Gawd I hope your wrong. Either way MGT gets to chair a committee? WAAF

In that scenario you want to stock up on trillion dollar coins obviously.

In the end the trillion dollar coin solves all the issues because the debt ceiling is dumb self imposed limit

I’d be interested in hearing your reasonings on why you think that bitcoin wouldn’t get slaughtered worse than the dollar if the US jumps ship with a default.

I think we’re drawing live to Speaker MTG or Speaker Gaetz.

The billionaires and big corporations no longer have a say?

Eventually the leopard is going to eat their face too

When we say debt default, what does that even mean? The government will randomly choose which debts to pay only as new revenue comes into the system?

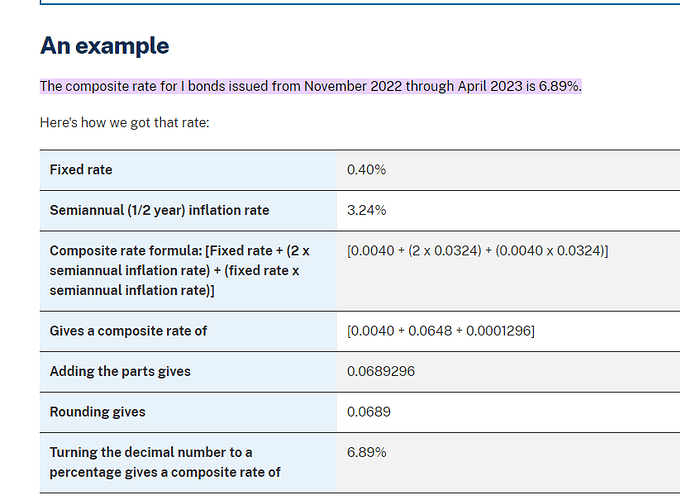

are Ibonds still safe if US defaults? also is it still worth it to keep buying them? now that 10 yr treasuries are over 4% 6.89% for 6 months doesn’t seem like as great of a deal esp since its not that easy to sell them w/o paying penalties

Nobody really knows because the whole financial system is built on the assumption that US debt is risk free. I think in practice what would happen is a suspension of all interests payments on debt but principal would be repaid. When smaller countries default they get help from the IMF but that won’t work for the US.

If it ever actually happened I think that the resultant shockwave through the market would be worse than the actual interest suspension. When a giant borrower defaults it just becomes a negotiation, eventually a deal is reached to repay X% of all debts and life goes on. The problem with a US debt default is all the collateral damage. Lenders will take a haircut, but the economy would get wrecked.

If those morons decided that they wanted to “default on the debt”, it seems like they will basically be told that the computer can’t do that and that they need to go make a balanced budget or come up with some long drawn out Brexit style plan where the global financial system is reimagined.

I didn’t buy any more i-bonds. once i heard that all the retail investors were rushing to buy them i assumed that it was a sucker move. i can get 4% in a money market and jump back into stock markets at some point if they keep going down.

If a debt ceiling extension isn’t passed, that means the US can no longer run an official deficit. There are a variety of ways that could play out, but it would mostly be up to the Treasury Dept. The last time the GOO fucked around with the debt ceiling, short term T-bills took a hit but long term didn’t care.

The reason the world economy would get wrecked is a default reduces or zeros out the value of the bonds which represents trillions in wealth to people who aren’t risk tolerant.

I don’t think it’s random, but yes, some debts would not be paid.

It might do worse, it might not. Something somewhere or some handful of things have to hold value, so if it’s not going to be fiat currency that leaves precious metals, crytpo, real estate, and commodities to barter. Real estate and most commodities can’t be used as a currency, and I don’t see people going back to bartering, so that basically leaves precious metals and crypto. I listed both initially, because in such a runout, I’d want exposure to both due to the extreme uncertainty.

That’s a good point, it’s not like the trillion dollar coin is necessarily inflationary (at least not proportionally to the money supply) in this situation because it’s not being put into circulation.

They own the establishment, the GOP is being overtaken from the inside out by the insane right. Especially in the House.

They can ultimately pay the debt, they will just have to stop doing things like pay out social security checks and pay employees. You know, very good things for a stable society.

Crypto gets slaughtered because it is relatively liquid so as a risk off sell off occurs crypto gets sold along with everything else. In this sort of panic it isn’t really about value, it is just about selling what you can sell.

This is like the nuclear war stuff in that yeah we’d like to hedge against it but reality is that it is out of our control and we are just mega fucked (in different ways) if it happens.

I had no idea crypto’s problem was that it was too liquid. TIL.

DWAC was up 50% and is still up 26% in anticipation of Trump announcing.

Good thing he’s getting indicted right… right?

I think the odds of Speaker Jordan are very low and MTG or Gaetz are close to zero.

Stefanik however…

Its not like treasuries or anything, but its going to be more liquid than a lot of risk assets the institutional guys are in. Like its easier to dump bitcoin than a private equity fund stake, as one example.

Imagine minting a $1T coin then it falls out of your pocket. The next civilization to rise finds it and has a hearty lol at our primitive understanding of economics.