Probably dilution. It probably wasn’t actually at $90. Medical stocks seem to always do this, it’s why I think they’re usually a terrible investment. One example I owned at one point was Delcath Systems (DCTH). If you look at their stock price chart, it shows that in 2017 their shares were worth 600 million per share. That’s a jopke of course, they just kept diluting and diluting to raise money, fucking over the stockholders. It happenedwhile I held there too, my $200 of their stock ended up being worth like 20 cents. Same thing, I thought maybe they would cure cancer.

down $500 overall but CLVS and CCIV are going to take me to the moon my man

Your friend needs an intervention.

I’ve tried. It’s hopeless.

Did you tell him to double down?

Since he does the opposite of any of my advice I should try that.

Hasn’t the market pretty much doubled since May? I actually rolled out of blue chips because they doubled and then some. I was like this is ridiculous. Then they went up even more of course.

Yeah, probably. He did say that it has been a great market since he started with that bankroll so he wasn’t bragging really. The RandCorp guy was doing shots of Maker’s Mark and taking dab hits and he’s up since January. Sounds right up my alley! I just want to learn mostly and if it works out, it works out. I’ll definitely start small. I made a whole $75 off KOSS and AMC. Lost a few bucks on Clovis and now it’s in SPY in my individual non Roth account.

My whole nest egg is up about 80% since May and I haven’t been that risky with it. I have gotten extremely lucky - especially with AMC lol. That’s a once in a lifetime score. I’m still kind of in shock about it. Does not motivate me to want to stay at my job a minute longer than I have to - that’s for sure.

KOSS ran up huge right when I sold Clovis and put it in KOSS but I didn’t get out right away. I would have almost tripled my money in that account if I had got out when it started dropping. The gambool itch started there lmao.

I got out of Clovis too at a loss. I was checking the price way too many times / day. Gotta get stuff done.

Looks like Vanguard 2035 did go up a lot from March 23rd but I don’t even know if I invested any during that dip and before it wasn’t a ton lower than now. Like 15% it looks like. I’ll still take it though. If I had bought the whole $6k for 2020 at the March 23 bottom that would have been sweet.

I wish, Dow and S&P are up 20-30% since May

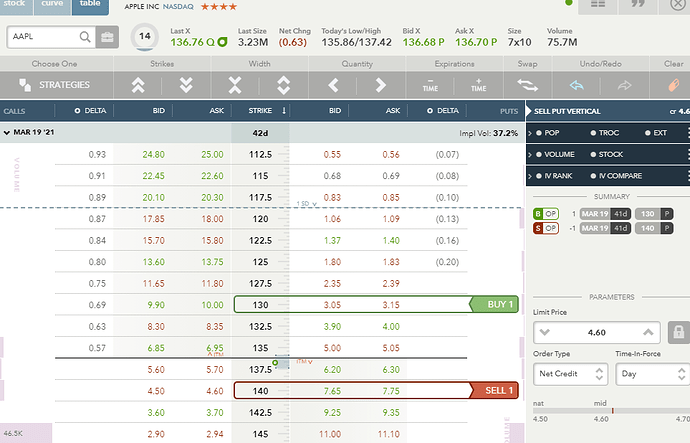

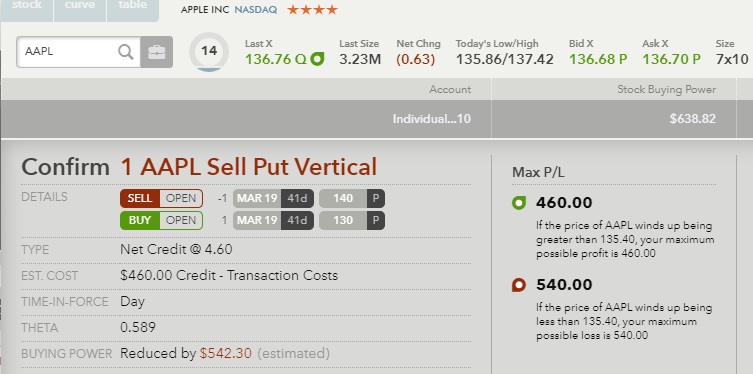

I’ve been having a lot of success “day trading” using theta selling strategies. I put day trading in quotes because most of these plays are over 20-30 days, so I’m not exactly making dozens of trades a day.

Specifically, put credit spreads on big tech are very simple and effective imo.

Sounds like 538… right?

The numbers look a little off (8.5 seems too high and $2 seems too low), but that’s the basics. Prices are HEAVILY dependent on Implied Volatility (IV) though. Here is price with a real world example, using similar strikes on AAPL ($5 above current price and $10 wide spread)

Selling the $140 for $7.7 and buying the $130 for $3.1 gives us:

I haven’t really been selling puts above the current stock price, as you are depending on the stock to go up. If it is flat, you are slightly profitable, but are tying up a lot of money to make a couple %, and if the stock declines at all you are fucked. I have been mainly selling 1-2 strikes below the current price, which allows you to win if the stock increases, is flat, OR declines (slightly). Obviously, with much lower risk, you also have much lower reward compared to selling a put a strike above, as in the example.

(replying to goofyballer)

One of the fundamental rules of options trading is that you won’t be able to arbitrage it. If you could, the firms like the one I work at would be taking all the volume instantly and moving the prices to where there’s no arbitrage.

If your thought of arbitrage is selling 1 put spread and selling one share, then you’re just accruing short deltas as a position (the 280 put has a delta higher than 50, 270 put less than 50, how far they are from 50 is determined by time to expiration). So if you sell 1 put spread you accrue long (280delta - 270delta)/100 deltas. Because if you’re short a put spread you want the price to go up, that’s better for your postion. By selling one share, you sell one delta making your fractional delta just short instead of long.

The instance of selling one put spread and selling one share works great if you go to $270. You can buy back the share, collect $5 on selling the share at $275 and buying at $270, and collect $6.50 in premium on the put spread, while having a capped loss of $10 on the put spread.

But think of the reverse example. You sell the share at $275 and it goes to $280. Now you owe 0 on the put spread if it stays above $280 but you’re still short the share. If you buy back the share, you lose $5 on that so now you’ve sold the put spread for $1.50. If you hold the share you now are down $$ if it goes above $281.50.

Sick sick life

Heh idk. I’ve never checked, but Nate might do good math with lousy data. My financebro is the opposite: he has access to good data, but doesn’t know how to analyze it and in fact doesn’t bother doing math at all, just runs backtests and picks the best historical performer. The best performer is ofc whichever blind algorithm (out of many) benefited the most from randomness in a sample of about 200 trades over a span of 12 years, with each position only being held for a few hours on average. He then invests leveraged money on it in hopes that a fraction of the historical performance will carry into the future. If his algo has a lucky several months, he’ll try to convince a whale or few to invest in it too. This guy is a CFA lol.

Best of all, buying/holding the S&P in the same period would have vastly out-performed his algo, earning like 8x the profit.