Going to the redwoods and Lassen volcano shortly.

What’s the not miss things?

For the redwoods, I have:

Tall trees trail

Gold bluffs Beach

Stout Grove trail

Fern canyon

What else?

I know nothing about Lassen.

We have 3 days at each.

Going to the redwoods and Lassen volcano shortly.

What’s the not miss things?

For the redwoods, I have:

Tall trees trail

Gold bluffs Beach

Stout Grove trail

Fern canyon

What else?

I know nothing about Lassen.

We have 3 days at each.

+1 on Tall Trees Grove. You have to get a permit a day ahead of time at one of the ranger stations, and they try to talk you out of it for some reason. But be persistent.

Also check out Trees of Mystery. Fun place that has a really nice American Indian museum inside. I’ve never actually taken the cable car thing through the trees. But it looks fun.

Oh yeah, there’s a diner along the main artery between the park sections (they used to be 3 separate state parks, and they’re still labeled that way sometimes, which can be confusing). The blackberry pie there was one of the best desserts I’ve ever had. Although blackberries might not be in season yet. But if they are, find that pie.

I don’t remember much about Lassen except hiking to the top of Mt. Lassen, which was cool.

Also I don’t know if you like to drive out of the way, but CA 211 that goes along the coast from Ferndale to Petrolia and then back to the bigger highway to me anyway is just surreally beautiful and very empty drive. But apparently always very windy. Also the Lost Coast trail starts at the bottom part of this drive where it’s on the beach.

Already got the permit for this, as well as Fern canyon and Gold bluffs Beach.

Someone else mentioned this to me. We’re stopping on the way down.

Guess I should have mentioned that we’re going to Crater lake on the way home, but I think I have that figured out.

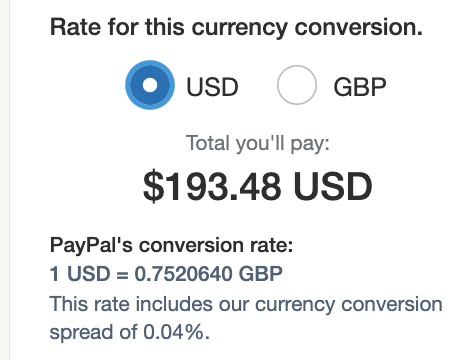

FWIW I did an experiment with my Chase Sapphire card on the exchange rate. My Dad is publishing a book with a publisher in England for some reason, and since getting on Paypal is far far beyond him, I’m doing the payments for him.

So on the invoice it gave me the option of them converting to USD for me, or charging me in GBP and letting my credit card do the conversion.

Here’s the rate if I let them do it:

And here’s what showed up on my bill when I let Chase Sapphire do it:

Chase Sapphire wins!

(In retrospect, he probably could have used his bank card and paid through Paypal. But they told him Paypal so that’s what we assumed.)

Speaking of Chase Sapphire, I have like a bajillion points, accumulated over years, that I’ve never even attempted to use before. The other day I went on the website to see what it would buy. I was told: You have the dollar equivalent of $1800!

I also hoard points. I’ve opened up a few accounts for the sign up bonuses and then never actually use the points. I figure if I go busto in the future I can still take myself on a nice ass vacation or two!

Look for bonuses where you can get 1.5x if you pay for groceries or something. I always use that. You can go back and retroactively pick payments.

I looked into converting Chase Sapphire to miles and it was barely better than taking the cash.

I’ve read that you can really maximize the points if you’re booking first class or business class for international flights. And staying at Hyatts is supposedly good value for the points? I never do any of these things, so I can’t say for sure.

This is sort of true, depending on how you define “value”. For example, I have a trip coming up where I could either

A) pay a cash rate of $800 a night to stay at a specific Hyatt that is very nice and exactly where I needed to be

B) pay a lower cash rate (~350) for a lower quality hotel 10 minutes from my ideal location

C) Take 20,000 points(that Chase would let me cash out for $200), send it to the Hyatt program and book the same room as in A

Some people would say that I just got $800 worth of value from those 20,000 points. Others argue that if I would not have actually paid the $800 in cold hard cash (and would have booked room B instead), I don’t actually value the points at $800.

Personally, my approach is “I’d never actually pay money to fly business class, but I don’t have a pressing need for $ at the moment and these points don’t feel real, so why not use them on something cool?”

Anyone here extensively use the Apple credit card? I noticed that the few purchases I’ve made using it paid quite generously in terms of cash back. Might be a better value than accumulating mileage these days.

My read on the Apple Card is it is pretty good if you can use Apple pay, but I don’t think the rate is great for other purchases.

I think that mileage programs have gotten harder to get great value out of in the last few years, especially if you are unable/unwilling to do some homework about the different programs and how they work. If you really know about credit card transfer partners, bonus categories, and airline alliances, you can probably get 6% or 7% back on your spending (maybe more if you really take advantage of sign up bonuses).

That being said, I think most people would probably be best served by getting a simple cash back card that pays around 2% back (either because all purchases are 2% or it has some mix of bonus categories that works out to about 2%)

I believe if you use Chase Sapphire points to book the travel, you get about a 15-20% bump on the value of the points. You have to book through their little page.

So your options are:

To do 3, you need to be pretty sure you can get better than 85 points per dollar

Or pay groceries at 1.5x. I use my Chase Sapphire for everything. So every now and then I just go in and mark off a bunch of grocery purchases.

Boring! But yeah, that’s probably one of the most economical ways to use the points. Although I’m with BigOldNit, I’m gonna treat the points as play money and use them to splurge on stuff I wouldn’t normally pay for myself.

Chase Sapphire gives you a 50% bonus on points you spend on travel through their website, and I’ve always found that flights are the same price as if you book through an airline directly. Not as sure about hotels, but I almost always end up spending my points on holiday flights.

Important to note that the Chase Sapphire Reserve - with it’s $500-ish annual fee gives 1.5x value on those Chase bookings. I believe the Chase Sapphire Preferred - and it’s $95 annual fee - gives 1.25x.

The one downside of booking flights (or hotels) through those portals is in the case of significant disruptions, changes, etc., it can be a real PITA to get resolution vs. working with a booking that has been booked directly with the airline.

Amex plat lets you book directly with the airlines for their 5x points. I have that and the gold. Probably going to get a Chase cash back card for my final card for the things the Amex doesn’t give bonuses for. Debating whether to keep the plat after this year since I already got the sign up.

Any San Diego friends have a restaurant suggestion in the Gas Lamp district? Got an evening to kill next week…

My suggestion is to take an Uber up to Hillcrest and gorge on Bronx Pizza.