Grocery store inflation is fucking nuts. It’s hammering the poor the hardest, and I think it’s why the fed is right too try to get inflation under control at the expense of everything else.

nah, majority could they just don’t and won’t

our financial literacy is just trash here overall which is half the problem

that was 2016, gotta be worse now

edit–50% this one https://www.thestreet.com/investing/51-americans-say-they-have-unwanted-subscription-charges

71% $50 or more a month on this one Survey from Chase Reveals That Two-Thirds of Consumers Have Forgotten About At Least One Recurring Payment In The Last Year

people just suck with money and blow it like the gov’t does; if that was ever taught in schools that would fix a good chunk of the problem but we live in a spend all your money every week on stupid shit economy so here we are

Are cat food futures tradable?

I love how every finance bro on twitter knows exactly what to do and oh by the way Jerome Powell is a moron.

This shit is super complicated! I don’t know what else the guy is supposed to do - we’ve seen what happens if inflation persists and it’s really really bad.

It’s very attractive if they can collectively corner the market in certain areas: think NYC, Philly, Austin, LA, Houston, etc.

Yeah I do think they’re targeting specific areas but that won’t be much consolation when those are the areas the middle class wants/needs to live.

It depends. If high interest drops prices on homes enough, they may be able to just buy in cash.

I’ve been screeching about this on Unstuck for a while, so I agree, but…

I’m not sure what the Fed can do about a global food shortage due to a war, or supply chain issues tracing to covid.

Only bad choices are left at this point. It’s inflation or a recession. Possibly both which would be a nightmare scenario. A recession isn’t going to leave the poor in a good spot either.

The one doubt I have about jacking rates up working to curb inflation is what CW just said. The price of gas and food is not being driven by an overheated economy. It’s being driven by factors that won’t change by changing interest rates.

Criticism I have seen is the other way, should have increased rates and generally tightened policy a long time ago as things like monkey jpegs trading for millions of dollars were a clear and obvious sign things were out of hand beyond transitory supply chain issues.

Well, this is turning into a recurring theme…

Market still seems way too expensive for Buffett to do a lot of buybacks IMO. Headline P/E less awful but the E part likely materially high.

Not much, but they can break the back of the labor markets so that there isn’t wage inflation built in as those factors eventually ease.

Seems like pain/volatility in markets until the exogenous factors mentioned improve.

Yeah it seems worrisome that the FED is focused on CPI which they can do little to control. They should also see that USD is strongly appreciating against other currencies and commodities and think about what additional rate increases will do to US labor competitiveness if they plan to just keep raising rates until the CPI comes down to an acceptable number. Deflation can quickly fall into a feedback loop that is hard to undo and ultimately more damaging than inflation.

well they’re all trying to do exactly what it takes to pump their bags

not sure how jacking up rates doesn’t help inflation when we import most goods so jacking up rates make those prices lower from the usd boost

or just import everything from the UK, prices cheaper by the day it seems

Only 15% of us food and 43% of us gasoline is imported.

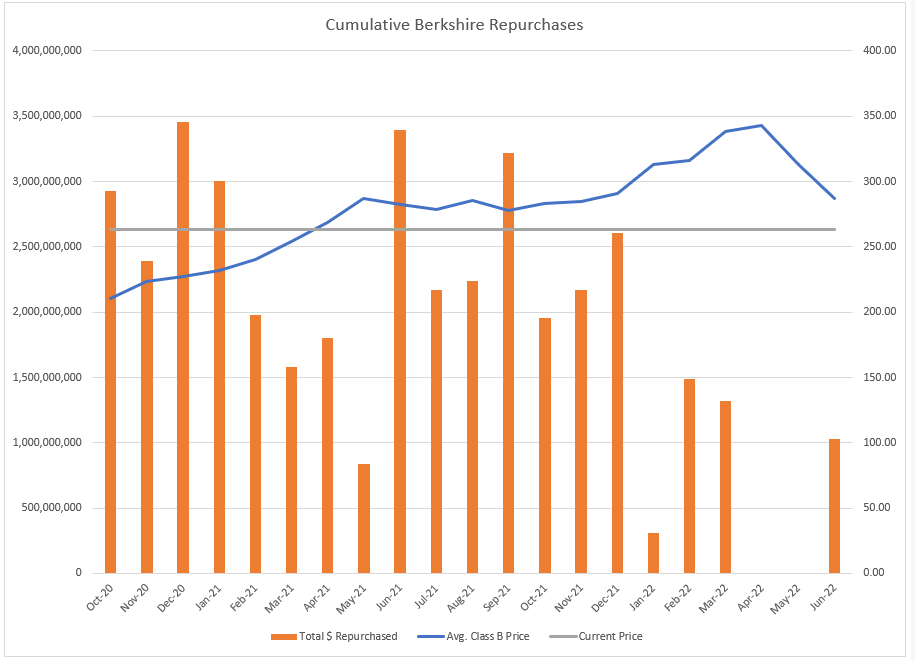

Looking back over the last 2 years or so, he’s repurchased a ton of stock at higher prices than this:

Even with the price of imported goods, I think it will help but it takes time for that to trickle down to the price on the store shelf. Like stuff being bought today arrived at a US port when? When was the contract actually signed to buy those goods or raw materials overseas?

Things like the price of cars from Japan and things made with foreign steel or whatever will eventually by impacted by the strong dollar but it might be next year. The fed shouldn’t just keep raising rates each quarter if the USD is noticeably appreciating against all alternatives or they will overshoot and cause deflation.

Maybe, but the higher interest rates go the more it makes sense to just take that money and park it in lower risk, more liquid investments. No matter how you slice it, real estate investing only makes sense when real estate is the best investment, and high prices with high interest rates both fundamentally work against that. My only doubt is they’re both already pretty high and it hasn’t seemed to slow investors down. So the question is am I missing a less fundamental factor that will persist as rates keep going up or are we just short of triggering a massive sell off of residential investment properties? I don’t know the answer to that but I’m open to arguments for either case from someone smarter with better info. Obviously as a prospective buyer I’m hoping for the latter.

Curious what that looks like on a longer time scale. Not surprised Berkshire cutting back with the storm clouds on the horizon. Likely a lot of better potential cash uses on the horizon for companies with strong balance sheets.

well, deflation is better for me on a personal level than inflation, so let’s do that instead then