AI-generated ads ldo

I’m not sure that’s the case. The disclaimer says that cash is insured up to 250k.

This seemed like an interesting way to segment the data. I read similarly that “The S&P 500 has historically outperformed the market in the 12-month period after a midterm election, with an average return of 16.3%.” and that the market is up 12 months after Midterm elections 100% of the time since JFK (maybe further back, but that was all the data presented).

https://twitter.com/allstarcharts/status/1590737428255760385

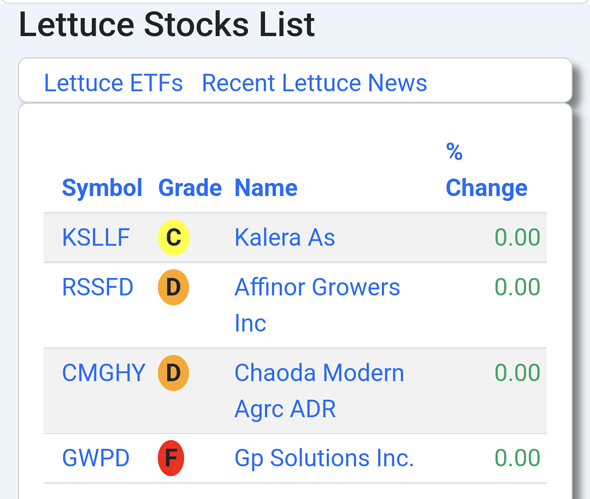

Lettuce stonk then!

Chaoda is hot garbage. Affinor 4 lyfe baby!!!

There are actual companies that only do lettuce? Do any diversify into kale?

Probably Kalera

And I-ah-ay-ah-ay will always love you!

Damn there were a bunch of people from my firm that jumped over to Amazon when an office opened nearby. They might be at risk here. I can’t see this being contained to just tech firms, there are going to be ripples

So is this pre recession jitters from these companies, or is there something more on the horizon that they are seeing before us?

in all of these instances they are either losing money or aren’t making enough for greedy shareholders thus people get fired stock price goes down, fire people, stock price goes up

Most every company reporting earnings that I deal with talks about preparing for a meaningful impending slowdown in 2023. Sort of a mixed bag as to whether companies are seeing slowness yet, but most/all putting in plans to cut back on hiring/reduce headcount for 2023. US not as bad as Europe/Asia

Thread on the inflation numbers. I don’t know anything about this guy, but an investor I follow who’s had some good content in the past RT’d it.

https://twitter.com/GordonJohnson19/status/1591062535586848768

The partial offset to this is the lag for rent/housing costs that’s in the number and overstates current conditions.

Does show these numbers are messy and we shouldnt overreact to one month numbers.

Fed happy that financial markets have rallied, will make it easier to be hawkish in the near-term with a little less fear about breaking new things. Not impossible they would use a miss right before their meeting to “surprise” with 75, but I personally think its unlikely.

WTF is going on with that Y Axis?

Good question.

The tech companies with all the data about everything are doing major cost-cutting or layoffs.

On the one hand they could be using their data and AI knowledge to make sharp predictions about the future. In which case their reactions show a major economic disaster is coming.

On the other hand they could be shallow, incompetent, and reacting to meaningless inputs like their horoscope or the wall street journal. The reality of the reactions could snowball and make a recession out of nothing. Or it could all just disappear.

As usual, I have no idea what the future holds.

Just like price raising felt like a case of “Well the public is used to it now and everyone’s doing it, so let’s raise our prices”, the layoffs feel like a case of “Well everyone’s doing it now, so we won’t look any worse than anyone else, let’s trim some fat”.

A lot of anecdotal stuff on HackerNews and elsewhere has suggested to me for a while that big tech companies were over-employed. To some degree just to drain the talent pool from potential smaller competitors and an arms race amongst each other. At least I’ve heard a few posters who work for FAANGs suggest this. You don’t have to pay $500k tc for a good engineer. You do that to lock them up so no one else can get them.

So one round of layoffs feels like it could be healthy for them. Another big round is where I would be like “uh oh”. And yes I know I don’t know shit. But I do work in tech and have done ok playing my hunches in the past.

Price raising didnt really happen because "the public is used to it’. There were massive increases in nearly all input costs over last two years. Companies do try to use input cost increases to drive margins higher when demand is strong, so theres certainly some of that, but most manufacturing companies would have been completed fucked without prices increases over the last year.