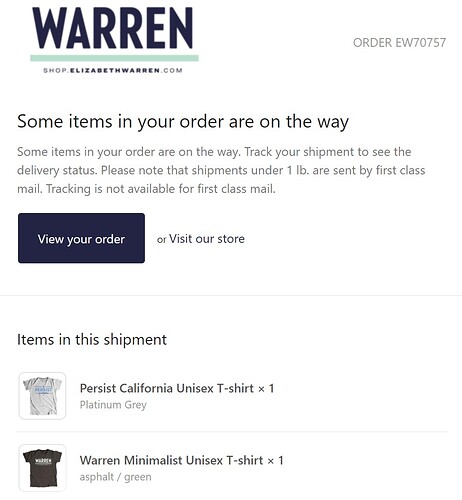

Need a couple of new t-shirts.

you’d think dems would’ve learned the military guy or most electable thinking mistake after john kerry. Republicans successfully attacked it with total nonsense and he definitely was the “guy we think is the most electable rather than the one we actually want” candidate.

Biden - 24

Warren - 18

Sanders - 17

Harris - 8

Buttigieg - 6

O’Rourke - 5

LIZ LIZ LIZ LIZ LIZ

I made fun of that on Twitter and got this reply:

https://twitter.com/bgc85/status/1158900394464071680

I’m sure that $10 a share JPM ended up paying really felt like a “rescue”.

Ed Rendell writes a scathing attack of Warren’s transfer of big dollar donations from her Senate fund to her Presidential fund - only to slip in at the end that he is supporting Biden. His whole point is that really everyone accepts big money and who cares.

Fuck this party man.

Warren’s message was that the superwealthy, those worth more than $50 million, would pay just pennies on the dollar — a 2 percent annual tax on assets — to fund the vast array of social programs she’s proposing, from universal child care to free college tuition. At her prompting, crowds recently have held up two fingers and chanted, “Two cents!” to express their support for the tax, and the programs it would pay for.

But there’s another way of looking at how this tax would impact the country’s wealthiest families: The 15 largest fortunes in country would be, on average, half their current size if the tax had been in place since 1982, according to new figures published by a pair of economists who helped Warren write her wealth tax proposal.

Instead of $97 billion, Microsoft founder Bill Gates would now have $36.4 billion, according to the figures. Rather than $44.9 billion, Walmart heiress Alice Walton would be sitting on $15 billion. Instead of $160 billion, Amazon founder (and Washington Post owner) Jeff Bezos would have $86.8 billion.

Some economists, seizing on such numbers, say Warren’s tax could do more than just make the wealthy uncomfortable: It could erase great fortunes.

“This is not some small little tax,” said Lawrence Summers, former treasury secretary in the Clinton administration and past Harvard University president. “If it was successfully enforced — and there are questions about whether it would be — this would be an extremely burdensome tax on wealth.”

How are they supposed to feed their families on such a pittance?

This is a TRAVESTY

That will scare off all the temporarily embarrassed millionaires from voting for Warren. No fucking way are they going to take the one in a trillion chance that they might be in a spot to lose $40bil to the gubmint.

She could actually do really well tapping the envy of the upper middle class on this…

https://mobile.twitter.com/jhcoleman2225/status/1171842321073098752

https://mobile.twitter.com/EricJafMN/status/1171859231252852738

She really needs to use this article as a cudgel because it’s hilarious

You can’t really do a 100% tax on wealth over $50M because so much of it would evaporate if the wealthy were forced to liquidate, but it would be fine morally imo and the incentives people have for being productive would not be hurt. Perhaps a 2% per year is the best way of accomplishing that and this plan is as radical as can be.

Lol @ “erase great fortunes” as if they were cherished works of art. This article is so good.

What about my boats?!

2% wealth tax is fantastic policy. You want access to the best public markets in the world, to the rule of law, etc., pay up.

It’s also super effective in deterring dynastic wealth. 2% a year, assuming no BS workarounds for trusts (this is critical) would, over time, make a huge difference. Obviously effective implementation, given incentives, is a major issue.

Maybe discount it to 1.5% because there’s no more rule of law here

The post-debate discussion is fucking awful. “Joe won the debate” is an actual position being taken by serious political commentators. Props to Julian for trying to take him down, hope others follow his lead. Joe would get absolutely demolished in debate by Trump–you think Donnie is gonna pull any punches about Joe’s age or coherence???

“Serious political commentators”. Every single one just lost their credibility in my eyes.