Do you remember “easiest recession ever”? Hopefully the same thing doesn’t happen here. We’ve had some really hard ones though, but there are also mild ones.

Real wages are sharply down too. This is a different kind of recession. We’re not seeing 5% of people get their wages cut to zero, we’re seeing everyone get their (real) wages cut 5% by inflation. It’s the same decline in output, just spread out more evenly, and happening gradually enough that people don’t notice as much.

find it hard to believe his costs didn’t increase with what’s happening in the labor market, freight etc. I don’t know what goes into making lights but just about material i work with (metals, plastics, chemicals) have seen significant increases in the past year or two. We use those materials to make parts that go into just about everything in our lives.

These times make me think that we can lean on history to analyse and worry/not worry about this but ultimately as with everything else there comes a time when the times change so to speak and a new history is created (the stonks go brrr era)

Yeah, and to be clear I think it’s great for a recession to take the form of modest belt-tightening for everyone rather than immiseration of a small handful of people. This is basically the point the “market monetarist”/NGDP zealots were making 10 years ago–that if the Fed keeps NGDP going up, there’s enough dollars floating around to avoid an unemployment spike even if there are real factors that make real GDP go down, and that’s way, way better than having long-term unemployment and debt crises.

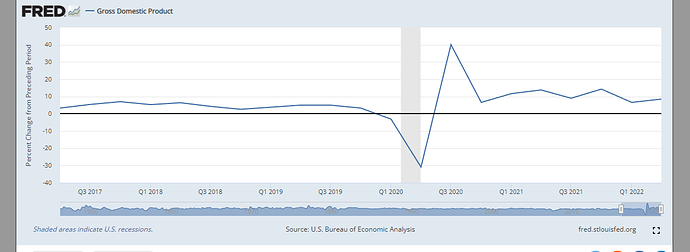

The problem we have today is that the Fed is letting NGDP grow too fast:

Which means we’re seeing more inflation than we need to. But we’re in such a better position than if policymakers had erred on the side of being too cautious and we ended up with Great Recession II as a result of Covid and the Ukraine War.

The problem is that next year/post election we are probably going to get real fiscal tightening to go along with tight monetary policy so that Great Recession may yet be in sight. Id feel much more confident if I thought Congress would do stimmy if the Fed overshoots, but I dont think the MGT/Gaetz House is gonna break away from the Hunter Biden impeachment hearings to ramp up domestic spending.

Contributions to traditional IRAs and after-tax Roth IRAs will increase as well – to $6,500 from $6,000 currently,

…

To put any money in a Roth in 2023 your modified adjusted gross income must be below $153,000 ($228,000 if married filing jointly). That’s up from $144,000 ($214,000 for joint filers) currently.

![]()

Starting next year, you will be allowed to contribute up to $22,500 into your 401(k), 403(b), most 457 plans or the Thrift Savings Plan for federal employees.

![]()

… if you’re 50 or older you can contribute up to $30,000 in 2023.

![]()

the rate of return is expected to be higher as a matter of fact (if you accept any modern theories re: securities pricing)

Next week: S&P 500 drops 5% after Hopes of Fed Mulling Slowdown in Rate Hikes are dashed

:copium:

Yeah why would the Fed suddenly be mulling that, and who even started that rumor? JPow said they’d decide based on the data, and the data that came out last week was bad - inflation hasn’t peaked.

Until recently, all of this:

Almost all daily “the market went up/down today on investor hopes/fears of X” are just lazy post hoc narrative building because people like to image that the reason the market moves up and down on a daily basis is rational and predictable. In reality, most days the underlying reasons for market movements are wildly speculative, the total price of broad market indices are the unpredictable outputs of chaotic systems with more inputs than you can contemplate let alone measure.

For sure, it’s just I think I remember reading the same thing at like 10am on WSB, so I thought maybe it was an actual rumor going around as opposed to the usual Yahoo intern/AI making shit up.

They should not be doing this. One of the problems with all these breathless “Highest rate hike since the 80’s!!!1!!!1!!1one!” takes is that it doesn’t take into acccount that the rates started from fucking zero. They need to be much much fucking higher than the piddling 3.5 percent or 4 percent than they are now to actually do something about inflation. They should be dropping multi-point increases, not slowing down.

By way of comparison Volcker raised rates from 11 percent in 1979 to 20 percent in 1981. Raising rates from 0 to 4 percent is loltastic by comparison.

Not sure about this take. The US dollar has risen substantially vs. competing currencies this year which should make imports cheaper to Americans but also impact to cost of American labor and exports. There is a risk to overshooting this here and the counter inflationary impact of the rate hikes takes some time to play out, while at the same time there are still factors which should positively impact the supply of goods in the next few years (e.g. overcoming issues with semiconductor supply) and also help with consumer price inflation.

The impact of a 1% rate hike is higher at low rates!

The US dollar has risen substantially vs. competing currencies this year which should make imports cheaper to Americans.

Imports might be cheaper for corporations but why would they lower the prices for consumers? Consumers are willing to pay these prices, so that just means even bigger profit margins for corporations.