And I still wouldn’t put a large amount of my net worth in it.

But what if I split my allocation between BRK and AAPL?

Fixed that for you.

(Kidding, mostly.)

Kind of makes you wonder why so many people are so excited to have 300% of their net worth tied up in a single property. Modern portfolio theory really does a number on the conventional wisdom of home ownership.

You’re still completely delusional about the difficulty of beating the market but we will just go in circles. The number of professional investors who have done so over decades is low single digits.

This is really circular because I feel like the more we fully understand that professional investors don’t really know what the hell is going on with markets, the more tempting it is to think “Hey these morons are morons! I can do better than these clowns!”

This is always an intoxicating thought but it’s the old expert vs. wisdom of the crowds thing. If the ways in which other investors are wrong are somehow normally distributed around the right answer then it is not enough to be smarter than them or even a majority. To find mispriced securities you really need either luck or to have some angle that is not even considered in their collective thoughts.

As things get more illiquid this is less the case and smaller Mexican companies might be more illiquid, but I would be wary because smaller companies and illiquid markets have harder to define risks. Like we know how corrupt things can be in Mexico? What if this controlling family finds a way to screw all the other shareholders and bribe a local judge? Who’s going to protect commonwealth’s capital in that scenario?

And those that have are simply the recipients of random luck. There is zero evidence anyone can beat the market. People who are accidentally on the long tail pretend it’s skill in many industries (hi hellmuth).

only Warren has done so long term and he usually falls behind big time in bull markets.

I know of a few portfolio advisors that have done so, but they beat it net of fees by ~1% annually over the long term.

Usually hedge funds fail because some of them either get lucky or are skilled at finding small and micro caps with little analyst coverage. Then money pours into them and they can’t invest in those any more and can only invest in the highly liquid large and mega caps where they have no edge.

For clarity I am 100% passive investing. I was commenting on why pointing out the apparent futility of professional active managers doesn’t seem to persuade lots of people that active management is futile. It just convinces them that there are in fact stupid people out there that will take the wrong side of your smart trade.

I do think private markets are mega beatable but obviously that rarely scales. Good operators can make insane ROE on stuff like car dealerships, widget makers and commercial real estate, but you’re really blurring the line between investing and working. I would absolutely hate managing people and dealing with stuff like HR, nuisance lawsuits, insurance and a million other things but I definitely think I could outperform a REIT in any CRE asset class. Many, many private firms regularly do so. Simply not the case for highly liquid public securities.

OMG so much this. I am investing money so I can earn a passive income and play with my dog all day. This has been my argument against “investing” in rental property as well. I have no doubt that I could get good returns by levering up and buying a couple of condos in Toronto to rent. I could also get a second job, but I’m not doing that either. HUSTLE and GRIND culture seems like a nightmare to me, I spent years getting my actuarial license so I can do work that is pleasant. Why the fuck would I want to deal with tenants now!?!?

He’s saying if you look at the forward rates for locking in MXN/USD 9 months out, you are going to pay a 5% premium. There went your 7% return.

It gets infinitely harder to beat the market when you are managing too much money. They’re trying to beat online $50/100 NL, I’m playing $1/2 NL.

Warren thinks a lot of people have.

Exactly. Most of what I’m finding is small and micro caps, with some exceptions.

Why do you not believe the mountains of research that demonstrates you can’t beat the market?

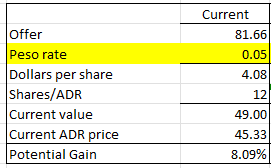

As I understand it:

- Potential offer is 81.66 per share in pesos

- Each ADR represents 12 shares

I think your math is this:

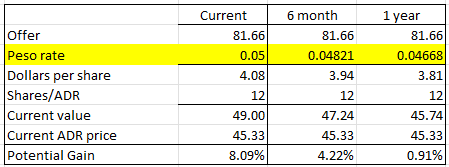

That gets you to an 8% return at current peso rates. But obviously this proposed transaction isn’t happening today. So you’ve got to estimate when it might. Then, if you want to hedge currency risk, you’d lock into a forward rate for the appropriate horizon. Now, I’ve never actually done this so I can’t tell you what this involves at IBKR, but I think the economics are straightforward. Look at forward peso rates here:

https://www.cmegroup.com/markets/fx/emerging-market/mexican-peso.html

Then use those forward rates to determine the dollar value that you’d get in the future. If you think this proposed transaction happens in 6 months, use the February 2023 rate. If 12 months, use the August 2023 rate. Here’s what you get:

I love the optimism, but I often get this feeling that your confidence in identifying seemingly mispriced securities isn’t really warranted. This is kind of superficial stuff.

I get that its probably mostly for fun, but if you really want to get rich it would be pretty easy for you to do so by doing a million other things like buying a car wash or 4-unit apartment building or whatever. Those things both cash flow and benefit immensely from having a smart motivated owner. There are also all kinds of value add financing plays (SBA loans, HUD / Fannie / Freddie, etc.) not available for a stock investor. I know so many people who have gotten legit rich this way. I don’t know anyone who got rich beating the stock market (though I know many who have stayed rich with index funds).

Problem with small and micro caps is that is where most of the outright fraud occurs.

Definitely doesn’t make you a chump. There’s a guy I know through poker who’s a good investor, he beat the market over a 30-40 year period by a decent amount

If someone told me they have “beaten the market over 30-40 years by a decent amount”, I’d just nod and be like yeah that’s nice.

I mean how many people actually have the wherewithal to keep those kind of records going back to an era before personal computers, etc? I also have people that tell me they are up a decent amount on blackjack, sports betting, and slots. Or at least they would be up if they just had better bankroll management.

However, off their earnings report through 3/31 (so a full month after the NASDAQ halt and 5 weeks or so after the invasion), adjusting for the current black market exchange rate between RUB/USD, the shares are worth a tangible book of $4.48 and they earned $0.30 per share.

So if this were a random company with that balance sheet that was actually trading, I’d buy them at $5.37 or lower, and sell no lower than $8.05.

Going back to this post, because I think this brief set of statements is really useful. You seem fixated on tangible book value and the possibility of buying something at less than tangible book value. But here’s the thing, buying at less than book value is only a good thing if:

- You expect an immediate liquidation/realization or you have the ability to immediately force a liquidation/realization of that book value, or

- The firm generates a reasonable return on that book value.

This is QIWI we’re talking about, so you certainly have no ability to force a realization of that book value. And if they’re earning only 0.30 per 4.48 of book value, that’s only a 6.7% return they’re generating. (I’m taking your numbers for granted; I’m not diving back into QIWI.) That, at least for me, is well below the return I’d require for owning this kind of stock. If you anticipate that the firm will generate an ROE that’s less than your required rate of return, you shouldn’t be willing to pay even book value for it. That’s basic valuation.

To make this idea more obvious/intuitive, imagine a savings account with $100 in cash. How much is that worth? Obviously if you control it, it’s worth $100. But suppose I control it and I’m willing to sell you 100% of the economic rights, but none of the control rights. The savings account is generating 1% per year and I emphatically insist that I am going to keep the $100 invested for 5 years. Are you really willing to pay book value ($100) in this scenario? You shouldn’t be.