It’s fascinating how much younger males have bought into this stuff. Some of my most liberal friends, to Q-supporting friends-of-friends i still have a window into, are all entranced by this nonsense.

It works as a joke but it’s also absolutely correct and it’s what I meant the other day by,

(mathbros don’t @ me I know ‘fractal’ doesn’t actually mean ‘self-similar’)

I mean, lol the details of my personal daytrading cryptocurrency fractal strategy are for the other thread, but here’s one from literally just now on a 5min chart:

Essentially, anything from Gut Feels to drawing-a-million-lines-on-a-chart technical analysis could’ve told you what was incoming.

Um on that note I’m not a fan of multi-quoting but let’s give it a spin:

Yeah, the rest of that post was:

The bitcoin chart’s mean slope rises and dogecoin’s is flat, but with GME there’s one cycle and this was it. My guess is that the dogecoin thing happening in the middle of all this warped the GME bulls’ perception. It’s like they think, bitcoin isn’t even real, and dogecoin is a parody of that not-real-thing, but gamestop is a stop for games!

Who is this Levine character and why is he stealing my shit?

See my above post lol. The conditions are perfect but I’m afraid Elon is going to tweet out any second I CHANGED MY MIND DOGECOINS ARE STUPID.

Yea, I have no idea what the fuck I’m doing. I was looking into making a bot for this. I would now guarantee my bot would go broke. Still interested in making it on an academic level. Could be fun.

I’m reminded of playing Badugi on Pokerstars in 2007. It’s dumb, It’s fun.

I miss 5 card draw and Badugi most of all Pokerstars.

Feb 11 may be the day that CLVS finally eclipses $8.50

I’ve never actually seen the front page of WSB but I’d bet 10 million dogecoins (like $3.50 or so) that if somebody asks you to join their pump-and-dump inner circle then they’re really trying to set you up to dump on you. (none of this is actually a ‘pump and dump’ just like none of it is a ‘ponzi scheme’ but whatev, the words have caught on)

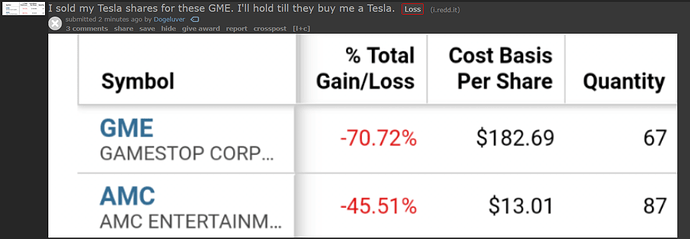

Best thing that happened to me was AMC shooting up from $5 to $17 while I slept. It had been creeping up steadily I probably would have sold around $8-$10, maybe sooner if I got spooked.

Although if I unloaded right at the opening bell I might have gotten close to $20. I knew it was going to pop too from the chatter - just didn’t think it would go that crazy. I did a literal double take when I looked at my account. Then I was afraid I wouldn’t be able to sell because no way this is real - someone’s going to put a stop to it.

https://1450club.com/lm/obscure-code/

Andrew Keene hit rock bottom back in 2008.

Struggling in life… burning through most of his life savings…

And with no real prospects on the horizon…

He knew he had to do something radically different to change his life…

So he turned to the stock market – determined to find an edge…

It was when he began to look closely at a company’s stock price data that he discovered an obscure 18-digit “code.”

This code let him see when the hedge funds and investment banks were making incredibly lucrative trades. Trades that wouldn’t make sense to the everyday American simply because the company wasn’t in the news! And at that moment…

He wondered if he could tag along with these mysterious trades – taking a slice of the profits.

So he tested it out…

And it worked better than he could have ever dreamed.

Guys. We’re all going on a rocket to Mars. Don’t share this with anyone else but us.

-

Have your bot look at the RSI, the stochastic RSI, the ADX, and the EMA crosses on a 1-minute chart and buy and sell accordingly.

-

???

The code is “buy low sell high!”. Count 'em up.

I have no idea what goes up in someone’s mind when you decide to start buying GME at over 300. I mean what is your expectation? That the stock doubles again? The risk is infinite and the upside is pretty much capped. Kinda similar how I feel about the highroller bowlcomps in poker. Why risk 5k(and even re-enter) when you can barely win 10 times your buyin playing against the toughest competition

The question is if we all got into GME at 10. When would you have gotten cold feet? At 70? Once it went over 100. I probably would have done what I did at the start of my poker career after my first cash. I cashed out the amount of money I deposited and only played with the winnings. But even then I probably woouldn’t just look at a 6 digit profit and dont care aboutit. At some point its just too much you ever want to lose again.

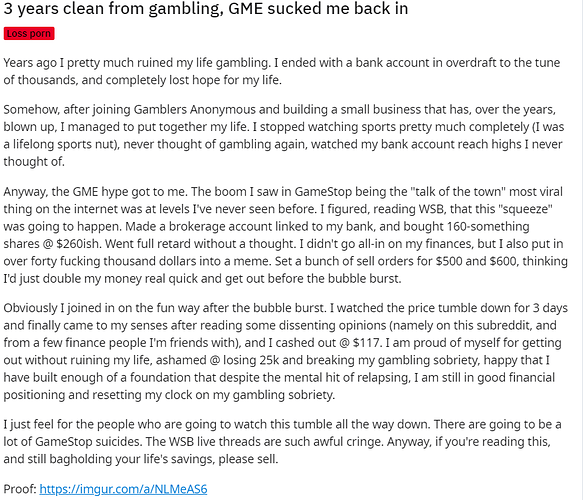

This has me in the middle of a 14way crossroads,

but I can’t help that my first thought is, “The only gambling problem you have is that you’re a stupid fucking fish.” This is why I never felt bad about winning money in poker. I’d rather Robin Hood that shit from a dumbass jetski dealership owner and give it to Childrens Inc. I’m doing God’s work.

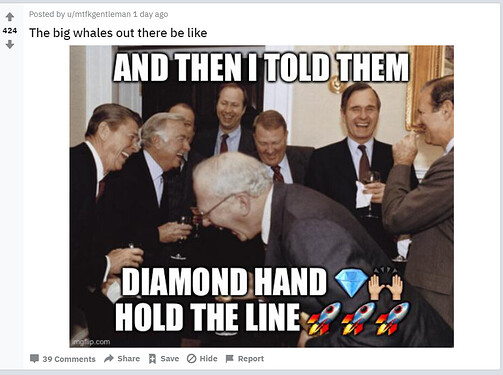

There’s a subtext I haven’t seen mentioned underneath all this: These people’s animus isn’t that they’re addicts, or greedy, or even dumb. It’s that they have an overwhelming sense of privilege making them feel like nothing can really ever go wrong. Like our guy in the screenshot, selling jetskis without a care in the world and a braincell in the head, not thinking he’d need to take a minute and look for the ‘you are here’ in the picture below, post-squeeze:

Lol I’m not sure why I sound so mad, I’m in a great mood.

p.s. mf using trump style scare quotes it’s not a “squeeze” you fucking moron it’s just a squeeze

Honestly though, reading shit like this,

you can’t help but root for the WSB gang. It’s real enemy-of-my-enemy hours.

The quote right there is good but there it’s an embarrassment of riches:

Though the particulars have changed, the GameStop stock surge is actually part of a longer history of attempts to manipulate markets, often with catastrophic results. Unless the Securities and Exchange Commission (SEC) regulates these efforts, such attempts will continue as speculative (and greedy) investors get more creative in the years ahead.

All we have to do is look back on September 24, 1869, when the nation suffered its first “Black Friday.” Gold prices were sent plunging after the US government uncovered a clever scheme by investors Jay Gould and James Fisk to corner the gold market.

Gould and Fisk were able to reveal a weakness in the way the US gold supply was being used to bolster the country’s financial system. They partnered with Abel Corbin, who was married to the sister of President Ulysses S. Grant and could secure them a meeting with the president. In that meeting, Gould and Fisk convinced President Grant that the government should avoid selling gold at all costs. As a result, Grant ordered the Treasury to temporarily suspend the sale of gold.

Gould and Fisk also persuaded Daniel Butterfield, the assistant treasurer of the United States, to warn them if the government began to sell gold again.

Illustration depicts James Fisk Jr (left) and Jay Gould (center), with an unidentified man (standing), as they plot to corner the gold market, 1869. This precipitated the financial panic of 1869, also known as Black Friday. Illustration published in the late nineteenth century.

Seizing their opportunity, Gould and Fisk bought up as much gold as they could, effectively raising the price of the precious metal and, in turn, the value of their own gold supply.

Ah yes, manipulating the fucking president with an inside man in the president’s fucking cabinet, and some bros trying to short hunt a stock with meme magic. Totally the same except for the part where they’re completely the opposite. And somebody with a PhD in STONKS is gonna have to explain how short hunting is any different than stop hunting.

But a major difference between the cornering of the gold market in 1869 and the GameStop bubble of 2021 turns on access. Gould and Fisk were part of the wealthy elite and had to worm their way to the highest person in government office to gain insider advantage. By contrast, the bar to entry is much lower today, and the average person can participate in these speculative manias — often for free — on discount brokerage sites.

That anyone can now have the power to manipulate markets reveals the need for more targeted regulation of trading platforms and financial systems more generally. With potential for the GameStop bubble to cause a meltdown in markets, we should all be game for these changes.

I want to make the astronaut meme with 'Wait, it’s all manipulation?" and,

tattoo it on this dude’s face.

Not totally related but funny:

The headline is fine but when faced with an actual fucking ponzi scheme, after all the laymen’s redefinition of ponzi scheme to mean any bad and speculative investment, the writer decides to go with “Ponzi-like”.

This is a trigger for me. My financebro is always going on about RSI and it feels like when the fun player at the table is bragging about his Gambler’s Fallacy based Roulette strategy that printed money that one time. I looked up the formula for RSI and it’s completely derived from the price movement, so it literally gives you no more information than a price chart.

I’ve offered to statistically analyze (aka debunk) his algorithms, but it’s impossible because he always trains them on all the available data up to the present (because “Gotta be robust in all market conditions brah!”). Never does a year go by before he re-trains them after some minor tweak, so there’s never a good out-of-sample period of trades to analyze. He does so much backtesting involving tens of thousands of combinations of 10+ input variables, and sure enough, the top-performers are always those with the fewest trades. Textbook curve-fitting garbage.

GME opened +8% then dropped like a rock.

AMC started positive then went negative, dragging CNK with it both ways as always. Those auto-pilot algorithms are really silly.

GME all over the place

Time to relight the rocket emojis?

Shorts covering before the weekend?